FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Question attached inthe SS

Thanks

tkn42n242-4924

646

464064062-4

420i6

0h4

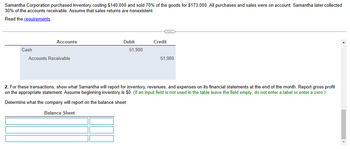

Transcribed Image Text:Samantha Corporation purchased inventory costing $140,000 and sold 70% of the goods for $173,000. All purchases and sales were on account. Samantha later collected

30% of the accounts receivable. Assume that sales returns are nonexistent.

Read the requirements.

Cash

Accounts

Accounts Receivable

Debit

51,900

C

Credit

51,900

2. For these transactions, show what Samantha will report for inventory, revenues, and expenses on its financial statements at the end of the month. Report gross profit

on the appropriate statement. Assume beginning inventory is $0. (If an input field is not used in the table leave the field empty; do not enter a label or enter a zero.)

Determine what the company will report on the balance sheet:

Balance Sheet

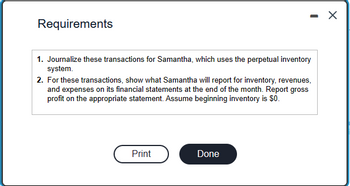

Transcribed Image Text:Requirements

1. Journalize these transactions for Samantha, which uses the perpetual inventory

system.

- X

2. For these transactions, show what Samantha will report for inventory, revenues,

and expenses on its financial statements at the end of the month. Report gross

profit on the appropriate statement. Assume beginning inventory is $0.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 9.1cdarrow_forwardonsee mywCC orkshop 9 (Ch 16) (1 LO 5 Ints Question 5 - Workshop 9 (Ch 16 X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%25 eBook + X References Mc Graw McGraw-Hill Connect Drill Problem 16-6 (Static) [LU 16-2 (2)] X Net sales Cost of sales Gross margin From the French Instrument Corporation second-quarter report ended 2023, do a vertical analysis for the second quarter of 2023. Note: Input all answers as positive values except other (income) which should be indicated by a minus sign. Round your answers to the nearest hundredth percent. $5 FRENCH INSTRUMENT CORPORATION AND SUBSIDIARIES Consolidated Statements of Operation (Unaudited) (In thousands of dollars, except share data) Expenses: Selling, general and administrative Product development Interest expense Other (income), net Total expenses Income before income taxes Provision for income taxes Net income Net income per common share* Weighted…arrow_forward00 %24 6 Question 9 - Assignment #2 Chp X VUSYouTube + x o.mheducation.com/ext/map/index.html?_con3con&external browser%-D0&launchUrl-https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252FM... nent #2 Chp. 12 due Jan.26 8:00 amG Saved Help Save & Exit Check my Tony Ring wants to attend Northeast College. If he deposits $43,722 today, how much will he have 6 years from now at 8% interest compounded semiannually? (Use the Table provided.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Amount eBook Print References a. dy 144 2.arrow_forward

- X Topic: Unit 5 DQ: Distribu X ASi Topic: Unit 8 DQ: Selling S X M Question 7-ACCT3231_X M Question 15-ACCT3231 to.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware Required information [The following information applies to the questions displayed below.] e. What is Matt's ending basis in his partnership interest? Ending basis -- T Coy and Matt are equal partners in the Matcoy Partnership. Each partner has a basis in his partnership interest of $32,500 at the end of the current year, prior to any distribution. On December 31, each receives an operating distribution. Coy receives $12,700 cash. Matt receives $3,765 cash and a parcel of land with a $8,935 fair market value and a $4,900 basis to the partnership. Matcoy has no debt or hot assets. Q Search Saved < Prev PRE 15 X of 15 M Question 1 Nextarrow_forwardCengageNOWv2 | Online teachin X = Ch. 12 Key Terms - Principles of A X + ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ow to Cancel Your. F Startup Opportuniti. V How brands are co... Assignment Practic.. A COVID-19 Student. . C20-128PR01-: Record the journal entries for each of the following payroll transactions. If an amount box does not require, leave it blank. Apr. 2 Paid $640 and $300 cash to a federal depository for FICA Social Security and FICA Medicare, respectively. Apr. 4 Paid accumulated employee salaries of $16,220. Apr. 11 Issued checks in the amounts of $480 for federal income tax and $300 for state income tax to an IRS-approved bank. Apr. 14 Paid cash to health insurance carrier for total outstanding health insurance liability of $800. Apr. 22 Remitted cash payments for FUTA and SUTA to federal and state unemployment agencies in the amounts of $130 and $250, respectively. Аpг. 2 Apr. 4 Apr. 11 Apг. 14 Apг. 22 78°F…arrow_forwardFreeTaxUSAⓇ -- X2021 Schedule C x Gmail art 1 - Scenario 8 с • hrblock.csod.com/Evaluations/EvalLaunch.aspx?loid-47a30875-9c0b-4ea2-bf63-40a9c98c0b29&evalLvl=5&redirect_url=%2fphnx%2fd YouTube Maps FreeTaxUSAⓇ LE - Sig... I TRADE ONLINE INVESTMENTS 5631 LA HABRA PARKWAY, STE 13 YOUR CITY, YS XXXXX (XXX)548-5734 CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country. ZIP Applicable checkbox on Form 8949 or foreign postal code, and telephone no. D PAYER'S TIN eview the following scenario. Use the information provided to answer questions about the taxpayer's 2021 return. he sale was reported to him on Form 1099-B. avier Brown (32) is filing as a single taxpayer. During the year, he was unhappy with the performance of an investment he had made in ALX Corporation in 2019. Xavier sold his sha Cavier had no other capital gains or losses during the year. His only other income was from wages. 07-2011702 Question 15 of 50. Xavier received the following Form…arrow_forward

