Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need Help Please Provide Answer

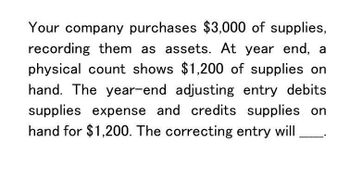

Transcribed Image Text:Your company purchases $3,000 of supplies,

recording them as assets. At year end, a

physical count shows $1,200 of supplies on

hand. The year-end adjusting entry debits

supplies expense and credits supplies on

hand for $1,200. The correcting entry will

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Need answer the questionarrow_forwardYour company purchases $4,500 of supplies, recording them as assets. At year end, a physical count sAhows $1,400 of supplies on hand. The year-end adjusting entry debits supplies expense and credits supplies on hand for $1,400. The correcting entry will _. Provide Answerarrow_forwardThe general ledger of the Jumper Incorporated is showing an Accounts Receivable balance of $80,000, Sales Revenue of $650,000, and Sales Returns and Allowances of $30,000. If Jumper Inc used the direct write-off method to account for uncollectible accounts, do the adjusting journal entry on December 31st, assuming Jumper Inc determines that John Hancock's $2,500 balance is uncollectable.arrow_forward

- prepare these entries for Sarah's plant services. prepare general journal entries for the needed balance dy adjustments for the year ending 30/6/21: A stocktake of the inventory on hand was completed on 30/6/21. The value of the stocktake was $17,000. The inventory asset account as at 30/6/21 before adjustments was $18.000 The allowance for Doubtful debts should be 5% of the balance of Accounts Receivable. The accounts receivable balance at 30/6/21 is $76,120 and the balance of the Allowance for Doubtful Debts was $3,450arrow_forwardThe ledger of Pina Colada Corp. at the end of the current year shows Accounts Receivable $108,000; Sales Revenue $832,000; and Sales Returns and Allowances $18,100. If Pina Colada uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at (a) December 31, assuming Pina Colada determines that L. Dole's $1,000 balance is uncollectible. If Allowance for Doubtful Accounts has a credit balance of $2,000 in the trial balance, journalize the adjusting entry at (b) December 31, assuming bad debts are expected to be 11% of accounts receivable. If Allowance for Doubtful Accounts has a debit balance of $199 in the trial balance, journalize the adjusting entry (c) December 31, assuming bad debts are expected to be 8% of accounts receivable.arrow_forwardPlease to do the Journal and the balance sheet and the allowance for uncollectablearrow_forward

- For a business that uses the allowance method of accounting for uncollectible receivables: Journalize the entries to record the following: Use correct journal format. Just use the month for the date. Record the adjusting entry at December 31, the end of the first fiscal year, to record the bad debt expense. The accounts receivable account has a balance of $850,000, and the contra asset account before adjustment has a debit balance of $4000. Analysis of the receivables (aging) indicates uncollectible receivables of $17,200. In March of the next year, the $720 owed by Fronk Co. on account is written off as uncollectible. In November of the next year, $400 of the Fronk Co. account 1s reinstated and payment of that amount is received. In December of the next year, $250 is received on the $800 owed by Dodger Co. and the remainder is written off as uncollectible.arrow_forwardThe ledger of Metlock, Inc. at the end of the current year shows Accounts Receivable $85,700; Credit Sales $845,580; and Sales Returns and Allowances $42,390. (a) If Metlock, Inc. uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Metlock, Inc. determines that Matisse’s $883 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $1,191 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 9% of accounts receivable. (c) If Allowance for Doubtful Accounts has a debit balance of $450 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) enter an account title enter a…arrow_forwardNeed Answerarrow_forward

- The ledger of Pina Colada Corp. at the end of the current year shows Accounts Receivable $108,000; Sales Revenue $832,000; and Sales Returns and Allowances $18,100. (a) If Pina Colada uses the direct write-off method to account for uncollectible accounts, journalize the adjusting entry at December 31, assuming Pina Colada determines that L. Dole’s $1,000 balance is uncollectible. (b) If Allowance for Doubtful Accounts has a credit balance of $2,000 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 11% of accounts receivable. (c) If Allowance for Doubtful Accounts has a debit balance of $199 in the trial balance, journalize the adjusting entry at December 31, assuming bad debts are expected to be 8% of accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation Debit Credit (a) enter an account title…arrow_forwardAt December 31, 2021, Wonder of the World Travel has an Accounts Receivable balance of $89,000. Allowance for Uncollectible Accounts has a credit balance of $830 before the year-end adjustment. Service revenue (all on account) for 2021 was $700,000. Wonder of the World estimates that its uncollectible-account expense for the year is 2% of service revenue. Read the requirement. Make the year-end entry to record uncollectible-account expense. (Record debits first, then credits. Exclude explanations from any journal entries.) Date Dec 31 Journal Entry Accounts Debit Credit Show how Accounts Receivable and the Allowance for Uncollectible Accounts are reported on the balance sheet at December 31, 2021. BALANCE SHEET (Partial) Current assets: Less:arrow_forwardFor a business that uses the allowance method of accounting for uncollectible receivables:Journalize the entries to record the following: Use correct journal format. Just use the month for the date.(1) Record the adjusting entry at December 31, the end of the first fiscal year, to record the bad debt expense. The accounts receivable account has a balance of $850,000, and the contra asset account before adjustment has a debit balance of $4000. Analysis of the receivables (aging) indicates uncollectible receivables of $17,200.(2)In March of the next year, the $720 owed by Fronk Co. on account is written off as uncollectible.In November of the next year, $400 of the Fronk Co. account is reinstated and payment of that amount is received.In December of the next year, $250 is received on the $800 owed by Dodger Co. and the remainder is written off as uncollectible.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub