Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

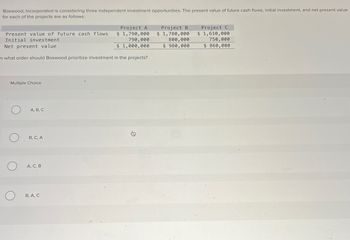

Transcribed Image Text:Boxwood, Incorporated is considering three independent investment opportunities. The present value of future cash flows, initial investment, and net present value

for each of the projects are as follows:

Present value of future cash flows

Initial investment

Net present value

Project A

$ 1,790,000

790,000

$ 1,000,000

In what order should Boxwood prioritize investment in the projects?

Project B.

$ 1,780,000

800,000

$980,000

Project C

$ 1,610,000

750,000

$ 860,000

Multiple Choice

A, B, C

B, C, A

О

О

A, C, B

B, A, C

的

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects’ NPVs, IRRs, MIRRs, and PIs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected?arrow_forwardCarol, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, and net present value for each of the projects are as follows: Project A Project B Project C Present value of future cash flows $ 651,200 $ 476,700 $ 585,200 Initial investment 280,000 235,000 270,000 Net present value $ 371,200 $ 241,700 $ 315,200 In what order should Carol prioritize investment in the projects? Multiple Choice A, B, C C, A, B C, B, A A, C, Barrow_forwardCarmen, Inc. is considering three different independent investment opportunities. The present value of future cash flows, initial investment, net present value, and profitability index for each of the projects are as follows: Project A Project B Project C Present value of future cash flows $450,100 $313,100 $405,000 Initial investment 200,000 155,000 190, еее Net present value $250, 100 $158,100 $215,000 Profitability index 2.25 2.02 2.13 In what order should Carmen prioritize investment in the projects? Multiple Cholce С, В, А O A, B, C А, С, В C, A, Barrow_forward

- A company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Project A $ 11,226 (10,000) Project B $ 10,568 (10,000) a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will it accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the net present value of each project. Potential Projects Project A Project B Project C Present value of net cash flows Initial investment Net present value $ $ $arrow_forwardABC Company has calculated the net present value of two investment opportunities but must decide which option to pursue: Project X: Present value of cash flows = $117,000 Investment = $100,000 Net present value = $17,000 Project Z: Present value of cash flows = $138,000 Investment = $120,000 Net present value = $18,000 Complete the following: Present value ratio of Project X = Present value ratio of Project Z = Decision = Invest in (Project X/Project Z)arrow_forwardK.Broni Company is considering two mutually exclusive investments. Project P and Project The expected cash flows of these projects are as follows: Year Project (P) Project (Q) ($) ($) 0 (1,000) (1,600) 1 (1,200) 200 2 (600) 400 3 (250) 600 4 2,000 800 5 4,000 100 (a) Construct the NPV profiles for Projects P and Q. (b) What is the IRR of each project? (c) Which project would you choose if the…arrow_forward

- Bruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 66,000 −$ 66,000 1 42,000 28,400 2 36,000 32,400 3 24,000 38,000 4 15,200 24,400 a-1. What is the IRR for each of these projects? a-2. If you apply the IRR decision rule, which project should the company accept? b-1. Assume the required return is 12 percent. What is the NPV for each of these projects? b-2. Which project will you choose of you apply the NPV decision rule? c-1. Over what range of discount rates would you choose Project A? c-2. Over what range of discount rates would you choose Project B? d. At what discount rate would you be indifferent between these two projects?arrow_forwardBruin, Incorporated, has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$ 28,500 −$ 28,500 1 13,900 4,050 2 11,800 9,550 3 8,950 14,700 4 4,850 16,300 a-1. What is the IRR for each of these projects? a-2. Using the IRR decision rule, which project should the company accept? multiple choice 1 Project A Project B a-3. Is this decision necessarily correct? multiple choice 2 Yes No b-1. If the required return is 11 percent, what is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. Which project will the company choose if it applies the NPV decision rule? multiple choice 3 Project A Project B c. At what discount rate would the company be indifferent between these two projects? (Do not round intermediate…arrow_forwardGarage, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$43,500 -$43,500 1 21,400 6,400 2 18,500 14,700 3 13,800 22,800 4 7,600 25,200 What is the IRR for each of these projects? Using the IRR decision rule, which project should the company accept? Is this decision necessarily correct? If the required return is 11 percent, what is the NPV for each of these projects? Which project will the company choose if it applies the NPV decision rule? Over what range of discount rates would the company choose project? A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.arrow_forward

- A company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Project A $ 8,328 (10,000) Project B $ 10,809 (10,000) Project C $ 10,685 (10,000) a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will it accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the net present value of each project. Potential Projects Project A Project B Project C Present value of net cash flows Initial investment Net present valuearrow_forwardThe management of Winstead Corporation is considering the following three investment projects (Ignore income taxes.): Project Q Project R Project S Investment required $ 57,200 $ 97,200 $ 176,000 Present value of cash inflows $ 62,092 $ 111,792 $ 193,320 The only cash outflows are the initial investments in the projects. Required: Rank the investment projects using the project profitability index.arrow_forwardAll techniques: Decision among mutually exclusive investments Pound Industries is attempting to select the best of three mutually exclusive projects. The initial investment and subsequent cash inflows associated with these projects are shown in the following table. Cash flows Project A $30,000 $10,000 Project B Project C Initial investment (CF) $60,000 $21,500 $70,000 $22,500 Cash inflows (CF), t= 1 to 5 a. Calculate the payback period for each project. The NPv of projeci C is 017.10|. (Rouna to tne nearesi cEnt.) c. The IRR of project A is %. (Round to two decimal places.) The IRR of project B is %. (Round to two decimal places.) The IRR of project C is %. (Round to two decimal places.) d. Which project would you recommend? (Select the best answer below.) O A. Project C OB. Project B OC. Project Aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning