FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

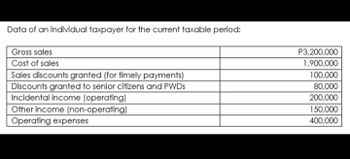

How much is the special itemized deductions from gross income?

a. Zero

b. 80,000

c. 100,000

d. 180,000

Transcribed Image Text:Data of an individual taxpayer for the current taxable period:

Gross sales

Cost of sales

Sales discounts granted (for timely payments)

Discounts granted to senior citizens and PWDs

Incidental income (operating)

Other income (non-operating)

Operating expenses

P3,200,000

1,900,000

100,000

80,000

200,000

150,000

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- is there a $100 need to be deducted as per the $100 rule?!?arrow_forwardUse the marginal tax rate chart to answer the question. Tax Bracket Marginal Tax Rate $0–$10,275 10% $10,276–$41,175 12% $41,176–$89,075 22% $89,076–$170,050 24% $170,051–$215,950 32% $215,951–$539,900 35% > $539,901 37% Determine the effective tax rate for a taxable income of $95,600. Round the final answer to the nearest hundredtharrow_forwardWhich taxes are major taxes on income? That is, which taxes are normally paid in the form of deductions from a worker's paycheck? Major Tax Sc property tax Medicare tax income tax 1 Not a Major Tax Q A 2 ZI option WS # 3 X H command c E D S4 JAR 19 CRF +++ % 5 sales tax Search or type URL Social Security tax VT 6 GY B tv 7 H SHIVA UN* CO 8 J1 M 9 K(+ OH comarrow_forward

- d cion The table given below shows the absolute tax amounts under five different tax policies for respective income levels. Table 19.2 Annual Pretax Income Tax Policy Alpha O Gamma. Alpha. SO $0 $0 $0 $0 $10,000 $1,000 $1,000 $1,000 $1,000 $1,000 $50,000 $5,000 $6,000 $4,000 $1,000 $900 $100,000 $10,000 $15,000 $6,000 $1,000 $800 Beta. O Eta. Refer to Table 19.2. The tax structure which leads to maximum income inequality is: Delta. Tax Policy Beta Question 18 Tax Policy Gamma 27 Tax Policy Delta Tax Policy Eta $0 tv 9 N 4.nts. Narrow_forwardQUESTION 8 Given the following information, calculate the total annual tax liability of the homeowner: market value of property: $350,000; assessed value of property: 40% of the market value; exemptions: $2,000; millage rate: 33.95 mills. O $11, 882.50 O $4,753.00 O $4,685.10 O $46,851.00arrow_forwardDetermine taxable income in each of the following independent cases. In all cases, the company was formed in 2012, was very profitable in all years prior to 2017, and had retained earnings of $1,000,000 at the end of 2017. Required: In 2018, Company A has taxable income of $60,500 prior to consideration of any net operating loss. In 2017, the company incurred a net operating loss of $10,200. It did not elect to waive the carryback period. Determine 2018 taxable income. In 2018, Company B has taxable income of $50,400 prior to consideration of any net operating loss. In 2017, the company incurred a net operating loss of $20,300. It elected to waive the carryback period. Determine 2018 taxable income. In 2021, Company C has taxable income of $35,350 prior to consideration of any net operating loss. In 2020, the company incurred a net operating loss of $30, 320 and elected to forgo the carryback period. Determine 2021 taxable income. In 2021, Company D has taxable income of $35,350 prior…arrow_forward

- Jeremy (unmarried) earned $101, 000 in salary and $6, 100 in interest income during the year. Jeremy's employer withheld $10,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child (age 14) who lives with him. Jeremy qualifies to file as head of household and has $25,000 in itemized deductions. b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,080. What is Jeremy's tax refund or tax due including the tax on the capital gain?Schedule Z - Head of Householdarrow_forwardD42 Enter X 21 Gross FUTA Tax DUE 22 23 Problem 4 24 25 26 27 28 29 30 Total Futa Taxable Wages 31 Credit against FUTA (assume applicable) 32 33 34 Problem 5 35 36 37 38 39 40 Gross FUTA Tax DUE 41 Credit against FUTA (assume applicable) 42 NET FUTA tax: With the following data, compute the Credit against FUTA: (assume applicable as well as the Maximum Credit allowed). Esc B With the following data, compute the NET FUTA Tax. Instructions Accessibility: Good to go ☆ Type here to search F1 fx 3650 Problem 1 4₁ @ 2 F2 # F3 Problems 2-5 3 $ 127,000 (c) $ Ş ZI -¤- CỌ: C (b) 6,750 3,100 (d) 3650 $ O E F4 4 F5 % 5 F6 8 AS b F7arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 ernment Budget Fiscal Policy FILL IN THE BLANK UNIT TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% D) The average tax rate for someone making $120,000. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forward

- Question 14 What is your average tax rate if you pay taxes of $7134 on taxable income of $57920? (Reminder: Enter your answer as a decimal, not a percentage.) Your Answer: Answerarrow_forwardWynn Farms reported a net operating loss of $225,000 for financial reporting and tax purposes in 2021. The enacted tax rate is 25%. Taxable income, tax rates, and income taxes paid in Wynn's first four years of operation were as follows: Income Taxable Income 2017$ 73,000 2018 83,000 2019 145,000 2020 Таx Таxes Paid $21,900 24,900 58,000 18,000 Rates 30% 30 40 40,000 45 Required: 1. NOL carrybacks are not allowed for most companies, except for property and casualty insurance companies as well as some farm-related businesses. Assume Wynn is one of those businesses. Complete the table given below and prepare the journal entry to recognize the income tax benefit of the net operating loss. 2. Show the lower portion of the 2021 income statement that reports the income tax benefit of the net operating loss. X Answer is not complete. Complete this question by entering your answers in the tabs below. Required Required Required 1 GJ 1 2 NOL carrybacks are not allowed for most companies, except…arrow_forward2020 Tax Rate Schedules Single-Schedule X Head of household-Schedule Z If taxable of the If taxable of the income is: But not атоunt income is: But not атоunt Over- over- The tax is: over- Over- over- The tax is: over- $ 9,875 .........10% 2$ $ $ 14,100 .........10% 2$ 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 + 12% 14,100 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 53,700 85,525 163,300 14,605.50 + 24% 85,525 85,500 163,300 13,158.00 + 24% 85,500 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 163,300 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 207,350 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 + 37% 518,400 Married filing jointly or Qualifying widow(er)- Schedule Y-1 Married filing separately-Schedule Y-2 If taxable of the If taxable of the income is: But not атоunt income is: But not атоunt Over- over- The tax is: over- Over- over- The tax is: over- 2$ $ 19,750 .........10% $ $ $ 9,875…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education