Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Sommers Company is evaluating a project requiring a capital expenditure of $300,000. The project has an estimated life of 5 years and no salvage value. The estimated net income and net cash flow from the project are as follows:

| Year | Net Income | Net Cash Flow | ||

| 1 | $60,000 | $120,000 | ||

| 2 | 50,000 | 110,000 | ||

| 3 | 45,000 | 105,000 | ||

| 4 | 30,000 | 90,000 | ||

| 5 | 20,000 | 80,000 | ||

| $205,000 | $505,000 |

The company's minimum desired

| Year | Present Value of $1 at 12% |

| 1 | 0.893 |

| 2 | 0.797 |

| 3 | 0.712 |

| 4 | 0.636 |

| 5 | 0.567 |

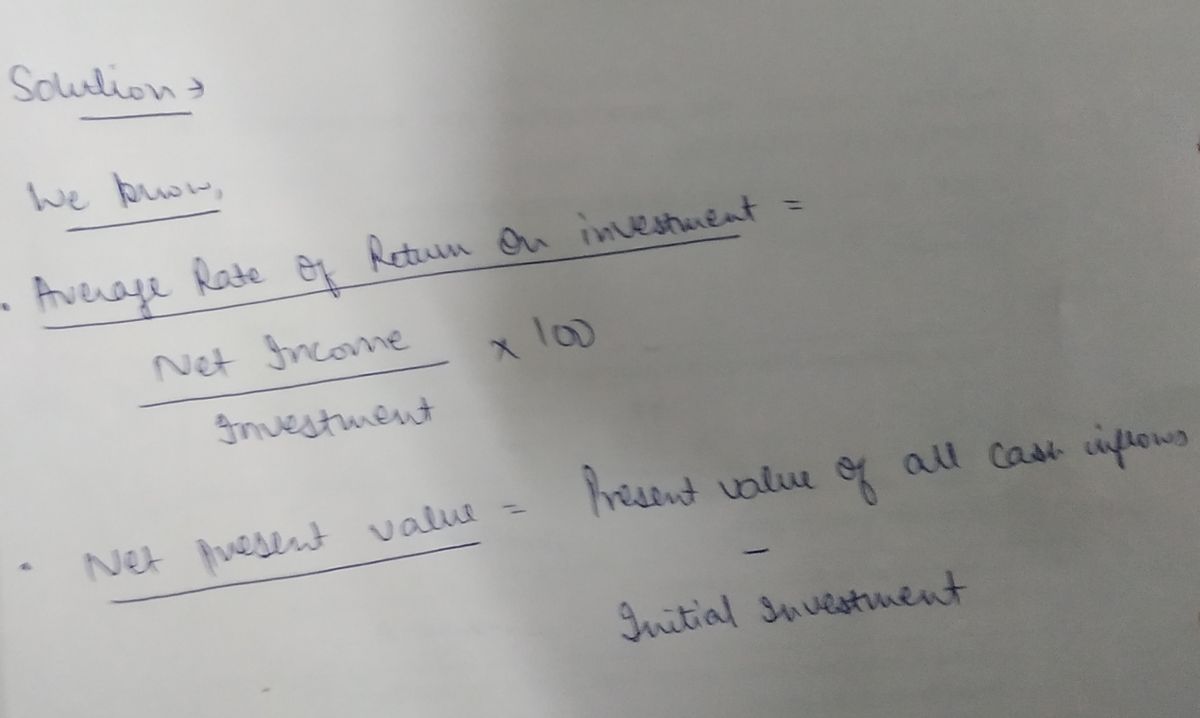

a. Determine the average rate of

fill in the blank 1 %

b. Determine the net present value.

