Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

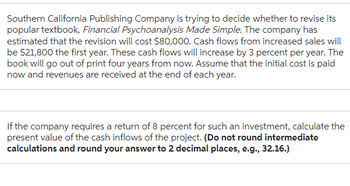

Transcribed Image Text:Southern California Publishing Company is trying to decide whether to revise its

popular textbook, Financial Psychoanalysis Made Simple. The company has

estimated that the revision will cost $80,000. Cash flows from increased sales will

be $21,800 the first year. These cash flows will increase by 3 percent per year. The

book will go out of print four years from now. Assume that the initial cost is paid

now and revenues are received at the end of each year.

If the company requires a return of 8 percent for such an investment, calculate the

present value of the cash inflows of the project. (Do not round intermediate

calculations and round your answer to 2 decimal places, e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Your firm is contemplating the purchase of a new $595,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $63,000 at the end of that time. You will save $225,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $78,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. IRR Answer is complete but not entirely correct. 8.96arrow_forwardYour firm is contemplating the purchase of a new $535,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $ 30,000 at the end of that time. You will save $165,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $60,000 (this is a one-time reduction). If the tax rate is 24 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe Elite Car Rental Corporation is contemplating expanding its short-term rental fleet by 30 automobiles at a cost of $900,000. It expects to keep the autos for only two years and to sell them at the end of that period for 60 percent, on average, of what they cost. The plan is to generate $21,000 of incremental revenue per additional auto in each year of operation. The controller estimates that other costs will amount to 20 cents per kilometre on an average of 40,000 kilometres per car per year. She also estimates that the new business will require an investment of $10,000 in additional working capital. The firm is in a 30 percent tax bracket and uses 12 percent as a cost of capital a. Calculate the NPV (Do not round the intermediate calculations. Round the final answer to the nearest whole dollar. Negative answer should be indicated by a minus sign. Omit $ sign in your response.) b. Should Elite purchase the automobiles? O a. a)NPV = $82,286 ± 0.1% and b)NO O b. a)NPV = -$72,386 ±…arrow_forward

- Your firm is contemplating the purchase of a new $540,000 computer - based order entry system. The system will be depreciated straight - line to zero over its five - year life. It will be worth $52, 000 at the end of that time. You will save $300,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $67,000 (this is a one - time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardAllegience Insurance Company's management is considering an advertising program that would require an initial expenditure of $196,945 and bring in additional sales over the next five years. The projected additional sales revenue in year 1 is $94,000, with associated expenses of $34,500. The additional sales revenue and expenses from the advertising program are projected to increase by 10 percent each year. Allegience's tax rate is 30 percent. (Hint: The $196,945 advertising cost is an expense.) Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: 1. Compute the payback period for the advertising program. 2. Calculate the advertising program's net present value, assuming an after-tax hurdle rate of 10 percent. (Round your intermediate calculations and final answer to the nearest whole dollar.) 1. Payback period 2. Net present value yearsarrow_forwardA small northern California consulting firm wants to start a recapitalization pool for replacement of network servers. If the company invests $14,000 at the end of year 1 but decreases the amount invested by 5% each year, how much will be in the account 5 years from now? Interest is earned at a rate of 12% per year. Five years from now, the account will have $.arrow_forward

- Sauer Food Company has decided to buy a new computer system with an expected life of three years. The cost is $290,000. The company can borrow $290,000 for three years at 11 percent annual interest or for one year at 9 percent annual interest. Assume interest is paid in full at the end of each year. a. How much would Sauer Food Company save in interest over the three-year life of the computer system if the one-year loan is utilized and the loan is rolled over (reborrowed) each year at the same 9 percent rate? Compare this to the 11 percent three-year loan. 9 percent loan 11 percent loan Interest savings Interest b. What if interest rates on the 9 percent loan go up to 14 percent in year 2 and 17 percent in year 3? What would be the total interest cost compared to the 11 percent, three-year loan? Fixed-rate 11% loan Variable-rate loan Additional interest cost Interestarrow_forwardYour firm is contemplating the purchase of a new $515,000 computer-based order entry system. The system will be depreciated straight-line to zero over its five-year life. It will be worth $53,000 at the end of that time. You will save $153,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $78,000 (this is a one-time reduction). If the tax rate is 21 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR %arrow_forwardThe Hangover Diner is considering a project to build a new diner next to Saint Joseph's University with an initial cost of $350,000. Construction will take 3 years. The diner will open in year 4, so no cash will be received in the first 3 years. At the end of the fourth year, the diner expected to produce a cash inflow of $100,000. Starting in the fifth year the cash flows are expected to grow by 2% per year forever. What is the project's net present value today at a 16% discount rate? a) -$4,818 b) $44,494 c) $50,411 d) $107,613arrow_forward

- Your firm is contemplating the purchase of a new $435,000 computer-based order entry system. The system will be depreciated straight-line to zero over its 6-year life. It will be worth $54,000 at the end of that time. You will save $157,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $43,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. If the tax rate is 23 percent, what is the IRR for this project? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. IRR 25.73 %arrow_forwardFEX, a grocery store, is considering offering one-hour photo developing in their store. The firm expects that sales from the new one-hour machine will be $139,000 per year. FEX currently offers overnight film processing with annual sales of $90,000. While FEX expects that many of the one-hour photo sales will be to new customers, it also expects that most of the old customers will switch to the new one-hour machine. Specifically, FEX estimates that 75% of their current overnight photo customers will switch and use the one-hour service. Given these expectations, the level of incremental sales associated with introducing the new one hour photo service is closest to O $206,500 O $36,300 O $71,500 $139,000 O $121,800 O $94,800arrow_forwardYour firm is contemplating the purchase of a new $615,000 computer-based order entry system. The system will be depreciated straight-line to zero over its 5-year life. It will be worth $97,000 at the end of that time. You will save $192,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $112,000 (this is a one-time reduction). If the tax rate is 23 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education