FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Sp25 ACCT X CengageNOWv2 | Online teaching X

exhibit 6.4.jpg 71x399)

x +

bw.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true

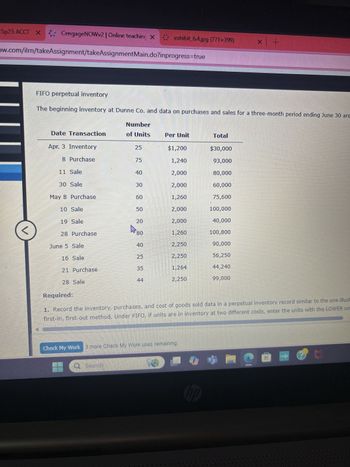

FIFO perpetual inventory

The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period ending June 30 are

Number

Date Transaction

of Units

Per Unit

Total

Apr. 3 Inventory

25

$1,200

$30,000

8 Purchase

75

1,240

93,000

11 Sale

40

2,000

80,000

30 Sale

30

2,000

60,000

May 8 Purchase

60

1,260

75,600

10 Sale

50

2,000

100,000

19 Sale

20

2,000

40,000

<

28 Purchase

80

1,260

100,800

June 5 Sale

40

2,250

90,000

16 Sale

25

2,250

56,250

21 Purchase

35

1,264

44,240

28 Sale

44

2,250

99,000

Required:

1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illust

first-in, first-out method. Under FIFO, if units are in inventory at two different costs, enter the units with the LOWER un

Check My Work 3 more Check My Work uses remaining

Q Search

hp

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- %24 %24 Cengage Learning signment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook 4Show Me How ECalculator FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 8,100 units at $180 Sale 5,300 units at $300 First purchase 15,000 units at $185 Sale 13,000 units at $300 Second purchase 16,000 units at $192 Sale 14,000 units at $300 The firm uses the perpetual inventory system, and there are 6,800 units of the item on hand at the end of the year. a. What is the total cost of the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? ツ 日 a 五 prt sc f12" end homearrow_forwardThree Assignment - ACC X CengageNOWv2 | Online teachin X+ om/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogre.. еBook Show Me How FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory 33 units at $41 Sale 22 units at $57 First purchase 34 units at $44 Sale 32 units at $58 Second purchase 30 units at $47 Sale 16 units at $60 The firm uses the perpetual inventory system, and there are 27 units of the item on hand at the end of the year. a. What is the total costrof the ending inventory according to FIFO? b. What is the total cost of the ending inventory according to LIFO? Prev Check My Work 46°F ^ Earrow_forwardX CengageNOWv2 | Online teachin X N2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocato... Q Not syncing 田 eBook E Print Item Swing Company's beginning inventory and purchases during the fiscal year ended September 30, 20-2, were as follows: Units Unit Price Total Cost October 1, 20-1 Beginning inventory 1st purchase 2nd purchase 400 $19 $7,600 October 18 490 19.5 9,555 November 25 190 20.5 3,895 January 12, 20-2 Brd purchase 310 21 6,510 March 17 4th purchase Sth purchase 6th purchase 7th purchase 890 22.5 20,025 June 2 770 23 17,710 August 21 200 24 4,800 September 27 710 25 17,750 3,960 $87,845 Use the following information for the specific identification method. There are 1,300 units of inventory on hand on September 30, 20-2. Of these 1,300 units: 100 are from October 18, 20-1 1st purchase 200 are from January 12, 20-2 Brd purchase 100 are from March 17 4th purchase 400 are from June 2 5th purchase 200 are from August 21 6th purchase 300…arrow_forward

- Edit View History Bookmarks Window Help A education.wiley.com ssan D 74) XAYAAD XIKMO OO. w NWP Assessment Playe. N Solved > 5-1 Accounti.. C Home | Chegg.com A DQ9: Data Mining - S Question 5 of 10 - /3 view Policies Current Attempt in Progress Shellhammer Company's inventory records show the following data for the month of September: Units Unit Cost Inventory, September 1 100 $3,34 Purchases: September 8 450 3.50 September 18 350 3.70 A physical inventory on September 30 shows 200 units on hand. Calculate the value of the ending inventory and cost of goods sold if the company uses weighted average inventory costing and a periodic inventory system. (Round cost per unit to 2 decimal places, e.g. 15.25 and ending inventory and cost of goods sold to the nearest dollar, e.g. 5,275.) Ending inventory Cost of goods sold $ Save for Later Attempts: 0 of 1 used Submit Answer 7,288 MAR 7 tv ... 80arrow_forwardX CengageNOWv2 | Online teachin X + com/ilm/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignmentSessionLocator assign... eBook Show Me How Weighted average cost flow method under perpetual inventory system The following units of a particular item were available for sale during the calendar year: Jan. 1 Inventory 9,000 units at $50.00 Mar. 18 Sale 7,000 units May 2 Purchase 8,000 units at $56.50 Aug. 9 Sale 8,000 units Oct. 20 Purchase A✩ 中 4,000 units at $60.00 The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5. Round your "Unit Cost" answers to two decimal places. Weighted Average Cost Flow Method Goods Sold Cost ofarrow_forwardQuestion attached inthe SS Thanks tkn42n242-4924 646 464064062-4 420i6 0h4arrow_forward

- How to solve fifo and lifoarrow_forwardnot use ai please 3wjdudid7djsjsj3mwolamdjgig8r8rxarrow_forward* CengageNOwv2 | Online teachir x s://v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssi. 31 回 eBook Show Me How Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are as follows: Oct. 1 Inventory 300 units at $12 13 Sale 170 units 22 Purchase 370 units at $15 29 Sale 200 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of goods sold on October 29. Round your "average unit cost" to two decimal places. C. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost" to two decimal places. Check My Work ( Previous Next> All work saved. Email Instructor Save and Exit Submit…arrow_forward

- cakeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Show Me How Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Copper are as follows: Mar. 1 Inventory 450 units at $7 9. Sale 390units 13 Purchase 410 units at $8 25 Sale 340 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on March 25 and (b) the inventory on March 31. a. Cost of merchandise sold on March 25 2,720 X b. Inventory on March 31 980 Feedback Check My Work a. When the FIFO method is used, costs are included in cost of merchandise sold in the order in which they were purchased. Think of your inventory in terms of "layers." Determine how much inventory remains from each layer after each sale. b. The ending inventory is made up of the most recent purchases. Previous Next Check My Work 1:18 AM E ロ 4/18/2021 主 6的arrow_forward1/1 me A My Home CengageNOWv2| Online te x (28) Migos- Straightenin (C x+ com/ilrn/takeAssignment/takeAssignmentManrao?inprogress=true eBook Using the weighted-average method, compute the equivalent units of production if the beginning inventory consisted of 21,000 units; 58,000 units were started in production; and 63,000 units were completed and transferred to finished goods inventory. For this process, materials are added at the beginning of the process, and the units are 25% complete with respect to conversion. Equivalent Units of Materials Equivalent Units of Conversionarrow_forwardA b and c pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education