CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

I need the soulation in table in detail please

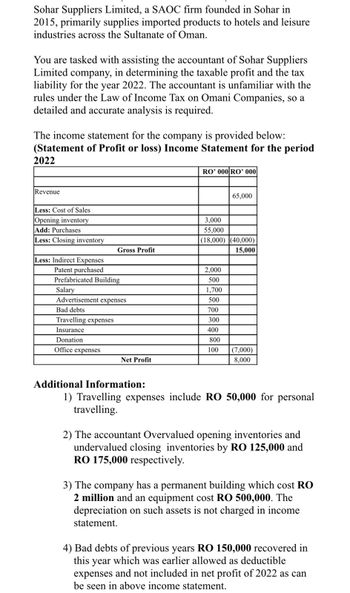

Transcribed Image Text:Sohar Suppliers Limited, a SAOC firm founded in Sohar in

2015, primarily supplies imported products to hotels and leisure

industries across the Sultanate of Oman.

You are tasked with assisting the accountant of Sohar Suppliers

Limited company, in determining the taxable profit and the tax

liability for the year 2022. The accountant is unfamiliar with the

rules under the Law of Income Tax on Omani Companies, so a

detailed and accurate analysis is required.

The income statement for the company is provided below:

(Statement of Profit or loss) Income Statement for the period

2022

Revenue

Less: Cost of Sales

Opening inventory

RO' 000 RO' 000

65,000

Add: Purchases

Less: Closing inventory

3,000

55,000

(18,000) (40,000)

Gross Profit

15,000

Less: Indirect Expenses

Patent purchased

2,000

Prefabricated Building

500

Salary

1,700

Advertisement expenses

500

Bad debts

700

Travelling expenses

300

Insurance

400

Donation

800

Office expenses

100

(7,000)

Net Profit

8,000

Additional Information:

1) Travelling expenses include RO 50,000 for personal

travelling.

2) The accountant Overvalued opening inventories and

undervalued closing inventories by RO 125,000 and

RO 175,000 respectively.

3) The company has a permanent building which cost RO

2 million and an equipment cost RO 500,000. The

depreciation on such assets is not charged in income

statement.

4) Bad debts of previous years RO 150,000 recovered in

this year which was earlier allowed as deductible

expenses and not included in net profit of 2022 as can

be seen in above income statement.

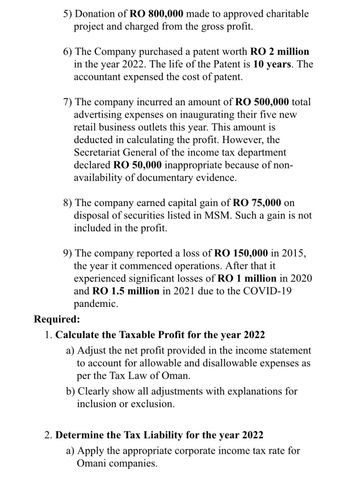

Transcribed Image Text:5) Donation of RO 800,000 made to approved charitable

project and charged from the gross profit.

6) The Company purchased a patent worth RO 2 million

in the year 2022. The life of the Patent is 10 years. The

accountant expensed the cost of patent.

7) The company incurred an amount of RO 500,000 total

advertising expenses on inaugurating their five new

retail business outlets this year. This amount is

deducted in calculating the profit. However, the

Secretariat General of the income tax department

declared RO 50,000 inappropriate because of non-

availability of documentary evidence.

8) The company earned capital gain of RO 75,000 on

disposal of securities listed in MSM. Such a gain is not

included in the profit.

9) The company reported a loss of RO 150,000 in 2015,

the year it commenced operations. After that it

experienced significant losses of RO 1 million in 2020

and RO 1.5 million in 2021 due to the COVID-19

pandemic.

Required:

1. Calculate the Taxable Profit for the year 2022

a) Adjust the net profit provided in the income statement

to account for allowable and disallowable expenses as

per the Tax Law of Oman.

b) Clearly show all adjustments with explanations for

inclusion or exclusion.

