FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Determine taxable income in each of the following independent cases. In all cases, the company was formed in 2012, was very profitable in all years prior to 2017, and had retained earnings of $1,000,000 at the end of 2017. Required: In 2018, Company A has taxable

income of $60,500 prior to consideration of any net operating loss. In 2017, the company incurred a net operating loss of $10,200. It did not elect to waive the carryback period. Determine 2018 taxable income. In 2018, Company B has taxable income of $50,400 prior to

consideration of any net operating loss. In 2017, the company incurred a net operating loss of $20,300. It elected to waive the carryback period. Determine 2018 taxable income. In 2021, Company C has taxable income of $35,350 prior to consideration of any net operating

loss. In 2020, the company incurred a net operating loss of $30, 320 and elected to forgo the carryback period. Determine 2021 taxable income. In 2021, Company D has taxable income of $35,350 prior to consideration of any net operating loss. In 2017, the company

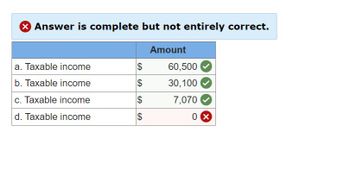

incurred a net operating loss of $5,050. It elected to waive the carryback period. In 2018, the company incurred a net operating loss of $40, 400. In 2019 and 2020, the company had net income of zero. Determine 2021 taxable income. Answer is complete but not entirely

correct.

Transcribed Image Text:Answer is complete but not entirely correct.

Amount

a. Taxable income

$

60,500

b. Taxable income

SA

$

30,100

c. Taxable income

d. Taxable income

$

$

7,070

SA

0 ☑

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Paresarrow_forward(Two Differences, One Rate, Beginning Deferred Balance, Compute Pretax Financial Income) Andy McDowell Co. establishes a $100 million liability at the end of 2017 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2018. Also, at the end of 2017, the company has $50 million of temporary differences due to excess depreciation for tax purposes, $7 million of which will reverse in 2018. The enacted tax rate for all years is 40%, and the company pays taxes of $64 million on $160 million of taxable income in 2017. McDowell expects to have taxable income in 2018.Instructions(a) Determine the deferred taxes to be reported at the end of 2017.(b) Indicate how the deferred taxes computed in (a) are to be reported on the balance sheet.(c) Assuming that the only deferred tax account at the beginning of 2017 was a deferred tax liability of $10,000,000, draft the income tax expense portion of the income…arrow_forwardam.101.arrow_forward

- WCC Corporation has a $125,000 net operating loss carryover to 2022 from a previous year. Assume that it reported $80,000 of taxable income in 2022 (before the net operating loss deduction) and $55,000 of taxable income in 2023 (before the net operating loss deduction). Note: Leave no answer blank. Enter zero if applicable. Required: What is WCC's taxable income in 2022 and 2023 (after the net operating loss deduction), assuming the $125,000 NOL carryover originated in 2017? What is WCC’s taxable income in 2022 and 2023 (after the net operating loss deduction), assuming the $125,000 NOL carryover originated in 2021? Assuming the $125,000 NOL carryover originated in 2020, what is WCC’s book–tax difference associated with the NOL inarrow_forwardBrown Corp has a deferred tax asset account with balance of $80,000 at the end of 2019 due to a single cumulative temporary difference of $350,000. At the end of 2020, this same temporary difference has increased to cumulative amount of $410,000. Taxable income for 2020 is $800,000. The tax rate is 25% for all years. No valuation account related to the deferred tax asset is in existence at the end of 2019. What one of the following is correct about the journal entry to record Brown's 2020 income tax expense? Group of answer choices Dr. Deferred tax asset $15,000 Dr. Deferred tax liability $25,000 Dr. Income tax expense $200,000 Cr. Tax payable $112,000arrow_forwardplease helparrow_forward

- Luck Corporation , which was formed January 1, 2015, has a net short-term capital gain of $60,000 and a net long-term capital loss of $100,000 during 2020. Luck Corporation had taxable income from other sources of $200,000. Prior years' transactions included the following (note 2019 had no capital gains or losses):2015- net long term capital gain of 150k 2016- net short term capital gain of 24k 2017- net short term capital gain of 12k 2018- net long term capital gain of 8kLuck's carryover to 2021 is: Select one: a. $0 b. $40,000 long-term capital loss c. $20,000 long-term capital loss d. $20,000 short-term capital loss e. None of the abovearrow_forwardDetermine taxable income in each of the following independent cases. In all cases, the company was very profitable in all years prior to 2017 and it had retained earnings of $1,000,000 at the end of 2017. Required: In 2019, Company C has taxable income of $36,750 prior to consideration of any net operating loss. In 2018, the company incurred a net operating loss of $31,600. Determine 2019 taxable income. In 2019, Company D has taxable income of $36,750 prior to consideration of any net operating loss. In 2017, the company incurred a net operating loss of $5,250. It elected to waive the carryback period. In 2018, the company incurred a net operating loss of $42,000. Determine 2019 taxable income.arrow_forwardWCC Corporation has a $125,000 net operating loss carryover into 2021. Assume that it reported $80,000 of taxable income in 2021 (before the net operating loss deduction) and $55,000 of taxable income in 2022 (before the net operating loss deduction). (Leave no answer blank. Enter zero if applicable.) b. What is WCC’s taxable income in 2021 and 2022 (after the net operating loss deduction), assuming the $125,000 NOL carryover originated in 2020 and WCC elected to not carry back the loss?arrow_forward

- If a C corporation incurs a net operating loss in 2023 and carries the loss forward to 2024, the NOL carryover is allowed to offset 80 percent of the corporation's taxable income remaining after deducting NOL carryovers from years before 2018. True or False True Falsearrow_forwardGoose Corporation, a C corporation, incurs a net capital loss of $23,900 for 2021. It also has ordinary income of $19,120 in 2021. Goose had net capital gains of $4,780 in 2017 and $9,560 in 2020. If an amount is zero, enter "0". a. Determine the amount, if any, of the net capital loss of $23,900 that is deductible in 2021.$fill in the blank 1 _______ ? b. Determine the amount, if any, of the net capital loss of $23,900 that is carried forward to 2022.$fill in the blank 1 ______?arrow_forwardPronghorn Inc. incurred a net operating loss of $583,900 in 2023. Combined income for 2020, 2021, and 2022 was $464,400. The tax rate for all years is 30%. Assume that it is more likely than not that the entire tax loss carryforward will not be realized in future years. Assume that Pronghorn earns taxable income of $20,300 in 2024 and that at the end of 2024 there is still too much uncertainty to recognize a deferred tax asset. (a) Prepare the journal entries that are necessary at the end of 2024 assuming that Pronghorn does not use a valuation allowance account. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Year Account Titles and Explanation 2024 2024 (To record current tax expense) (To record current tax benefit) Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education