Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

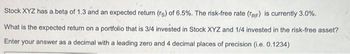

Transcribed Image Text:Stock XYZ has a beta of 1.3 and an expected return (rs) of 6.5%. The risk-free rate (TRF) is currently 3.0%.

What is the expected return on a portfolio that is 3/4 invested in Stock XYZ and 1/4 invested in the risk-free asset?

Enter your answer as a decimal with a leading zero and 4 decimal places of precision (i.e. 0.1234)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You have estimated the following probability distributions of expected future returns for Stocks X and Y: Stock X Stock Y Probability Return Probability Return 0.1 -12 % 0.2 4 % 0.1 11 0.2 7 0.3 14 0.3 11 0.3 30 0.2 17 0.2 40 0.1 30 What is the expected rate of return for Stock X? Stock Y? Round your answers to one decimal place.Stock X: % Stock Y: % What is the standard deviation of expected returns for Stock X? For Stock Y? Round your answers to two decimal places.Stock X: % Stock Y: % Which stock would you consider to be riskier? is riskier because it has a standard deviation of returns.arrow_forwardThe market and Stock J have the following probability distributions: Probability rM rJ 0.3 15.00 % 19.00 % 0.4 10.00 6.00 0.3 18.00 10.00 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet Calculate the expected rate of return for the market. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank %Calculate the expected rate of return for Stock J. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank % Calculate the standard deviation for the market. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank %Calculate the standard deviation for Stock J. Do not round intermediate calculations. Round your answer to two decimal places.fill in the blank %arrow_forwardA stock has an expected return (rs) of 10.4%, the risk-free rate (TRF) is 1.7%, and market risk premium (M-TRF) is 8.3%. What is this stock's Beta? Enter your answer as a number with two decimal places of precision (i.e. 1.23)arrow_forward

- A stock has a required return of 16%, the risk-free rate is 5.5%, and the market risk premium is 4%. a) What is the stock's beta? b) If the market risk premium increased to 8%, what would happen to the stock's required rate of return? Assume that the risk-free rate and the beta remain unchanged. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardAssume that the risk-free rate is 7.5% and the required return on the market is 9%. What is the required rate of return on a stock with a beta of 3? Round your answer to two decimal places.arrow_forwardConsider the following table, which gives a security analyst’s expected return on two stocks and the market index in two scenarios: Scenario Probability Market Return Aggressive Stock Defensive Stock 1 0.5 6% 2.0% 5.0% 2 0.5 20 32 15 Required: a. What are the betas of the two stocks? (Round your answers to 2 decimal places.) Beta A : Beta D: b. What is the expected rate of return on each stock? (Round your answers to 2 decimal places.) % Rate of Return on A: % Rate of Return on B:arrow_forward

- You own a portfolio equally invested in a risk-free asset and two stocks. One of the stocks has a beta of 1.27 and the total portfolio is equally as risky as the market. What must the beta be for the other stock in your portfolio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Betaarrow_forwardQ1: Explain the meaning and significance of a stock's beta coefficient. Illustrate your explanation by drawing, on one graph, the characteristic lines for stocks with low, average, and high risk. (Hint: Let your three characteristic lines intersect at r_i=r_m=6%, the assumed risk-free rate.) Q2: Define the following terms, using graphs or equations to illustrate your answers where feasible. a) Risk, stand-alone risk b) Expected rate of return c) standard deviation, variance d) risk premium for stock i, market risk premium e) Capital Asset Pricing Model (CAPM) f) Expected return on a portfolio g) market risk, diversifiable risk h) Beta i) Security Market Line; SML equation j) Slope of SML and its relationship to risk aversion. Q3. Differentiate between (a) stand-alone risk and (b) risk in a portfolio context. How are they measured, and are both concepts relevant for investors? Q4. Can an investor eliminate market risk from a portfolio of common stocks? How many stocks must a portfolio…arrow_forwardStock Y has a beta of 0.9 and an expected return of 9.46 percent. Stock Z has a beta of 2.1 and an expected return of 15.59 percent. What would the risk-free rate (in percent) have to be for the two stocks to be correctly priced relative to each other? Answer to two decimals.arrow_forward

- Assume that the risk-free rate is 2.5% and the required return on the market is 12%. What is the required rate of return on a stock with a beta of 2? Round your answer to two decimal places.arrow_forward6) see picarrow_forwardStart with A-C and I will submit seperately for D! Thank you :)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education