FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Sleeping Bear Travel, Incorporated, is trying to decide between the following two alternatives to finance its new $24 million gaming center:

-

Issue $24 million, 5% note.

-

Issue 1 million shares of common stock for $24 per share with expected annual dividends of $1.20 per share.

Required:

1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative.

2. Answer the following questions for the current year:

(a) By how much are interest payments higher if issuing the note?

(b) By how much are dividend payments higher by issuing stock?

(c) Which alternative results in higher earnings per share?

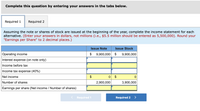

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each

alternative. (Enter your answers in dollars, not millions (i.e., $5.5 million should be entered as 5,500,000). Round your

"Earnings per Share" to 2 decimal places.)

Issue Note

Issue Stock

Operating income

$

9,900,000

$

9,900,000

Interest expense (on note only)

Income before tax

Income tax expense (40%)

Net income

$

Number of shares

2,900,000

3,900,000

Earnings per share (Net income / Number of shares)

Required 1

Required 2

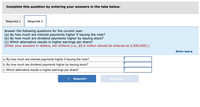

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Answer the following questions for the current year:

(a) By how much are interest payments higher if issuing the note?

(b) By how much are dividend payments higher by issuing stock?

(c) Which alternative results in higher earnings per share?

(Enter your answers in dollars, not millions (i.e., $5.5 million should be entered as 5,500,000).)

Show less A

a. By how much are interest payments higher if issuing the note?

b. By how much are dividend payments higher by issuing stock?

c. Which alternative results in higher earnings per share?

< Required 1

Required 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Use the commission schedule from Company A shown in the table to find the annual rate of interest earned on the investment. (Note: commissions are rounded to the nearest cent.) An investor purchases 250 shares at $11.21 a share, holds the stock for 37 weeks, and then sells the stock for $13.65 a share. The annual rate is %. (Round to five decimal places.) Principal (Value of Stock) Under $3,000 $3,000 to $10,000 Over $10,000 Commission $25+1.8% of principal $37+1.4% of principal $107+0.7% of principalarrow_forwardSeattle Adventures, Incorporated, is trying to decide between the following two alternatives to finance its new $17 million gaming center: a. Issue $17 million, 6% note. b. Issue 1 million shares of common stock for $17 per share with expected annual dividends of $1.02 per share. Required: 1. Assuming the note or shares of stock are issued at the beginning of the year, complete the income statement for each alternative. 2. Answer the following questions for the current year: (a) By how much are interest payments higher if issuing the note? (b) By how much are dividend payments higher by issuing stock? (c) Which alternative results in higher earnings per share?arrow_forwardEuropCar Rental is considering two alternatives for the financing of a purchase of a fleet of cars. These two alternatives are: Issue 60,000 shares of common stock at $45 per share. Issue 12%, 10-year bonds at face value for $2,500,000. It is estimated that the company will earn $750,000 before interest and taxes as a result of this purchase. The company has an estimated tax rate of 30% and has 90,000 shares of common stock outstanding prior to the new financing. Instructions Determine the effect on net income and earnings per share for these two methods of financing.arrow_forward

- An enterprise owner is considering three options to raise funds for his business activities, each with a different source of capital: • option I-business activities financed exclusively with equity of $600,000, • option II equity amounts to $450,000, the remaining $150,000 is borrowed from a bank at the annual rate of 7.6%, option III equity amounts to $350,000, the remaining $250,000 is borrowed from a bank at the annual rate of 10.4%. The annual net sales revenue is expected to reach $760,000 with total operating costs being $687,000. The enterprise pays 19% income tax. Based on the information provided, determine: return on equity depending on the adopted financing option and its increase (AROE) possible to obtain due to using the debt, ● the degree of financial leverage for each financing option, .threshold EBIT and the threshold return on equity needed for financial leverage to work.arrow_forwardIt is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 75,000 shares of stock plus a new bond issue. Assume the stock can be issued at yesterday's stock price ($33.55) and leverage changes to 2.8. Which of the following statements are true? Select all that apply. Select: 3 - Total liabilities will be $123,713,264 -The total investment for Digby will be $206,542,591 - Total Assets will rise to $217,831,113 - Working capital will remain the same at $10,349,434 - Equity will be $80,313,076 - Digby will issue stock totaling $2,516,250arrow_forwardJohn Tye has just been hired as the new corporate finance analyst at I-Ell Enterprises and has received his first assignment. John is to take the $25 million in cash received from a recent divestiture and use part of these proceeds to retire an outstanding $10 million bond issue and the remainder to repurchase common stock. However, the bond issue cannot be retired for another two years. If John can place the funds necessary to retire this $10 million debt into an account earning 6 percent compounded monthly,how much of the $25 million remains to repurchase stock?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education