FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't use ai to answer I will report your answer Solve it Asap with explanation and calculation

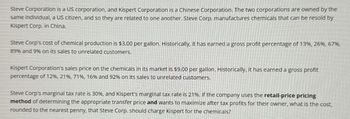

Transcribed Image Text:Steve Corporation is a US corporation, and Kispert Corporation is a Chinese Corporation. The two corporations are owned by the

same individual, a US citizen, and so they are related to one another. Steve Corp. manufactures chemicals that can be resold by

Kispert Corp. in China.

Steve Corp's cost of chemical production is $3.00 per gallon. Historically, it has earned a gross profit percentage of 13%, 26%, 67%,

89% and 9% on its sales to unrelated customers.

Kispert Corporation's sales price on the chemicals in its market is $9.00 per gallon. Historically, it has earned a gross profit

percentage of 12%, 21%, 71%, 16% and 92% on its sales to unrelated customers.

Steve Corp's marginal tax rate is 30%, and Kispert's marginal tax rate is 21%. If the company uses the retail-price pricing

method of determining the appropriate transfer price and wants to maximize after tax profits for their owner, what is the cost,

rounded to the nearest penny, that Steve Corp. should charge Kispert for the chemicals?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A system contains many processes. Three common processes that are “grouped” together are transaction corrections, adjustments, and cancellations. These three elements work to properly serve customers. Imagine a system that allows you to register for a class online. The online system must give you a way to correct any errors you made, such as registering for the wrong class. This would be a transaction correction. The system should also allow you to make adjustments, such as adding or dropping classes. Finally, the system should allow you to make cancellations, such as cancelling the registration process entirely. Notice that all three of these processes, correction, adjustment, and cancellation, work together to provide you with one service, which is registering for classes. What type of requirements are transaction corrections, adjustments, and cancellations? Select one. Question 4 options: A Functional Requirements B Nonfunctional Requirementsarrow_forwardNot a previously submitted question. Thank youarrow_forwardWhen should you use Power BI Services?arrow_forward

- can you please show me how to calculate this without using excel? Thanksarrow_forwardHow would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

- During the research process, if you are unsure whether or not you've found all the relevant literature, what should you do? A. Google it to see if there is anything else you've missed. B. Call your manager to verify that you've found it all. C. Use the search engine included in the Codification. D. Complain that it's too much work and call it a day.arrow_forwardThis question has not been submitted previously. Thank youarrow_forwardis there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education