Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

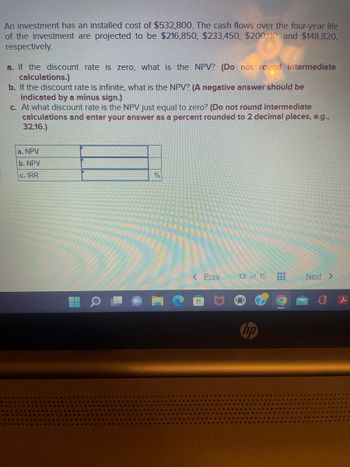

Transcribed Image Text:An investment has an installed cost of $532,800. The cash flows over the four-year life

of the investment are projected to be $216,850, $233,450, $200,110, and $148,820,

respectively.

a. If the discount rate is zero, what is the NPV? (Do not round intermediate

calculations.)

b. If the discount rate is infinite, what is the NPV? (A negative answer should be

indicated by a minus sign.)

c. At what discount rate is the NPV just equal to zero? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

a. NPV

b. NPV

c. IRR

Q

%

< Prev

www

13 of 15 ‒‒‒

hp

Next >

l

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Could you use formulas in order to get those answers, like the images I have attached to this follow-up questions?arrow_forwardYou are evaluating five different investments, all of which involve an upfront outlay of cash. Each investment will provide a single cash payment back to you in the future. Details of each investment appears here: Calculate the IRR of each investment. State your answer to the nearest basis point (i.e., the nearest 1/100th of 1%, such as 3.76%). The yield for investment A is The yield for investment B is The yield for investment C is The yield for investment D is The yield for investment E is %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) %. (Round to two decimal places.) C Data table Investment A B с D E Initial Investment $1,600 $10,000 $600 $3,400 $5,200 Future Value Print $3,120 $15,775 $2,923 $4,526 $8,789 End of Year 10 11 16 Done 3 (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 12 D Xarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- A firm evaluates all of its projects by applying the NPV decision rule. A project under consideration has the following cash flows: Year Cash Flow -$ 41,000 20,000 23,000 14,000 1 What is the NPV of the project if the required return is 11 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV At a required return of 11 percent, should the firm accept this project? O Yes O Noarrow_forwardAn investment has an installed cost of $527,630. The cash flows over the four-year life of the investment are projected to be $212,200, $243,800, $203,500 and $167,410, respectively. If the discount rate is 10%, at what discount rate is the NPV just equal to 0? (Input in percentage, keep 2 decimals. e.g. if you got 0.10231, input 10.23) Question 10 The Yurdone Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "looking up". As a result, the cemetery project will provide a net cash inflow of $145,000 for the firm during the first year, and the cash flows are projected to grow at a rate of 4% per year forever. The project requires an initial investment of $1,900,000. The company is somewhat unsure about the assumption of a growth rate of 4% in its cash flows. At what constant growth rate would the company just break even if it still required a return of 11% on investment? (Input in percentage, keep 2 decimals. e.g. if you got…arrow_forwardMansukhbhaiarrow_forward

- Please double check your work !! the answer is not 50.55 or 37.52 % You are considering an investment project with the cash flows of -300 (the initial cash flow), 800 (cash flow at year 1), -200 (cash flow at year 2). Given the discount rate of 10%, compute the Modified Internal Rate of Return (MIRR) using the discountingapproach. 50.55% 19.72% 71.94% 37.52%arrow_forwardMarielle Machinery Works forecasts the following cash flows for a project under consideration. It uses the Internal rate of return rule to accept or reject projects. C₁ Co -$ 10,000 C₂ +$ 7,500 IRR a. What is the project's IRR? Note: Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. C3 +$ 8,500 22.41 % b. Should this project be accepted if the required return is 12%? Yes Noarrow_forwardZLY calculates that a project with conventional cash flows and a required return of 14% has a negative NPV. What do we then know about the project's internal rate of return? A) equal to 21% B) greater than 14% C) less than 14% D) equal to zeroarrow_forward

- Consider an investment where the cash flows are: – $946.21 at time t = 0 (negative since this is your initial investment) $377 at time t = 1 in years $204 at time t = 2 in years $499 at time t = 3 in years (a) Use Excel's "Solver" to find the internal rate of return (IRR) of this investment. Take a screen shot showing Solver open with your entries for the function clearly visible. Paste the screen shot into an application (like Paint), and save it as a (.png) file. Upload your screenshot below. (b) What is the value of IRR found by Solver?arrow_forwardNet Present Value Method, Present Value Index, and Analysis for a service company Continental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: Ramp Computer Facilities Network $423,052 Amount to be invested Annual net cash flows: Year 1 Year 2 Year 3 Year 1 2 3 4 5 6 7 8 9 10 6% Present Value of $1 at Compound Interest 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 Maintenance Equipment $677,579 0.424 0.386 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 305,000 284,000 259,000 0.361 0.322 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 220,000 198,000 176,000 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 $188,789 125,000 86,000 63,000arrow_forwardA machine has the following cash flows: CF0 = -361,000; CF1 = -90,000; CF2 = -56,000. What is the machine's equivalent annual annuity (EAA) using a cost of capital of 7%? Round your answer to the nearest dollar. Be sure to enter a negative sign (-) if your answer is a negative number.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education