- Assignments: Corp Fin Reprtn x Question 8 - E&P Set #5 (Revie x M Inbox (1,094) ep6778a@stud x M (no subject) - ellse.patipev o.mheducation.com/ext/map/index.html?_con3Dcon&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252F... Review) i Не On August 1, 2021, Limbaugh Communications issued $30 million of 10% nonconvertible bonds at 104. The bonds are due on July 31, 2041. Each $1,000 bond was issued with 20 detachable stock warrants, each of which entitled the bondholder to purchase, for $60, one share of Limbaugh Communications' no par common stock. Interstate Containers purchased 20% of the bond issue. On August 1, 2021, the market value of the common stock was $58 per share and the market value of each warrant was $8. In February 2032, when Limbaugh's common stock had a market price of $72 per share and the unamortized discount balance was $1 million, Interstate Containers exercised the warrants it held. Required: 1. Prepare the journal entries on August 1,…arrow_forwardWP BAB140 Lab#2 Ch3 W2022 NWP Assessment Player UI Appli x A Player O New Tab G Taccounts. - Google Search + A education.wiley.com/was/ui/v2/assessment-player/index.html?launchld=59c96111-f5ca-414f-9f35-58b827278d0d#/question/1 E Apps W MarketWatch: Stock.. e Business News Market News | Seek... O FINVIZ.com - Stock.. 7 CVNA 228.28 A +1. S Stocktwits - The lar. EE Google Translate E Earnings and Econo. AV Short Interest Stock. * U.S. News | Reuters WSJ market volume E Reading list >> BAB140 Lab#2 Ch3 W2022 Question 2 of 4 > 0/ 2.5 Accounts Payable Aug. 5 (c) 18 3,600 Aug. 29 5,900 Aug.31 1,700 Sept. 12 7,200 Sept. 23 5,800 Sept.30 (d) Sales Aug. 10 50,000 Aug. 12 500 15 44,000 Aug. 31 (e) Sept. 12 (f) Sept. 25 400 Sept. 30 98,100arrow_forward* 0O T # 3 la Uni X L Grades for Cristian Catala: 22s X WP Ch7quiz with TF5 WP NWP Assessment Player UI Ap X + tion.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Dafd8fa6a-bc9b-4f11-82e4-3c0d1d4a7063#/question/8 TF5 Question 9 of 10 -/1 Cullumber Consulting Company is headquartered in Atlanta and has branch offices in Nashville and Birmingham. Cullumber uses an activity-based costing system. The Atlanta office has its costs for Administration and Legal allocated to the two branch offices. Cullumber has provided the following information: Activity Cost Pool Cost Driver Costs Administration % of time devoted to branch $703000 Legal Hours spent on legal research $141000 Hours % of time spend devoted to branch on legal research Nashville 000 Birmingham How much of Atlanta's cost will be allocated to Nashville? (round to nearest dollar) O $632900 O $670862 O $672962 O $675200 Save for Later Attemnts: 0 of 1 used MacBook Pro G Search or type URL 000 +, 000 %23 %24 7. 8. 4. 9-…arrow_forward

- F8'Ch X Book 4 xlsx Bb Signature E UTF-8Lece x Connect 9 Question 2 E Chapter 7E x 8 BUS 214 14 X Question 6 neducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%252Ffra pters 7-9) 6 Saved Help Misu Sheet, owner of the Bedspread Shop, knows his customers will pay no more than $140 for a comforter. Misu wants a 50% markup on selling price. What is the most that Misu can pay for a comforter? Misu's payment Ac Graw DII & %23 %24 96 2. 4. y. e NEIARDarrow_forwardBlackboard Learn Bb 2193555 + i learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com/5f7ce11c673e5/2193555?X-Blackboard-Expiration=1648004400000&X-Blackboard-Signature=9lhjClppXf7wSeUqx.. E * O w WordCounter - Cou... y! Yahoo A Regions Bank | Che.. Welcome, Justin – B. * eBooks, Textbooks... O Jefferson State Co... Electronics, Cars, Fa. C Home | Chegg.com 2193555 1 / 1 100% + | PR 14-4B Entries for bonds payable and installment note transactions The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: оВJ. 3, 4 V 3. $61,644,484 Year 1 Еxcel July 1. Issued $55,000,000 of 10-year, 9% callable bonds dated July 1, Year 1, at a market (effective) rate of 7%, receiving cash of $62,817,040. Interest is payable semiannually on December 31 and June 30. General Ledger Oct. 1. Borrowed $450,000 by issuing a six-year, 8% installment note to Intexicon Bank. The note requires annual payments of $97,342, with the first payment occurring on…arrow_forwardmation |x A Assignmenta: Corp Fin Reprtn x Question 2 Graded Assignme x HExam1-ep6778a@student.am x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser%3D0&launchUrl=https%253A%252F%252FIms.mheducation.com%252F... M (no subject) - ellse.patipewe@ x signment #4 (Leases) i Saved Help es At the beginning of 2021, VHF Industries acquired a machine with a fair value of $9,415,785 by signing a four-year lease. The lease is payable in four annual payments of $3.1 million at the end of each year. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What is the effective rate of interest implicit in the agreement? 2-4. Prepare the lessee's journal entries at the beginning of the lease, the first lease payment at December 31, 2021 and the second lease payment at December 31, 2022. 5. Suppose the fair value of the machine and the lessor's implicit rate were unknown at the time of the lease, but that…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education