Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

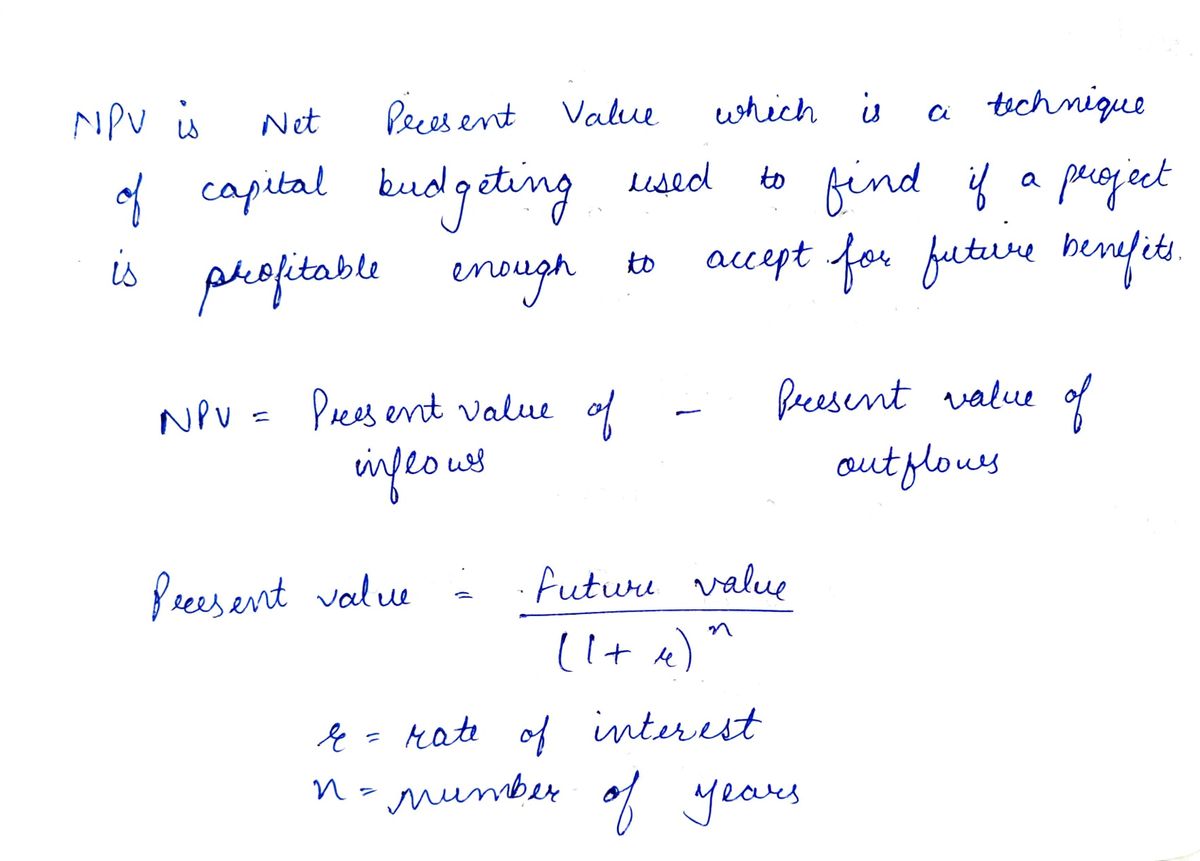

Southland Inc is considering a project that results in the following after-tax cash flows: t = 0: -292, t = 1: 250, t = 2: 150, and t = 3: 109. What would be the NPV of this project for southland Inc, if they discount future cash flows at a 6.9% rate?

Expert Solution

arrow_forward

Step 1

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please answer the following questions using the information below: NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected? Consider the following cash flows: Year 0 1 2 3 4 5 6 Cash Flow -$8,000 $3,000 $3,600 $2,700 $2,500 $2,100 $1,600 Payback. The company requires all projects to payback within 3 years. Calculate the payback period. Should it be accepted or rejected? Discounted Payback. Calculate the discounted payback using a discount rate of 10%. Should it be accepted or rejected? IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected? NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected? PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?…arrow_forwardYou are choosing between two projects. The cash flows for the projects are given in the following table ( $ million ) : What are the IRRs of the two projects? If your discount rate is 5.4 % , what are the NPVs of the two projects? Why do IRR and NPV rank the two projects differently?arrow_forwardGalaxy Corp. has to choose between two mutually exclusive projects. If it chooses project A, Galaxy Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 11%? Project A Year 0: Year 1: Year 2: Year 3: O $15,077 O $21,538 $12,923 O $14,000 O $19,384 Cash Flow -$12,500 8,000 14,000 13,000 Project B Year 0: Year 1: Year 2: Year 3: Year 4: Year 5: Year 6: -$40,000 9,000 13,000 12,000 11,000 10,000 9,000arrow_forward

- Please see attached:arrow_forwardA Company is considering two mutually exclusive projects whose expected net cash flows are in the table below. The company's WACC is 15%. What is the NPV for Project Y? What is the NPV for Project Z? What is the IRR for Project Y? What is the IRR for Project Z? Which Project, if any, should you choose? Time Project Y Project Z 0 S (420.00) S(950.00) 1 S(572.00) $270.00 2 S(189.00) S270.00 3 S(130.00) $270.00 4 $1,300.00 $270.00 5 $720.00 $270.00 6 $980.00 $270.00 7 $(225.00) $270.00 Pleaseshow in excel I think im getting the wrong valuesarrow_forwardTrovato Corporation is considering a project that would require an investment of $68,000. No other cash outflows would be involved. The present value of the cash inflows would be $89,080. The profitability index of the project is closest to (Ignore income taxes.):arrow_forward

- Net present value. Quark Industries has a project with the following projected cash flows: Initial cost: $280,000 Cash flow year one: $30,000 Cash flow year two: $80,000 Cash flow year three: $153,000 Cash flow year four: $153,000 a. Using a discount rate of 8% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 15%? c. Should the company accept or reject it using a discount rate of 18%?arrow_forwardYou calculate your firm’s WACC is 11.5% and you are evaluating a project that will generate the following cash flows: year 1 = $20,000, year 2 = $30,000, and year 3 = $50,000. Calculate the NPV of the project if the cost of the project is $90,000.arrow_forwardNewtown Corp. has to choose between two mutually exclusive projects. If it chooses project A, Newtown Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 12%? Cash Flow Project A Project B Year 0: –$15,000 Year 0: –$40,000 Year 1: 9,000 Year 1: 8,000 Year 2: 15,000 Year 2: 15,000 Year 3: 14,000 Year 3: 14,000 Year 4: 13,000 Year 5: 12,000 Year 6: 11,000 $13,512 $11,923 $15,897 $12,718 $10,333 Newtown Corp. is considering a five-year project that has a weighted average cost of capital of…arrow_forward

- ZLIK Inc is considering methods by which to evaluate a multi-year project that requires a large $55 million investment. Assuming the project has conventional cash flows, under which conditions would the project be an acceptable investment for ZLIK? Select all that apply. A) NPV < 0 B) NPV > 0 C) IRR > firm's required return D) IRR < firm's required return E) Profitability Index > 1.0 F) Profitability Index < 1.0arrow_forwardBarry company is considering a project that has the following cash flow and WACC data. what is the projects NPV? Note that you should use the WACC as the discount ratearrow_forwardYou are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRs of the two projects? b. If your discount rate is 4.7%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 Project A Year 1 - -$51 $27 B - $101 $22 Year 2 $21 $42 Year 3 $20 Year 4 $13 $51 $59 - ☑arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education