FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

At the end of the year, the company had actually incurred the following:

attached in 2 ss's below

thanks

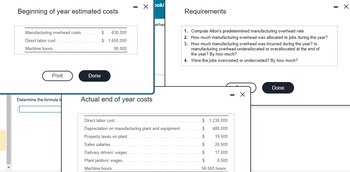

Transcribed Image Text:Beginning of year estimated costs

Manufacturing overhead costs

Direct labor cost

Machine hours.

Print

Determine the formula

Done

$ 630,000

$1,650,000

90,000

X

Actual end of year costs

bok/

erhea

Direct labor cost

Depreciation on manufacturing plant and equipment.

Property taxes on plant.

Sales salaries

Delivery drivers' wages.

Plant janitors' wages.

Machine hours.

Requirements

1. Compute Alton's predetermined manufacturing overhead rate.

2. How much manufacturing overhead was allocated to jobs during the year?

3. How much manufacturing overhead was incurred during the year? Is

manufacturing overhead underallocated or overallocated at the end of

the year? By how much?

4. Were the jobs overcosted or undercosted? By how much?

1,230,000

480,000

19,500

26,500

17,000

8,500

56,500 hours

$

$

$

$

$

$

Done

- X

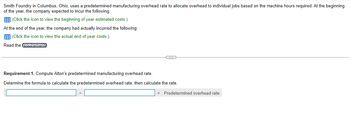

Transcribed Image Text:Smith Foundry in Columbus, Ohio, uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. At the beginning

of the year, the company expected to incur the following:

(Click the icon to view the beginning of year estimated costs.)

At the end of the year, the company had actually incurred the following:

(Click the icon to view the actual end of year costs.)

Read the requirements

C

Requirement 1. Compute Alton's predetermined manufacturing overhead rate.

Determine the formula to calculate the predetermined overhead rate, then calculate the rate.

= Predetermined overhead rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- am.104.arrow_forwardHawkeye Corporation starts business on April 2, 2023. The corporation reports startup expenditures of $64,000 all incurred in the prior year. Determine the total amount that Hawkeye Corporation can elect to deduct in 2023. O a. $0 O b. $3,200 O c. $4,267 O d. $7,950arrow_forwardPrint Item Exercise 8-24 (Algorithmic) (LO. 3) McKenzie placed in service qualifying equipment (7-year MACRS class) for his business that cost $404,900 in 2023. The taxable income of the business for the year is $70,700 before consideration of any § 179 deduction. If an amount is zero, enter "0". a. Calculate McKenzie's § 179 expense deduction for 2023 and any carryover to 2024. § 179 expense deduction for 2023: $ § 179 carryover to 2024: $ b. How would your answer change if McKenzie decided to use additional first-year (bonus) depreciation on the equipment instead of using § 179 expensing? Hint: See Concept Summary 8.3. Additional first-year depreciation for 2023: $ MACRS cost recovery for 2023: $ Total cost recovery for 2023: $arrow_forward

- Weld Corporation is constructing a plant for its own use. Weld capitalizes interest on an annual basis. The following expenditures are made during the current year: January 1, $102,000; July 1, $986,000; September 1, $2,720,000; and December 31, $7,174,000. The following debts were outstanding throughout the current year. Debt Construction note, 12% Short-term note payable, 15% Amount $340,000 1,360,000 Accounts payable (noninterest-bearing) 1,360,000 Note: Round all of your answers to the nearest whole number or whole percentage point. a. Compute the amount of interest to be capitalized during the year. Calculation of Actual Interest Debt Debt Amount Interest rate Interest Amount Specific Debt Construction loan $ 340,000 12 % $ 40,800 General Debt Note payable $ 1,360,000 15% Total Actual Interest $ 204,000✔ 244,800 Calculation of Weighted Average Accumulated Expenditures Weighted Avg. Date January 1 July 1 $ Expenditures 102,000 ✔ 986,000 ✔ Months outstanding Accum. Expenditures 12 $…arrow_forwardAccrued Expenses: Entity D acquired a piece of land on April 1, 20x1. The purchase price was reduced by a credit for the real property taxes accrued during the year. Entity D records real property taxes at each month-end by adjusting the prepaid tax or tax payable account as appropriate On May 1, 20x1 Entity D paid the first of two equal installments of P72,000 for real property taxes. Requirement: What is the entry to record the payment on May 1?arrow_forward3) Aira Company reported gross payroll of P600,000 for the month of January. The entity paid the payroll net of the following deductions: Income tax P80,000 20,000 SSS Philhealth 6,000 Pag-ibig/HDMF 8,500 In addition, the entity recognized its additional contributions for the following in relation to January payroll: SSS Philhealth P25,000 7,000 9,000 Pag-ibig/HDMF The net pay and mandatory deductions and contributions were paid on February. What is the total liability related to payroll for the month of January? (Note: TOTAL amount, include withheld amounts)arrow_forward

- Current Attempt in Progress Swifty Wholesalers Ltd. has a December 31 year end. The company incurred the following transactions related to current liabilities: 1. Swifty's cash register showed the following totals at the end of the day on March 17: pre-tax sales $55,000, GST $2,750, and PST $3,850. 2. 3. Swifty remitted $49,000 of sales taxes owing from March to the government on April 30. Swifty paid its employees for the week of August 15 on August 20. The gross pay was $80,000. The company deducted $4,240 for CPP, $1,264 for El, $6,400 for pension, and $16,020 for income tax from the employees' pay. 4. Swifty recorded the employer portions of CPP and El for the week of August 15 on August 20 for $4,240 and $1,770, respectively. 5. On September 15, all amounts owing for employee income taxes, CPP, and El pertaining to the payroll transactions above were paid. 6. On December 31, Swifty's legal counsel believes that the company will have to pay damages of $62,000 next year to a local…arrow_forwardThe following transactions apply to Walnut Enterprises for Year 1, its first year of operations: Received $50,000 cash from the issue of a short-term note with a 6 percent interest rate and a one-year maturity. The note was made on April 1, Year 1. Received $130,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. Paid $62,000 cash for other operating expenses during the year. Paid the sales tax due on $110,000 of the service revenue for the year. Sales tax on the balance of the revenue is not due until Year 2. Recognized the accrued interest at December 31, Year 1. The following transactions apply to Walnut Enterprises for Year 2: Paid the balance of the sales tax due for Year 1. Received $201,000 cash plus applicable sales tax from performing services. The services are subject to a sales tax rate of 6 percent. Repaid the principal of the note and applicable interest on April 1, Year 2. Paid $102,500 of other…arrow_forward11. The Dot Corporation has changed its year-end from a calendar year-end to August 31. The income for its short period from January 1 to August 31 is $54,000. The tax for this short period is: a.$2,040 b.$8,667 c.$11,340 d.$6,250arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education