Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Vijay

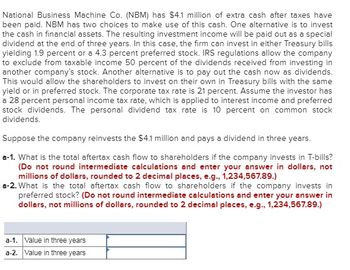

Transcribed Image Text:National Business Machine Co. (NBM) has $4.1 million of extra cash after taxes have

been paid. NBM has two choices to make use of this cash. One alternative is to invest

the cash in financial assets. The resulting investment income will be paid out as a special

dividend at the end of three years. In this case, the firm can invest in either Treasury bills

yielding 1.9 percent or a 4.3 percent preferred stock. IRS regulations allow the company

to exclude from taxable income 50 percent of the dividends received from investing in

another company's stock. Another alternative is to pay out the cash now as dividends.

This would allow the shareholders to invest on their own in Treasury bills with the same

yield or in preferred stock. The corporate tax rate is 21 percent. Assume the investor has

a 28 percent personal income tax rate, which is applied to interest income and preferred

stock dividends. The personal dividend tax rate is 10 percent on common stock

dividends.

Suppose the company reinvests the $4.1 million and pays a dividend in three years.

a-1. What is the total aftertax cash flow to shareholders if the company invests in T-bills?

(Do not round intermediate calculations and enter your answer in dollars, not

millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)

a-2. What is the total aftertax cash flow to shareholders if the company invests in

preferred stock? (Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)

a-1. Value in three years

a-2. Value in three years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- What's ROE?arrow_forwardUse the following accounts; Cash Foreign exchange gain Foreign exchange loss Capital Bank Short-term investments Loss on sale of short-term investment Gain on sale of short-term investment RA established his own company, r@ktas Co. The following transactions are the events that occurred during December 2018, the company's first month: Date 12/1 The owner invested $ 200,000 cash for capital. 12/5 r@ktas Co., opened deposit account on Don't Trust Bank and put 2.000 Euro (Exchange rate was 1 Euro= 1,5 Dollar) 12/10 The Company purchased short-term investment with cash for $2,500. 12/18 The Company sold short-term investment with cash for $2.000 Note: • Exchange rate was 1 Euro= 1,4 Dollar at the end of the period. Requirements: 1- Give the journal entry for each transaction. 2- Post each transaction to Taccounts.arrow_forwardDefine Ethics.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education