Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

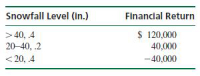

The financial success of the Downhill Ski Resort in the Blue Ridge Mountains is dependent on

the amount of snowfall during the winter months. If the snowfall averages more than 40 inches,

the resort will be successful; if the snowfall is between 20 and 40 inches, the resort will receive

a moderate financial return; and if snowfall averages less than 20 inches, the resort will suffer a

financial loss. The financial return and probability, given each level of snowfall, follow: A large hotel chain has offered to lease the resort for the winter for $40,000. Compute the expected

value to determine whether the resort should operate or lease. Explain your answer.

Transcribed Image Text:Snowfall Level (in.)

Financial Return

> 40, 4

20-40, .2

$ 120,000

40,000

< 20, 4

-40,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Solomon Auto Repair, Inc. is evaluating a project to purchase equipment that will not only expand the company's capacity but also improve the quality of its repair services. The board of directors requires all capital investments to meet or exceed the minimum requirement of a 10 percent rate of return. However, the board has not clearly defined the rate of return. The president and controller are pondering two different rates of return: unadjusted rate of return and internal rate of return. The equipment, which costs $106,000, has a life expectancy of five years. The increased net profit per year will be approximately $6,100, and the increased cash inflow per year will be approximately $29,405. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a-1. Determine the unadjusted rate of return and (use average investment) to evaluate this project. (Round your answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) a-2. Based on the…arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $11 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $69 million, and the expected cash inflows would be $23 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $24 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ million IRR: % Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forwardGreater Findlay Development Consortium is preparing to open a new retail strip mall and have multiple businesses that would like lease space in it. Each business will pay a fixed amount of rent plus a percentage of the gross sales generated each year. The cash flows from each of the businesses has approximately the same amount of risk. The business names, annual expected cash flows, and initial capital outflow for each of the businesses that would like to lease space in the strip mall are provided below. Greater Findlay Development Consortium uses a 12% hurdle rate which is its cost of capital. All business will be evaluated based on 4-year term because the contract will expire in four years. Video Now Apple Garden Croger Mart Horizon Wireless Initial Capital Outlay ($200,000) ($298,000) ($248,000) ($272,000) Annual Net Cash Flows Year 1 65,000 100,000 80,000…arrow_forward

- United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year's rental charge on the warehouse is $125,000, and thereafter, the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $1.35 million. This could be depreciated for tax purposes straight-line over 10 years. However, Pigpen expects to terminate the project at the end of 8 years and to resell the plant and equipment in year 8 for $450,000. Finally, the project requires an immediate Investment in working capital of $375,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $4.70 million, and thereafter, sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs…arrow_forwardUnited Pigpen (UP) is considering a proposal to manufacture high protein hog feed. The project would make use of an existing warehouse, which is currently rented out to a neighboring firm. The next year’s rental charge on the warehouse is $260,000, and thereafter the rent is expected to grow in line with inflation at 4% a year. In addition to using the warehouse, the proposal envisages an investment in plant and equipment of $3.1 million. This could be depreciated for tax purposes over 10 years. However, UP expects to terminate the project at the end of eight years and to resell the plant and equipment in year 8 for $1,040,000. Finally, the project requires an initial investment in working capital of $910,000. Thereafter, working capital is forecasted to be 10% of sales in each of years 1 through 7. Year 1 sales of hog feed are expected to be $10.9 million, and thereafter sales are forecasted to grow by 5% a year, slightly faster than the inflation rate. Manufacturing costs are…arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $9.66 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $57 million, and the expected cash inflows would be $19 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $20 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ IRR: % million Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forward

- A mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 15%. Should this project be undertaken? 1. The project should not be undertaken under the "no mitigation" assumption. 2. The project should be undertaken only under the " no mitigation" assumption. 3. The project should not be undertaken under the "mitigation" assumption. 4. Even when mitigation is considered the project has a positive NPV, so it should be undertaken. 5. Even when mitigation is considered the project has a…arrow_forwardTemporary Housing Services Incorporated (THSI) is considering a project that involves setting up a temporary housing facility in an area recently damaged by a hurricane. THSI will lease space in this facility to various agencies and groups providing relief services to the area. THSI estimates that this project will initially cost $4 million to set up and will generate $20 million in revenues during its first and only year in operation (paid in one year). Operating expenses are expected to total $8 million during this year and depreciation expense will be another $2 million. THSI will require no working capital for this investment. THSI's tax-rate is 20% Assume that THSI's cost of capital for this project is 15%. The net present value (NPV) of this temporary housing project is closest to:arrow_forwardA mining company is considering a new project. Because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. The firm could spend an additional $10 million at Year o to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlay of $60 million, and the expected cash inflows would be $20 million per year for 5 years. If the firm does invest in mitigation, the annual inflows would be $21 million. The risk-adjusted WACC is 12%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round intermediate calculations. Round your answers to two decimal places. NPV: $ million IRR: Calculate the NPV and IRR without mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round…arrow_forward

- A commercial real estate developer plans to borrow money to finance an upscale mall in an exclusive area of the city. The developer plans to get a loan that will be repaid with uniform payments of $300,000 beginning in year 2 and ending in year 16. How much will a bank be willing to loan at an interest rate of 13% per year? The bank will be willing to loan the developer a sum of $arrow_forwardMad Scientist, Inc. is considering investing into the nanotechnology business. After conducting a detailed due diligence process, the company's board decided that the current cost of entry into the nanotechnology business is too high. The board also thinks that the commercialization of technological advancements will eventually drive costs down and the company should get into the nanotech business one or two years from now, when they can realize a higher NPV on their investment. Given the above, the board has chosen the option to: Expand Abandon Delayarrow_forwardThe Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 12%, and the projects' expected net costs are listed in the following table: a. What is the IRR of each alternative? The IRR of alternative 1 is -Select- Year 0 1 2 3 4 5 -Select- Expected Net Cost Forklift -$200,000 -160,000 -160,000 -160,000 -160,000 -160,000 Conveyor -$500,000 -120,000 -120,000 -120,000 -120,000 -20,000 The IRR of alternative 2 is-Select- b. What is the present value of costs of each alternative? Do not round Intermediate calculations. Round your answers to the nearest…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education