FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

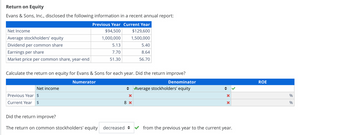

Transcribed Image Text:Return on Equity

Evans & Sons, Inc., disclosed the following information in a recent annual report:

Net Income

Average stockholders' equity

Dividend per common share

Earnings per share

Market price per common share, year-end

Net income

Previous Year Current Year

$94,500

$129,600

1,000,000

1,500,000

Previous Year $

Current Year $

5.13

7.70

51.30

Calculate the return on equity for Evans & Sons for each year. Did the return improve?

Numerator

5.40

8.64

56.70

Denominator

◆ Average stockholders' equity

X

8 x

Did the return improve?

The return on common stockholders' equity decreased

X

X

from the previous year to the current year.

ROE

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hammer Inc. just paid its common equity owners a dividend of $2.5. Hammer's management indicated in their recent conference call that they intend to increase the dividend by 3% each year. The common stock is currently traded at $35. What is cost of internal equity for Hammer according to the dividend growth model? Group of answer choices 7.14% 7.36% 10.36% 10.14%arrow_forwardA company has an ROE of 12% and payouts 44% of its earnings as dividends. It is planning to pay a $3.99 dividend next year with a current stock price of $40. What is the company's dividend growth rate? Express your answer as a percentage and round to two decimals.arrow_forwardWhat is the company's cost of retained earnings? Round your answer to two decimal places. _______ % What is its cost of new common equity? Round your answer to two decimal places. _______ %arrow_forward

- The co. recently paid a $2.80 annual dividend (Do). This dividend increases at the rate of 3.8%/year. The stock price = $26.91 / share. What is the market rate of return? A. 13.88%B. 14.03 %C. 14.21 %D. 14.60 %arrow_forwardAnswer in excel format and explain formulas used.arrow_forwardFirm A’s stock’s dividend’s growth rate = 2.75% annually. Do= $1.67. The dividend 6 years from now =? A) $1.88 B) $1.92 C) $1.97 D) $2.02 E) $2.05arrow_forward

- Estimating Stock Value Using Dividend Discount Model with Increasing Perpetuity Kellogg pays $2.28 in annual per share dividends to its common stockholders, and its recent stock price was $62.50. Assume that Kellogg’s cost of equity capital is 6.4%. Estimate Kellogg’s expected growth rate based on its recent stock price using the dividend discount model with increasing perpetuity. Do not round until your final answer. Round answer to two decimal places (ex: 0.02345 = 2.35%). Answer%arrow_forwardCalculating key stock performance metrics The Castle Company recently reported net profits after taxes of $11.4 million. It has 3.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company's stock currently trades at $60 per share. Compute the stock's earnings per share (EPS). Round the answer to two decimal places.$ per share What's the stock's P/E ratio? Round the answer to two decimal places.$ times Determine what the stock's dividend yield would be if it paid $2.82 per share to common stockholders. Round the answer to two decimal places. %arrow_forwardThe following financial information is available on the Haverty Company:Current per share market price $48.00Most recent per share dividend $3.50Expected long-term growth rate 5.0% Haverty can issue new common stock to net the company $44 per share. Determine the cost of equity raised through selling new stock using the dividend growth model approach. (Compute answer to the nearest .1%).arrow_forward

- Retained earnings versus new common stock Using the data for a firm shown in the following table, calculate the cost of retained earnings and the cost of new common stock using the constant-growth valuation model. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Current market price per share $36.00 a. The cost of retained earnings is %. (Round to two decimal places.) Dividend growth rate 9% Projected dividend per share next year $1.08 (…) Underpricing Flotation cost per share per share $2.50 $2.00arrow_forwardA company has an ROE of 12% and payouts 41% of its earnings as dividends. It is planning to pay a $3.02 dividend next year with a current stock price of $40. What is the company's dividend growth rate? Express your answer as a percentage and round to two decimals.arrow_forwardCost of common stock equity Ross Textiles wishes to measure its cost of common stock equity. The firm's stock is currently selling for $64.13. The firm just recently paid a dividend of $3.99. The firm has been increasing dividends regularly. Five years ago, the dividend was just $3.03. After underpricing and flotation costs, the firm expects to net $55.79 per share on a new issue. a. Determine average annual dividend growth rate over the past 5 years. Using that growth rate, what dividend would you expect the company to pay next year? b. Determine the net proceeds, N₁, that the firm will actually receive. c. Using the constant-growth valuation model, determine the required return on the company's stock, rs, which should equal the cost of retained earnings, rr. d. Using the constant-growth valuation model, determine the cost of new common stock, In- C--- a. The average annual dividend growth rate over the past 5 years is %. (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education