Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

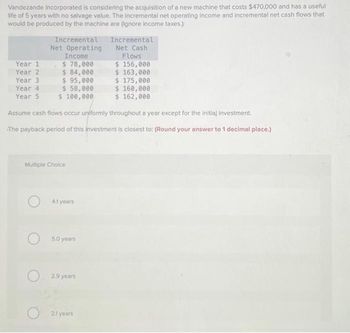

Transcribed Image Text:Vandezande Incorporated is considering the acquisition of a new machine that costs $470,000 and has a useful

life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that

would be produced by the machine are (ignore Income taxes.):

Year 1

Year 2

Year 3

Year 4

Year 5

Incremental

Net Operating

Income

$ 78,000

$ 84,000

$ 95,000

$ 58,000

$ 100,000

Assume cash flows occur uniformly throughout a year except for the initial investment.

The payback period of this investment is closest to: (Round your answer to 1 decimal place.)

Multiple Choice

4.1 years

5.0 years

2.9 years

Incremental

Net Cash

Flows

$ 156,000

$ 163,000

$ 175,000

$ 160,000

$ 162,000

21 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Emma Company is considering buying a machine for $206,000 with an estimated life of 15 years and no salvage value. The straight-line method of depreciation will be used. The machine is expected to generate net income of $20,500 each year. The cash payback on this investment is Round your answer 2 decimal places Selected Answer: 6,766.67 Correct Answer: 6.02 ± 0.05arrow_forward. Flexsteel Industries manufactures furniture for the retail, contract, and recreational vehicle furniture markets. The company is considering the purchase of a new piece of equipment, which would have an initial cost of $1,000,000 and a 5-year life. There is no salvage value for the equipment. The increase in cash flow each year of the equipment's life would be as follows: Year 1 Year 2 Year 3 Year 4 Year 5 $395,000 $ 370,000 $ 305,000 $ 250,000 $ 205,000 What is the payback period?arrow_forward18.arrow_forward

- Nonearrow_forwardHello, just need help with the annual net cash flow portion. I haven't computed it in this methodarrow_forwardHomer Corp. is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net income after tax of $143,000. The equipment will have an initial cost of $550,000 and have a 5-year life. If the salvage value of the equipment is estimated to be $18,000, what is the annual net cash flow? Multiple Choice 3 $125,000 $36,600 $249,400 $161,000arrow_forward

- B2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $360,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Equipment Selling, general, and administrative expenses Income (a) Compute the annual net cash flow. (b) Compute the payback period. (c) Compute the accounting rate of return for this equipment. Complete this question by entering your answers in the tabs below. Required A Compute the annual net cash flow. Required B Required C Annual Results from Investment Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Equipment Selling, general, and administrative expenses. Income Net cash flow Income $ 225,000 $ 120,000 30,000 22,500 52,500 $ 225,000 120,000 30,000 22,500 $ 52,500 Cash Flow Flowarrow_forwardXYZ Company has an opportunity to purchase and asset that will cost the company $60,000. The asset is expected to add $12,000 per year to the company’s net income. Assuming the asset has a 5-year useful life and a zero salvage value, the unadjusted rate of return will be?arrow_forwardB2b Co. Is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $360,000 and hasa 12-year life and no salvage value. The expected annual income for each year from thos equipment follows. Compute the (a) annual net cash flow, (b) payback period, and (c) accounting rate of return for this equipment. $225,000 ,120,000, 30,000, 38,250, Income 36,750?arrow_forward

- Vandezande Inc. is considering the acquisition of a new machine that costs $467,000 and has a useful life of 5 years with no salvage value. The incremental net operating income and incremental net cash flows that would be produced by the machine are (Ignore income taxes.): Incremental Net Operating Income Incremental Net Cash Flows Year 1 $ 75,000 $ 152,000 Year 2 $ 81,000 $ 160,000 Year 3 $ 92,000 $ 175,000 Year 4 $ 55,000 $ 157,000 Year 5 $ 97,000 $ 159,000 Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period of this investment is closest to: (Round your answer to 1 decimal place.)arrow_forwardHeidi Company is considering the acquisition of a machine that costs $828,800. The machine is expected to have a useful life of six years, a negligible residual value, an annual net cash flow of $112,000, and annual operating income of $80,000. What is the estimated cash payback period for the machine (round to one decimal point)? a.10.4 years b.4.3 years c.7.4 years d.1.4 years Determine the average rate of return for a project that is estimated to yield total income of $411,040 over four years, cost $668,000, and has a $66,000 residual value. %arrow_forwardHayden Company is considering the acquisition of a machine that costs $429,000. The machine is expected to have income of $71,400. The estimated cash payback period for the machine is (round to one decimal place) O a. 7.2 years Ob. 6.0 years O c. 1.2 years O d. 5.1 years useful life of 6 years, a negligible residual value, an annual net cash inflow of $84,000, and annual operatingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education