FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow

ideas from gpt, but please do not believe its answer.Very very grateful!

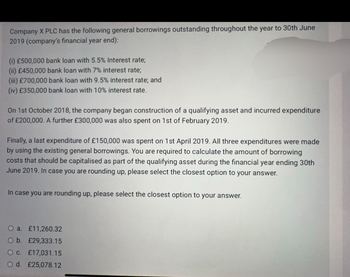

Transcribed Image Text:Company X PLC has the following general borrowings outstanding throughout the year to 30th June

2019 (company's financial year end):

(i) £500,000 bank loan with 5.5% Interest rate;

(ii) £450,000 bank loan with 7% interest rate;

(iii) £700,000 bank loan with 9.5% interest rate; and

(iv) £350,000 bank loan with 10% interest rate.

On 1st October 2018, the company began construction of a qualifying asset and incurred expenditure

of £200,000. A further £300,000 was also spent on 1st of February 2019.

Finally, a last expenditure of £150,000 was spent on 1st April 2019. All three expenditures were made

by using the existing general borrowings. You are required to calculate the amount of borrowing

costs that should be capitalised as part of the qualifying asset during the financial year ending 30th

June 2019. In case you are rounding up, please select the closest option to your answer.

In case you are rounding up, please select the closest option to your answer.

O a. £11,260.32

O b. £29,333.15

O c. £17,031.15

O d. £25,078.12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sometimes, a newly implemented AIS may not receive proper support from the users. These behavioural could take in the form of resisting this change. Explain TWO (2) reasons why this resistance occur and recommend TWO (2) approaches that companies can implement to reduce this resistance.arrow_forwardAn indirect strategY places the main idea after an explanation or reason. Which of the following is a situation that might call for an indirect strategy? Check all that apply. O You need to inform your team that the upcoming project will be a challenge. O You need to convince your coworkers to adopt a new software program that they don't understand. O You are sending a past-due notice on an account. O You need to fire your receptionist. O You want to schedule a meeting to update your boss on a client meeting. Which or the following is a situation that might call for an indirect strategy? O When preventing frustration O when trying to facilitate use of proper words Respects the feelings of the audiencearrow_forwardI really need help with this item below. I have tried a few different ways to do this problem, but the top box keeps coming back as incorrect. I know that the amounts are correct, but the first box is wrong for some reason. Please read the feedback boxes and include the appropriate formulas and cell references for this item. This is done through Excel. PLEASE HELP!!!!!! Note that the pictures are the same exact problem, but I used two separate formulas to try and solve this problem.arrow_forward

- You overheard a friend at a party say that computers and information technology will greatly decrease the demand for auditors. Do you believe this to be true. How would you respond to this comment?arrow_forwardWhat does the Ricardo-Barro effect say about the crowding-out effect? A. There is no crowding-out effect. B. The crowding-out effect will be large. C. The crowding-out effect will be small. D. It will be a crowding-in effect. Thanks!!!arrow_forwardjjoijoijuoil;jkjlkkllkmlkmllkarrow_forward

- Can you please do A and B by itself? It is confusing me when you combine both.arrow_forwardIm having an issue with this problem. Thank you!arrow_forwardA Framework for decision making: a. can help reduce the unexpected consequences of our actions. b. is not needed if the activity is legal. c. helps identify who gains the most from a decision.arrow_forward

- What are the computer ethical issues regarding artificial intelligence?arrow_forwardExplain with Headings: Question : Some time we cannot deliver message accurately and lucidly, which are those road blocks which become the hurdle in the way of effective communication? Explain.arrow_forwardWhy bother with pseudocode? Why not spend the time developing actual source code?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education