FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

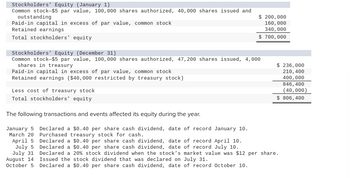

The following transactions and events affected its equity during the year. Question: What is the per share cost of the

Transcribed Image Text:Stockholders' Equity (January 1)

Common stock-$5 par value, 100,000 shares authorized, 40,000 shares issued and

outstanding

Paid-in capital in excess of par value, common stock

Retained earnings

Total stockholders' equity

$ 200,000

160,000

340,000

$ 700,000

Stockholders' Equity (December 31)

Common stock-$5 par value, 100,000 shares authorized, 47,200 shares issued, 4,000

shares in treasury

Paid-in capital in excess of par value, common stock

Retained earnings ($40,000 restricted by treasury stock)

$ 236,000

210, 400

400,000

Less cost of treasury stock

Total stockholders' equity

The following transactions and events affected its equity during the year.

January 5 Declared a $0.40 per share cash dividend, date of record January 10.

Purchased treasury stock for cash.

March 20

April 5

July 5

July 31

August 14

October 5

Declared a $0.40 per share cash dividend, date of record April 10.

Declared a $0.40 per share cash dividend, date of record July 10.

Declared a 20% stock dividend when the stock's market value was $12 per share.

Issued the stock dividend that was declared on July 31.

Declared a $0.40 per share cash dividend, date of record October 10.

846,400

(40,000)

$ 806,400

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- 17. Analyze the equity section of Gingerbread Corp's balance sheet and determine the following. Be careful to discriminate between a non monetary value and a monetary value. Use a $ sign to indicate a dollar value. 1.Number of shares of common stock that have been issued 2.Number of shares of preferred stock that have been issued 3.BlankDollar value the company paid to repurchase their own stock 4.How many shares of stock are in treasury stock?arrow_forwardAssume that you want to reindex with the index value at the beginning of the year equal to 100. What is the index level at the end of the year? (Round your answer to 2 decimal places.) Kirk, Inc. Picard Co. Shares Outstanding Index level 37,000 27,000 Price per Share Beginning of Year $ 52 77 End of Year $57 82arrow_forwardNikularrow_forward

- Return on Equity Evans & Sons, Inc., disclosed the following information in a recent annual report: Net Income Average stockholders' equity Dividend per common share Earnings per share Market price per common share, year-end Net income Previous Year Current Year $94,500 $129,600 1,000,000 1,500,000 Previous Year $ Current Year $ 5.13 7.70 51.30 Calculate the return on equity for Evans & Sons for each year. Did the return improve? Numerator 5.40 8.64 56.70 Denominator ◆ Average stockholders' equity X 8 x Did the return improve? The return on common stockholders' equity decreased X X from the previous year to the current year. ROE % %arrow_forwardThe following financial information is available for Flintlock Corporation. (in millions) Average common stockholders' equity Dividends declared for common stockholders Dividends declared for preferred stockholders Net income BIU T₂ T² Ix !!! 111 2022 lil $2,532 298 40 504 Calculate the payout ratio and return on common stockholders' equity for 2022 and 2021. Comment on your findings. W 2021 $2,591 144 611 40 555 트 M II á TT ¶ O Word(s)arrow_forwardFor the calculation of weighted average number of shares where does the (4) come from when you are doing (921,000/4) ?arrow_forward

- What is the answer for these? and how do we find them k. Return on common stockholders' equity % %l. Price-earnings ratio, assuming that the market price was $72.12 per share on May 29, 2018, and $53.06 per share on May 30, 2017.arrow_forwardDividends on Preferred and Common Stock Pecan Theatre Inc. owns and operates movie theaters throughout Florida and Georgia. Pecan Theatre has declared the following annual dividends over a six-year period: 20Y1, $32,000; 20Y2, $64,000; 20Y3, $144,000; 20Y4, $184,000; 20Y5, $224,000; and 20Y6, $280,000. During the entire period ended December 31 of each year, the outstanding stock of the company was composed of 20,000 shares of cumulative, preferred 4% stock, $100 par, and 100,000 shares of common stock, $20 par. Required: 1. Determine the total dividends and the per-share dividends declared on each class of stock for each of the six years. There were no dívidends in arrears at the beginning of 2OY1. Summarize the data in tabular form. If required, round your per share answers to two decimal places. If the amount is zero, please enter "0". Preferred Dividends Common Dividends Total Year Dividends Total Per Share Total Per Share 20Υ1 $32,000 20Y2 64,000 20Y3 144,000 20Y4 184,000 20Y5…arrow_forwardCompute number of shares outstanding after the stock dividend. Number of shares outstandingarrow_forward

- Please help me with all answers I will give upvotearrow_forwardFor the purpose of calculating earnings per share (EPS), the denominator is:Select one:a. Outstanding ordinary shares at balance date.b. Weighted-average number of the sum fully paid ordinary shares and partly paid equivalents.c. Outstanding ordinary shares at balance date and weighted-average number of fully paid ordinary shares.d. Weighted-average number of fully paid ordinary shares.arrow_forwardSuppose a stock had an initial price of $103 per share, paid a dividend of $2.55 per share during the year, and had an ending share price of $115. Compute the percentage total return. (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Percentage of total return %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education