Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

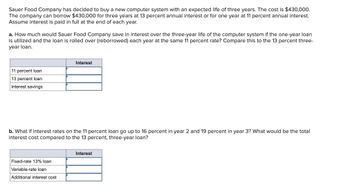

Transcribed Image Text:Sauer Food Company has decided to buy a new computer system with an expected life of three years. The cost is $430,000.

The company can borrow $430,000 for three years at 13 percent annual interest or for one year at 11 percent annual interest.

Assume interest is paid in full at the end of each year.

a. How much would Sauer Food Company save in interest over the three-year life of the computer system if the one-year loan

is utilized and the loan is rolled over (reborrowed) each year at the same 11 percent rate? Compare this to the 13 percent three-

year loan.

11 percent loan

13 percent loan

Interest savings

Interest

b. What if interest rates on the 11 percent loan go up to 16 percent in year 2 and 19 percent in year 3? What would be the total

interest cost compared to the 13 percent, three-year loan?

Fixed-rate 13% loan

Variable-rate loan

Additional interest cost

Interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A borrower made a constant payment mortgage loan 8 years ago for $400,000 at 12 percent interest for 30 years. 1. What is the monthly payment? 2. What is the current loan balance? 3. Assume this is homeowner has been offered a chance for refinance for the amount at the current balance for 22 years at 10.5% interest rate. What is the monthly payment if the homeowner chooses to refinance? 4. If the origination fees and closing costs are $25,500, and the costs are not financed by the lender. What is the effective cost of refinancing? Should this homeowner refinance? 5. If this homeowner plans to sell the house in 5 years, should this homeowner refinance (show your answer with the effective annual rate)? use excel to get the answers and show the formulasarrow_forwardwhat is the present value of a loan that calls for the payment of $500 per year for six years if the discount rate is 10 percent and yne forst payment will be made one year from now ? how would your answer change if $500 per year occured for ten years ?arrow_forwardSuppose you want to purchase a home for $525,000 with a 30-year mortgage at 4.84% interest. Suppose also that you can put down 30%. What are the monthly payments? (Round your answer to the nearest cent.) $ What is the total amount paid for principal and interest? (Round your answer to the nearest cent.) $ What is the amount saved if this home is financed for 15 years instead of for 30 years? (Round your answer to the nearest cent.)arrow_forward

- With the following information, compute the net benefit of refinancing: Current loan balance: $200,000 Remaining term: 15 years Interest rate: 6.5% Old loan monthly payment: $1742.22 Expected number of future payments you will make: 72 Interest rate available on a new loan: 4.5% Cost of refinancing:5% of the outstanding balance. what is the resulting net benefit?arrow_forwardPresent value with periodic rates. Cooley Landscaping needs to borrow $25,000 for a new front-end dirt loader. The bank is willing to loan the money at 8% interest for the next 6 years with annual, semiannual, quarterly, or monthly payments. What are the different payments that Cooley Landscaping could choose for these different payment plans? C What is Cooley's payment for the loan at 8% interest for the next 6 years with annual payments? $ (Round to the nearest cent.)arrow_forwardIf you could solve option 5 with the formulas please Option 5: Half the required money is taken out of an investment account that pays monthly interest at a 3% annual rate. The rest of the money is borrowed from a bank at a 4% annual interest rate, should payback within 3 years in equal monthly payments. Find the future value of the money taken from the investment account at the end of the shop development and periodic payments to the bank. Calculate Cumulative interest and principal payments.arrow_forward

- What size loan must we take today with a 14% compound interest rate to have end-of-year payments of $1400, $1320, $1240, $1160, and $1080 for the next five years, respectively? In other words, if you take out a loan today, and after making all five payments, above, the loan is paid off, what is the value of that loan? Answer:arrow_forwardDecreasing the number of years of a loan decreases the amount of interest repaid over the term of the loan. Suppose a dental hygienist has the option of a 30-year loan or a 25-year loan of $395.000 at an annual interest rate of 4.75%. (a) Calculate the monthly payment (in dollars) for each loan. (Round your answers to the nearest cent.) 30-year loan $? 25-year loan $? (b) Calculate the savings in interest (in dollars) by using the 25-year loan. (Round your answer to the nearest cent.)arrow_forwarda) Suppose you have $50,000 to invest in a savings account that pays interest annually with a 5-year term. After 5 years, you want to have $70,000 in your account. What annual interest rate do you need to earn on your investment to achieve this goal? b) Does the interest rate change if it compounds semi-annually instead of an annual compounding, as mentioned in (a)?arrow_forward

- Quantitative Problem: You need $14,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires a 9% annual return. a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. b. How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answers to the nearest cent. Interest: $ Principal repayment: $arrow_forwardYou've just taken out a student loan with a quoted interest rate of 4.1%. You will have to pay back $1,600 in 19 years, with no intermediate payments necessary. A. How much did you borrow if interest is compounded monthly? B. How much did you borrow if interest is compounded daily?arrow_forwardFind the accumulated value of an investment of $15,000 for 5 years at an interest rate of 1.45% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. i Click the icon to view some finance formulas. a. What is the accumulated value if the money is compounded semiannually? (Round to the nearest cent as needed.) b. What is the accumulated value if the money is compounded quarterly? (Round to the nearest cent as needed.) C. What is the accumulated value if the money is compounded monthly? S (Round to the nearest cent as needed.) d. What is the accumulated value if the money is compounded continuously? S (Round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education