FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

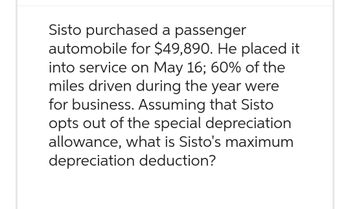

Transcribed Image Text:Sisto purchased a passenger

automobile for $49,890. He placed it

into service on May 16; 60% of the

miles driven during the year were

for business. Assuming that Sisto

opts out of the special depreciation

allowance, what is Sisto's maximum

depreciation deduction?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Andre acquired a computer on March 3, 2019, for $2,800. He elects the straight-line method for cost recovery. Andre does not elect immediate expensing under § 179. He does not claim any available additional first-year depreciation. Click here to access the depreciation table to use for this problem. Calculate Andre's cost recovery deduction for the computer for tax years 2019 and 2020. 2019: $ 2020: $arrow_forwardDuring the current year, Hom donates a sculpture that cost $1,000 to a museum for exhibition. The sculpture's fair market value was $1,700 on the date of the donation, and Hom's adjusted gross income is $40,000. Assume Hom held the sculpture for 4 months and the $700 ($1,700 − $1,000) of appreciation is a short-term capital gain. Calculate the amount of his itemized deduction for the contribution. Assume Hom held the sculpture for 2 years and the $700 appreciation is a long-term capital gain. Calculate the amount of his itemized deduction for the contribution.arrow_forwardOn June 15, 2023, Chang purchases $2,937,000 of equipment (seven-year property) for use in their business. It is their only purchase of business property in 2023. Chang has taxable income from their business of $2.5 million before any cost recovery. Click here to access depreciation Table 8-2. (If required, round your answers to the nearest dollar.) a. Assuming Chang does not elect Section 179 and elects out of bonus depreciation, what is their total 2023 cost recovery? $ 419,697 b. Assuming Chang elects the maximum Section 179 deduction allowable and elects out of bonus depreciation, what is their total 2023 cost recovery? 2,937,000 × $ c. Assuming Chang elects the maximum Section 179 deduction allowable and does not elect out of bonus depreciation, what is their total 2023 cost recovery? 2,937,000 ×arrow_forward

- On January 1, 2022, Aniyah, a sole proprietor, purchased for use in her business a used production machine (7-year property) at a cost of $4,000. Aniyah does not purchase any other property during 2022 and has net income from her business of $80,000. If the standard recovery period table would allow $572 of depreciation expense on the $4,000 of equipment purchased in 2022, what is Aniyah’s maximum depreciation deduction including the Section 179 election to expense (but not bonus depreciation) for 2022? a. $4,000 b. $2,000 c. $572 d. $800arrow_forwardMax uses a Ford F-350 Truck (it is a dually with a lift kit and has a 6.7L Power Stroke Turbo Diesel engine; Gross Vehicle Weight = 9,900 pounds) 100% for business. He acquired and placed the vehicle in service in his business in March of the current year. The vehicle cost $96,000. If Max takes the maximum amount of depreciation available to him for 2023, then his maximum deduction allowed this year is: A) $28,900. B) $53,680. C) $85,264. D) $96,000.arrow_forwardSandra acquires a new machine (7-year property) for her business on March 10, 2020, at a cost of $430,000. Sandra makes the election to expense the maximum amount under §179, and wants to take any additional first-year depreciation allowed. No election is made to use the straight-line method. Determine the total deductions in calculating taxable income related to the machine for 2020 assuming Sandra has taxable income of $500,000.arrow_forward

- In June 2022, a self-employed taxpayer purchased new equipment for $26,000 to be used in her business. Assuming she has net income from her business of $75,000 prior to the deduction, what is the maximum amount of cost recovery she can deduct rounded to the nearest dollar, assuming she does not elect §179 expense or bonus depreciationarrow_forwardBonnie Jo purchased a used camera (five-year property) for use in her sole proprietorship. The basis of the camera was $3000. Bonnie Jo used the camera in her business 60 percent of the time and used it for personal purposes the rest of the time during the first year. Calculate Bonnie Jo's depreciation deduction during the first year, assuming the sole proprietorship had a loss during the year. (Bonnie did not place the property in service in the last quarter.) Multiple Choice: A. $300 B. $360 C. $600 D. $3000 E. None of these choices are correct.arrow_forwardOn June 1, 2020, Irene places in service a new automobile that cost $45,000. The car is used 70% for business and 30% for personal use. (Assume this percentage is maintained for the life of the car). She does not take additional first-year depreciation but instead uses the 5-year (200% DB). Determine the cost recovery deduction for 2020 and 2021.arrow_forward

- Rodney, a resident taxpayer is employed by subiaco function center as a marketing manager. during the 2023 income year, Rodney used his private car for wpork related travel to meetings. he maintained fuel receipts amounting to $4000 and noted that he had travelled a total of 6000n work related kilometers during the year. rodney has not maintained a logbook. From the above information, calculate the maximum deduction available to Rodney for car expenses in respect of the 2023 income year. a)$3900 b) $4000 c) $4680 d) $0arrow_forwardEva purchased office equipment (7-year property) for use in her business. She paid $12,600 for the equipment on July 1, 2018. Eva did not purchase any other property during the year. For 2018, her business had net income of $6,000, before depreciation on the office equipment and before considering the election to expense. Eva elects out of bonus depreciation. a. What is the maximum amount that Eva can elect to expense in 2018 under Section 179? b. What is the total depreciation (regular depreciation and the amount allowed as a 2018 deduction under the election to expense) on the office equipment for 2018, assuming Eva uses the accelerated method under MACRS and claims the maximum amount allowable under the election to expense?arrow_forwardCole purchased a car for business and personal use. In 2022, he used the car 60% for business (13,000 total use miles – ratably through the year) and used the standard mileage rate to calculate his vehicle expenses. He also paid $1,500 in interest and $360 in county property tax on the car. What is the total business deduction related to business use of the car rounded to the nearest dollar?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education