$ fill in the blank 2

Expert Solution

arrow_forward

Step 1

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following data is associated with a proposed replacement project: A machine that originally cost $25,000 and was depreciated on a straight line basis has one year of its expected 5-year life remaining. Its current market value is $12,000. The corporate tax rate is 34%. The cash flow from disposing of the old machine, is:arrow_forwardCJN Corporation is evaluating a project requiring a capital expenditure of $725,650. The project has an estimated life of four years with no residual value at the end of the four years. The estimated net income and net cash flow from the project are as follows: Year Net Income Net Cash Flow 1 $ 75,000 $285,000 2 102,000 290,000 3 109,500 190,000 4 36,000 125,000 $322,500 $890,000 The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is: .893, .797, .712, and .636, respectively. Round all answers to two decimal places. Determine: (a) the average rate of return on investment, and (b) the net present value. (a) (b)arrow_forwardA project has an initial cost of $34051 and a three-year life. The company uses straight-line depreciation to a book value of zero over the life of the project. The projected net income from the project is $1,700, $2,000, and $2330 a year for the next three years, respectively. What is the average accounting return?arrow_forward

- CJN Corporation is evaluating a project requiring a capital expenditure of $806,250. The project has an estimated life of four years with no residual value at the end of the four years. The estimated net income and net cash flow from the project are as follows: Year Net Income Net Cash Flow 1 $ 75,000 $285,000 2 102,000 290,000 3 109,500 190,000 4 36,000 125,000 $322,500 $890,000 The company's minimum desired rate of return is 12%. The present value of $1 at compound interest of 12% for 1, 2, 3, and 4 years is: .893, .797, .712, and .636, respectively. Determine: (a) the average rate of return on investment, and (b) the net present value. (a) (b)arrow_forwardVandezande Incorporated is considering the acquisition of a new machine that costs $470,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are (ignore Income taxes.): Year 1 Year 2 Year 3 Year 4 Year 5 Incremental Net Operating Income $ 78,000 $ 84,000 $ 95,000 $ 58,000 $ 100,000 Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to: (Round your answer to 1 decimal place.) Multiple Choice 4.1 years 5.0 years 2.9 years Incremental Net Cash Flows $ 156,000 $ 163,000 $ 175,000 $ 160,000 $ 162,000 21 yearsarrow_forwardMost Company has an opportunity to invest in one of two new projects. Project Y requires a $325,000 investment for new machinery with a four-year life and no salvage value. Project Z requires a $325,000 investment for new machinery with a three-year life and no salvage value. The two projects yield the following predicted annual results. The company uses straight-line depreciation, and cash flows occur evenly throughout each year. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project Y Project Z Sales $ 370,000 $ 296,000 Expenses Direct materials 51,800 37,000 Direct labor 74,000 44,400 Overhead including depreciation 133,200 133,200 Selling and administrative expenses 26,000 26,000 Total expenses 285,000 240,600 Pretax income 85,000 55,400 Income taxes (38%) 32,300 21,052 Net income $ 52,700 $…arrow_forward

- A proposed cost-saving device has an installed cost of $795,000. The device will be used in a five-year project but is classified as three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $79,000, the tax rate is 22 percent, and the project discount rate is 11 percent. The device has an estimated Year 5 salvage value of $121,000. What level of pretax cost savings do we require for this project to be profitable? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Pretax cost savings $ 194.191.50 Xarrow_forwardNonearrow_forwardLewis enterprises…arrow_forward

- Please help mearrow_forwardWindsor Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $202,003 $41,080 6 years $0 B $306,910 $49,130 9 years $0 Windsor Company uses the straight-line method to depreciate its assets. Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the facto provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.)arrow_forwardIggy Company is considering three capital expenditure projects. Relevant data for the projects are as follows. Project Investment AnnualIncome Life ofProject 22A $243,600 $17,130 6 years 23A 271,500 20,700 9 years 24A 280,600 15,700 7 years Annual income is constant over the life of the project. Each project is expected to have zero salvage value at the end of the project. Iggy Company uses the straight-line method of depreciation.(a) Determine the internal rate of return for each project. (Round answers 0 decimal places, e.g. 13%. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Project Internal Rate ofReturn 22A % 23A % 24A % If Iggy Company’s required rate of return is 11%, which projects are acceptable?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education