Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

What is the

Assume that cost of debt = 8%; unlevered cost of capital = 10%; systematic risk of the asset is 1.5. Assume a 50% debt to equity ratio.

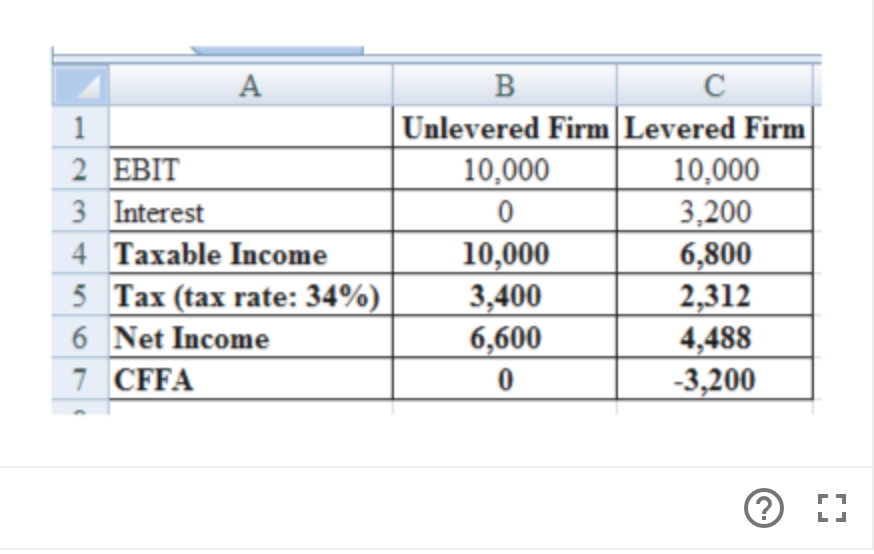

Transcribed Image Text:А

В

C

Unlevered Firm Levered Firm

10,000

3,200

6,800

2,312

4,488

3,200

1

2 EBIT

10,000

3 Interest

4 Taxable Income

10,000

3,400

6,600

5 Tax (tax rate: 34%)

6 Net Income

7 CFFA

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Kk.163.arrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions?arrow_forwardAssume that the following ratios are constant. Total asset turnover 1.37, profit margin 6.9%, equity multiplier 1.7, payout ratio 57%. What is the sustainable growth rate?arrow_forward

- Investors can allocate their wealth between (i) the risk-free asset, and (ii) one of the three risky assets as shown below. For example, 20% in risk-free and 80% in A, or 30% in risk-free and 70% in B, or 40% in risk- free and 60% in C, and so on. Risky Asset E(r) A B Stdev 20% 25% 30% 35% 40% 45% The risk-free rate is 5%. If investors target an expected annual return of 30%, what is the lowest stdev that can be achieved among all the possible allocations? Show your answer in % and round to two decimals (e.g. xx.xx%).arrow_forwardThe total in rate sensitive assets for a financial institution is $120 million and the total in rate sensitive liabilities is $95 million. What is the cumulative pricing gap (CGAP) and what is the interest rate sensitivity gap ratio if total assets equals $195 million? What would the projected change to net income be if interest rates rose by 2% on both assets and liabilities? What would the projected change to net income be if interest rates declined by 2% on both assets and liabilities? What would the projected change to net income be if interest rates rose by 1.8% on assets and 1.5% on liabilities? What would the projected change to net income be if interest rates declined by 1.8% on assets and 1.5% on liabilities?arrow_forwardYou are going to allocate capital into safe and risky assets. The risky asset will earn 200% return if the economy is good (with a 55% chance). If, otherwise, it will lose 60% of the investment principal. States of Rate of Prob. nature Return According to the Kelly's criterion, how much do you have to allocate for the risky asset to maximize final wealth? (The safe asset earns zero return.) → (1) 35%; (2) 47%; (3) 59%; (4) 65%; 1 Good 55% 200% your |(5) 69%; (6) 75%; (7) 85%; (8) 97%; (9) 102%; (10) 114%; (11) 115%; Bad 45% -60%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education