FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

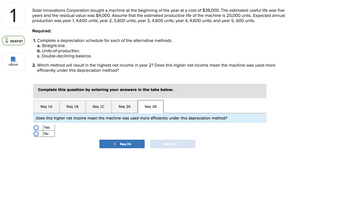

Transcribed Image Text:Solar Innovations Corporation bought a machine at the beginning of the year at a cost of $39,000. The estimated useful life was five

years and the residual value was $4,000. Assume that the estimated productive life of the machine is 20,000 units. Expected annual

production was year 1, 4,600 units; year 2, 5,600 units; year 3, 4,600 units; year 4, 4,600 units; and year 5, 600 units.

Required:

00:57:57

1. Complete a depreciation schedule for each of the alternative methods.

a. Straight-line.

b. Units-of-production.

c. Double-declining-balance.

eBook2. Which method will result in the highest net income in year 2? Does this higher net income mean the machine was used more

efficiently under this depreciation method?

Complete this question by entering your answers in the tabs below

Does this higher net income mean the machine was used more efficiently under this depreciation method?

Yes

No

Req 2A

Req 2B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- sdarrow_forwardHomy Ice Cream Company bought a new ice cream maker at the beginning of the year at a cost of $8,600. The estimated useful life was four years, and the residual value was $800. Assume that the estimated productive life of the machine was 12,000 hours. Actual annual usage was 4,000 hours in year 1; 3,700 hours in year 2; 2,700 hours in year 3; and 1,600 hours in year 4. Required: 1-a. Complete a separate depreciation schedule by using Straight-line method. (Round your answers to the nearest dollar amount. Make sure that the carrying amount at the end of year 4 is equal to the residual value. Depreciation expense for the last period should be calculated as Carrying value of 3rd year minus residual value.) Year Depreciation Expense Accumulated Depreciation Carrying Amount At acquisition 1 2 3 4 1-b. Complete a separate depreciation schedule by using Units-of-production method. (Round your answers to the nearest dollar amount Make sure that the carrving amount at the end of vear 4 is equal…arrow_forwardA granary purchases a conveyor used in the manufacture of grain for transporting, filling, or emptying. It is purchased and installed for $72,000 with a market value for salvage purposes that decreases at a rate of 20% per year with a minimum of value $2,350. Operation and maintenance is expected to cost $14,400 in the first year, increasing $1,200 per year thereafter. The granary uses a MARR of 15%. What is the optimum replacement interval for the conveyor? ___________ years.arrow_forward

- A manufacturing company is planning to install an equipment having a first cost of $90Kand a salvage value, after 15 years, of $10,520. The company uses an interest rate of 10%.Find the PW of the depreciation deductions for straight-line, SOYD, double-decliningbalance. Rank the strategies in order of their attractiveness. Identify/determine the bestmethod.arrow_forwardEastern corporation replace an old vibratory finishing machine and purchased new machine for $ 25,000. The salvage value of old machine is 5,000 .The useful life of the new machine is 10 years , at the end of which the machine is estimated to have a salvage value of 5,000. The machine generates net annual revenues of $ 6,000 . The annual operating and maintenance expenses are estimated to be $ 1,000 . Calculate NPW if Eastern's MARR ( rate of return ) is 10% ? A. $ 12,357 B. $ 12,651 C. $ 13,640 D. None of thesearrow_forwardMorris Associates bought a machine for $82,000 cash. The estimated useful life was five years and the estimated residual value was $7,000. Assume that the estimated useful life in productive units is 171,000. Units actually produced were 45,600 in year 1 and 51,300 in year 2. Required: 1. Determine the appropriate amounts to complete the following schedule.arrow_forward

- 4 Excelsior Industries is evaluating the purchase of a new manufacturing machine for its product line (referred to as a "project" for the purpose of setting up the questions). The machine has an estimated life of four years. The cost of the machine is $250,000, and the machine will be depreciated using the straight-line method to a residual value of $0. The machine is expected to generate additional sales of 10,000 units in year 1, with sales growing by 8% annually through year four. The selling price per unit will be $120, and the cost of goods sold unit will be $75. perarrow_forwardA new engine was installed by a textile plant at a cost of P353,000 and projected to have a useful life of 14 years. At the end of the useful life, it is estimated to have a salvage value of 31,000. Determine the annual cost if interest is 17% compounded semi-annually.arrow_forwardxact Photo Service purchased a new color printer at the beginning of Year 1 for $38,000. The printer is expected to have a four-year useful life and a $3,500 salvage value. The expected print production is estimated at 1,500,000 pages. Actual print production for the four years was as follows: Year 1 390,000 Year 2 410,000 Year 3 420,000 Year 4 300,000 Total 1,520,000 The printer was sold at the end of Year 4 for $1,650. Requireda. Compute the depreciation expense for each of the four years, using double-declining-balance depreciation.arrow_forward

- Assume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $22,000. The estimated useful life was four years, and the residual value was $2,000. Assume that the estimated productive life of the machine was 10,000 hours. Actual annua usage was 4,000 hours in Year 1; 3,000 hours in Year 2; 2,000 hours in Year 3; and 1,000 hours in Year 4. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Year At acquisition 1 2 3 4 Req 1C Complete a depreciation schedule using the straight-line method. Depreciation Accumulated Expense Depreciation Net Book Valuearrow_forwardAssume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $24,000. The estimated useful life was four years, and the residual value was $2,580. Assume that the estimated productive life of the machine was 10,200 hours. Actual annual usage was 4,080 hours in Year 1; 3,060 hours in Year 2; 2,040 hours in Year 3; and 1,020 hours in Year 4. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Complete a depreciation schedule using the units-of-production method. Note: Use two decimal places for the per unit output factor. Do not round intermediate calculations. Year Depreciation Expense At acquisition 1 2 3 4 Accumulated Depreciation Net…arrow_forward[The following information applies to the questions displayed below.]Cheetah Copy purchased a new copy machine. The new machine cost $140,000 including installation. The company estimates the equipment will have a residual value of $35,000. Cheetah Copy also estimates it will use the machine for four years or about 8,000 total hours. Actual use per year was as follows: Year Hours Used 1 3,000 2 2,000 3 2,000 4 2,000 2. Prepare a depreciation schedule for four years using the double-declining-balance method. (Hint: The asset will be depreciated in only two years.) (Do not round your intermediate calculations.) Please do a depreciation schdeule in double declining balance method witrh a coulumn for year 1-4 with total on bottom and end of year amounts for each year with a column for depreciation expense and accumulated deprecaiton and book value. Thanks a lot.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education