2. Determine the Tax Liability for the year 2022

a) Apply the appropriate corporate income tax rate for

Omani companies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Congratulations on your appointment as a Tax Trainee at a recognized audit firm in Jamaica. On your first assignment your supervisor asked you to assist him with the income tax computation of a small business in the tourism sector. The company provided the following information Allen’s Rest Well Resort is a resort cottage located incorporated in Jamaica. The company is a registered tourism operator under the Tourist Board Act. The hotelcommenced operations on the 1 January 2019. Fixed Assets Cost (J$) TWDV (J$) Building (hotel) 100,000,000 Furnitures 8,000,000 Computers (laptops and CPUs) 1,000,000 Computers (printers and monitors) 500,000 Motor Cars # 1 purchased in July 2019 # 2 purchased January 2019 3,000,000 2,500,000 2,437,500 1,875,000 Bus and Vans (purchased 1 January 2019) 8,000,0000 4,800,000 The following acquisitions and disposal occurred in 2021: 1. A Corolla motor car purchased for $3,000,000. Acquired 1 April 2021. 2. A BMW…arrow_forwardAccording to the Turkish tax legislation, there are two main types of tax statuses regulated on the basis of residence: resident taxpayers and non-resident taxpayers. Individual income tax rates applicable on resident taxpayers for 2018 - 2019 are as follows: Income Scales (TRY) Rate (%) Up to 14,800 15 14,801 - 34,000 20 34,001 - 120,000 27 120,001 and over 35 Create a Mathematical Model that represents the aforementioned information to calculate the annual income tax. How much annual income tax you will have to pay if your monthly taxable income is TRY 9,000.arrow_forwardThe following information has been taken from a taxable entity in Oman for the tax year 2019-2020 1. ABC Company had a plan to sell their Land on 1st December 2019. But the company postponed their sale plan to 1st December 2021. 2. A taxable entity in Oman purchase heavy equipment was OMR120,000 on 10th November 2019. It was investigated by the external auditor on 31st December 2019 that the business showed their invoice amount purposefully on profit and loss account was OMR210,000. 3. Moving funds into mutual funds equity on 1st March 2019, so that dividend can be earned tax free for the tax year 2019. 4. Altering a General expense bill of OMR700 to read OMR7000 on 10th April 2020 so that a larger tax deduction is claimed on tax return for the tax year 2020. 5. The company had a plan to sell the securities which are listed in MSM on 12th October 2020. But due to loss predicted on sale of securities for the tax year 2020, the company had postponed their…arrow_forward

- Which of the following statements concerning income taxes in Canada is not true? a) Income taxes must often be estimated based on prior years tax returns. b) Income taxes are usually paid through instalment payments throughout the year. c) The deadline for filing a corporate tax return and payment of any outstanding. Taxes is 6 months after the company’s year-end. d) Multinational companies located in Canada may be required to pay tax in Canada.arrow_forwardVishalarrow_forwardPlease solve all the questions 1. Discuss the withholding tax treatment on the RM350 million payment received by Turus Ltd from Fast Flow Sdn Bhd. 2 .Determine the withholding tax amount and due date for payment of withholding tax to the Inland Revenue Board in respect of the payment made to Tiwanis Ltdarrow_forward

- Martinez Ltd. made four quarterly payments of $4,000 each to the Receiver General for Canada during 2023 as instalment payments on its estimated 2023 corporate tax liability. At year end, Martinez's controller completed the company's 2023 tax return, which showed income tax owing of $10,300 on its 2023 income. (a) Your answer is incorrect. Prepare the adjusting year-end entry to recognize the 2023 income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Income Tax Receivable Income Tax Payable Debit 4000 Credit Annaarrow_forward Walter Wentworth Walter Wentworth lives in South Africa. He was on holiday in Australia for the last 92 days of the 2021year of assessment. Venicia Ltd Venicia Ltd is incorporated in South Africa. It carries on business in Europe. Its place of effectivemanagement is in Lucerne, Switzerland. Its year of assessment ends on the last day of February.REQUIRED: Indicate if the above persons will be subject to normal tax in South Africa for the 2021year of assessment. (Ignore the provisions of a double tax agreement that may be applicable.)arrow_forwardWhat kind of constraints would arise in an accounting firm during personal income tax seasion when all the income tax returns have to be prepared and filed with Canada Revenue Agency by the April 30 deadline? How could any constraints be relaxed?arrow_forward

- A company wishes to conduct business in a foreign country that attracts businesses by granting “holidays” from income taxes for a certain period of time. Would the company have to disclose this “holiday” to the SEC? If so, what information must be disclosed?arrow_forwardAs of December 31, 2024, Duffy Company believed it was probable that an unfavorable outcome would result from a dispute with the Massachusetts State tax authorities. In-house tax experts estimated that Duffy would owe between $2113 - $4362 of additional taxes, with $3369 being the most likely amount. What is the journal entry, if any, that Duffy should record to reflect this in the 2024 financial statements? a. A journal entry is not booked since this is a gain contingency. b. Debit to Contingent Loss for $3369; Credit to Contingent Liability for $3369 c. Debit to Contingent Loss for $2113; Credit to Contingent Liability for $2113 d. Debit to Contingent Liability for $4362; Credit to Contingent Loss for $4362arrow_forwardExchange Corp. is a company that acts as a facilitator in tax-favored real estate swaps. Such swaps, knownas 1031 exchanges, permit participants to avoid some or all of the capital gains taxes that would otherwisebe due. The bookkeeper for the company has been asked to prepare a report for the company to help itsowner/manager analyze performance. The first such report appears below:Exchange Corp.Analysis of Revenues and CostsFor the Month Ended May 31Planning Budget ActualUnit Revenues Unit Revenuesand Costs and Costs VariancesExchanges completed ............ 40 50Revenue .................................. $395 $385 $10 UExpenses:Legal and search fees .......... 165 184 19 UOffice expenses ................... 135 112 23 FEquipment depreciation ....... 10 8 2 FRent ..................................... 45 36 9 FInsurance ............................. 5 4 1 FTotal expense .......................... 360 344 16 FNet operating income .............. $ 35 $ 41 $ 6 FNote that the revenues and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you