FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

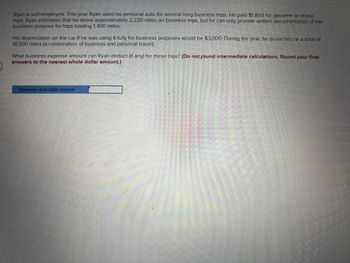

Transcribed Image Text:Ryan is self-employed. This year Ryan used his personal auto for several long business trips. He paid $1,850 for gasoline on these

trips. Ryan estimates that he drove approximately 2,220 miles on business trips, but he can only provide written documentation of the

business purpose for trips totaling 1,400 miles.

His depreciation on the car if he was using it fully for business purposes would be $3,000. During the year, he drove his car a total of

18,500 miles (a combination of business and personal travel).

What business expense amount can Ryan deduct (if any) for these trips? (Do not found intermediate calculations. Round your final

answers to the nearest whole dollar amount.)

Maximum deductible amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

So the answer is 1394 or2450?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

So the answer is 1394 or2450?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sidney is a car salesman. As a result of being the best salesman for the year, his employer permits him to buy a new BMW with a cost of Fair Market Value to the dealer of $40,000 for only $25,000. This is to be Sidney's personal vehicle and not used in business. As a result of this purchase, Sydney must report. Zero Income or Loss $40,000 income $15,000 income $20,000 incomearrow_forwardCurt is self-employed as a real estate salesman and drives his car frequently to take clients to see homes for sale. Curt drove his car 20,000 miles for business purposes and 25,000 miles in total. His actual expenses for operating the auto including depreciation are $10,000 since he drove it so much during the year. Curt has used the actual cost method since he started his business in 2015. How much is Curt’s deductible auto expense for the year?arrow_forwardBarbara sold land she purchased three months earlier for use in her business. Her cost and adjusted basis in the land prior to the sale were $80,000. She also incurred $10,000 in expenses related to the sale. The buyer paid $80,000 cash and assumed barbarous 20,000 mortgage on the property. What is the amount of Barbara's gain, and where on form 4797 will she report the sale?arrow_forward

- Max uses a Ford F-350 Truck (it is a dually with a lift kit and has a 6.7L Power Stroke Turbo Diesel engine; Gross Vehicle Weight = 9,900 pounds) 100% for business. He acquired and placed the vehicle in service in his business in March of the current year. The vehicle cost $96,000. If Max takes the maximum amount of depreciation available to him for 2023, then his maximum deduction allowed this year is: A) $28,900. B) $53,680. C) $85,264. D) $96,000.arrow_forwardIn 2018, Ensley drove her automobile 28,500 miles. She incurred the following expenses during the year related to the automobile:Gas and oil, lubrication: $1,800 Insurance: $980Repairs: $360Licenses and registration fees: $50Business parking and tolls: $170She uses the automobile 80% for business. Based on the data, Ensley's automobile deduction under the actual cost method isarrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forward

- Manjiarrow_forwardBenjamin is an artist. He sold some assets last week. He requests you to calculate the Capital Gain Tax (CGT) consequences of the following transactions: He purchased the following items last eight months ago. an antique ceramic bowl (for $4,000), An antique vase (for $5,000), A colourful painting (for $15,000), A TV sound system for his personal use (for $10,000) and Shares of a reputed Company (for $6,000) Last week he sold these assets as follows: an antique ceramic bowl (for $6,000), An antique vase (for $1,000), A colourful painting (for $ 5,000), A TV sound system for his personal use (for $9,000) and Shares of a reputed Company (for $26,000) Based on the legal provisions, discuss capital gain tax assets and calculate his net capital gain or net capital loss for the current tax yeararrow_forwardTerry purchased a machine for $15,000; the seller is holding the note. Terry paid $2,500 for the required wiring and installation. Terry has deducted depreciation on the machine for 3 years totaling $4,500. Terry owes $5,000 to the Seller. What is Terry’s adjusted basis in the machine? Group of answer choicesarrow_forward

- Steven is an accountant and maintains an office in his home. Expenses of the business (other than home office expenses) are $15,000. Steven incurs the following home office expenses: Real property taxes on residence: $2,400 Interest expense on residence: $4,000 Operating expenses of residence: $3,200 Depreciation on residence (based on 8% business use): $450. His office occupies 10% of the total floor space of his residence. Gross income from his business is $34,000. Assuming that Steven uses the regular method, what is his allowable office in the home deduction?arrow_forwardRocky repairs TV sets in the basement of his personal residence. Rocky uses 450 square feet (20%) of his residence exclusively for the repair business. Business profit is $4,000 before any office-in-home expenses are deducted. Expenses relating to the residence are as follows: Real property taxes $5,500 Interest on home mortgage 7,000 Operating expenses of residence 3,000 Depreciation (100% amount) 5,000 The maximum home office expense deduction he can take in 2020 using the regular (actual expense) method is _____. The amount of expenses Rocky would carryover to 2021 if he uses the regular method is _____. The amount of home office expense deduction he can take in 2021 using the simplified method is _____. The amount of expenses Rocky would carryover to 2021 if he uses the simplified method is ____. Rocky should use the regular method or the simplified method? _____arrow_forwardAfter several profitable years running her business, Ingrid decided to acquire the assets of a small competing business. On May 1 of year 1, Ingrid acquired the competing business for $312,000. Ingrid allocated $52,000 of the purchase price to goodwill. Ingrid’s business reports its taxable income on a calendar-year basis. a. How much amortization expense on the goodwill can Ingrid deduct in year 1, year 2, and year 3?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education