FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

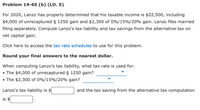

Transcribed Image Text:Problem 14-65 (b) (LO. 5)

For 2020, Lanzo has properly determined that his taxable income is $22,500, including

$4,000 of unrecaptured § 1250 gain and $2,300 of 0%/15%/20% gain. Lanzo files married

filing separately. Compute Lanzo's tax liability and tax savings from the alternative tax on

net capital gain.

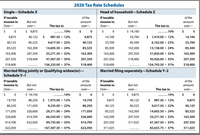

Click here to access the tax rate schedules to use for this problem.

Round your final answers to the nearest dollar.

When computing Lanzo's tax liability, what tax rate is used for:

• The $4,000 of unrecaptured § 1250 gain?

• The $2,300 of 0%/15%/20% gain?

Lanzo's tax liability is $

and the tax saving from the alternative tax computation

is $

Transcribed Image Text:2020 Tax Rate Schedules

Single-Schedule X

Head of household-Schedule Z

If taxable

of the

If taxable

of the

income is:

But not

атоunt

income is:

But not

атоunt

Over-

over-

The tax is:

over-

Over-

over-

The tax is:

over-

$ 9,875

.........10%

2$

$

$ 14,100

.........10%

2$

9,875

40,125

$

987.50 + 12%

9,875

14,100

53,700

$

1,410.00 + 12%

14,100

40,125

85,525

4,617.50 + 22%

40,125

53,700

85,500

6,162.00 + 22%

53,700

85,525

163,300

14,605.50 + 24%

85,525

85,500

163,300

13,158.00 + 24%

85,500

163,300

207,350

33,271.50 + 32%

163,300

163,300

207,350

31,830.00 + 32%

163,300

207,350

518,400

47,367.50 + 35%

207,350

207,350

518,400

45,926.00 + 35%

207,350

518,400

156,235.00 + 37%

518,400

518,400

154,793.50 + 37%

518,400

Married filing jointly or Qualifying widow(er)-

Schedule Y-1

Married filing separately-Schedule Y-2

If taxable

of the

If taxable

of the

income is:

But not

атоunt

income is:

But not

атоunt

Over-

over-

The tax is:

over-

Over-

over-

The tax is:

over-

2$

$ 19,750

.........10%

$

$

$ 9,875

.......10%

$

19,750

80,250

$

1,975.00 + 12%

19,750

9,875

40,125

$

987.50 + 12%

9,875

80,250

171,050

9,235.00 + 22%

80,250

40,125

85,525

4,617.50 + 22%

40,125

171,050

326,600

29,211.00 + 24%

171,050

85,525

163,300

14,605.50 + 24%

85,525

326,600

414,700

66,543.00 + 32%

326,600

163,300

207,350

33,271.50 + 32%

163,300

414,700

622,050

94,735.00 + 35%

414,700

207,350

311,025

47,367.50 + 35%

207,350

622,050

167,307.50 + 37%

622,050

311,025

83,653.75 + 37%

311,025

.........

.........

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem Renee and Sanjeev Patel, who are married, reported taxable income of $1,008,000 for 2022. They incurred positive AMT modifications of $142,500. Click here to access the exemption table. a. Compute the Patels' alternative minimum taxable income (AMTI) for 2022. 1,008,000 Taxable income Plus: Equals: AMTI AMTI b. Compute the Patel's tentative minimum tax. Computation of AMT Base and Tax 8) AMT modifications AMT exemption AMT base TMT $ 75,000 1,083,000 1,083,000arrow_forwardMr. Coleman, an unmarried individual, has the following income items: Interest income Schedule C net profit $23,200 61,640 He has $10,300 itemized deductions and no dependents. Mr. Coleman's Schedule C income is qualified business income (non service). Required: Compute Mr. Coleman's income tax. Assume the taxable year is 2020. Use Individual Tax Rate Schedules and Standard Deduction Table. (Round your intermediate calculations and final answers to the nearest whole dollar amount.) AGI Taxable Income Income tax Amountarrow_forwardA9arrow_forward

- ! Required information [The following information applies to the questions displayed below.] In 2023, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. d. Her AMT base is $422,500, which includes $13,000 of qualified dividends. Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amountarrow_forwardonly typed solutionarrow_forwardNikularrow_forward

- Required information [The following information applies to the questions displayed below.] In 2023, Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing jointly). Carson's parents provided most of his support. What is Carson's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. Carson is 23 years old at year-end. He is a full-time student and earned $16,400 from his summer internship and part-time job. He also received $5,280 of qualified dividend income Tax liabilityarrow_forwardUse the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is S (Simplify your answer. Round to the nearest dollar as needed.) Marco is married filing separately with a taxable income of $67,900. Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) Married Filing Separately up to $9325 up to $37,950 up to $76,550 up to $116,675 up to $208,350 up to $235,350 above $235,350 $6350 $4050arrow_forwardSubject -account Please help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education