FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

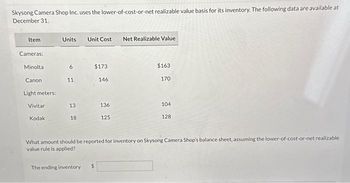

Transcribed Image Text:Skysong Camera Shop Inc. uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at

December 31.

Item

Cameras:

Minolta

Canon

Light meters:

Vivitar

Kodak

Units Unit Cost

6

11

13

18

$173

146

The ending inventory $

136

125

Net Realizable Value

$163

170

104

128

What amount should be reported for inventory on Skysong Camera Shop's balance sheet, assuming the lower-of-cost-or-net realizable

value rule is applied?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardBest Buy uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Net Realizable Cost Value Units per Unit per Unit Cameras Minolta LO 5 $159 $150 Canon 8 160 163 Light Meters Vivitar 12 135 116 Kodak 10 109 131 What amount should be reported on Best Buy's financial statements, assuming the lower-of-cost-or-net realizable value rule is applied? Total $arrow_forwardDhapaarrow_forward

- Harmes Company is a clothing store that uses the retail inventory method. The following information relates to its operations during the year: Cost Retail Inventory, January 1 $32,500 $65,000 Purchases 130,000 215,667 Markups (net) — 3,000 Markdowns (net) — 2,000 Sales — 190,000 Required:arrow_forwardLower-of-cost-or-market inventory Data on the physical inventory of Ashwood Products Company as of December 31 follow: Description InventoryQuantity Market Value per Unit(Net Realizable Value) B12 38 $57 E41 18 180 G19 33 126 L88 18 550 N94 400 7 P24 90 18 R66 8 250 T33 140 20 Z16 15 752 Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Description LastPurchasesInvoiceQuantityPurchased LastPurchasesInvoiceUnit Cost Next-to-the-LastPurchasesInvoiceQuantityPurchased Next-to-the-LastPurchasesInvoiceUnit Cost B12 30 $60 30 $59 E41 35 178 20 180 G19 20 128 25 129 L88 10 563 10 560 N94 500 8 500 7 P24 80 22 50 21 R66 5 248 4 260 T33 100 21 100 19 Z16 10 750 9 745 Required: Determine the inventory at cost and also at the lower of cost or market applied on an item-by-item basis, using the first-in, first-out method. Record the appropriate unit costs on the…arrow_forwardHarmes Company is a clothing store that uses the retail inventory method. The following information relates to its operations during the year: Cost Retail Inventory, January 1 $32,500 $65,000 Purchases 130,000 215,667 Markups (net) — 3,000 Markdowns (net) — 2,000 Sales — 190,000 Required: Compute the ending inventory by the retail inventory method for the following cost flow assumption: FIFO. Round the cost-to-retail ratio to three decimal places. HARMES COMPANYCalculation of ending inventory by retail inventory methodFIFOarrow_forward

- Best Buy uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Net Realizable Cost Value Units per Unit per Unit Cameras Minolta 5 $165 $156 Canon 7 136 140 Light Meters Vivitar 11 137 103 Kodak 10 120 123 What amount should be reported on Best Buy's financial statements, assuming the lower-of-cost-or-net realizable value rule is applied? Totalarrow_forwardWaterway Frame Camera Shop uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Item Units Cost per Unit Net RealizableValue per Unit Cameras: Minolta 8 $163 $155 Canon 10 154 156 Light Meters: Vivitar 20 121 110 Kodak 15 120 135arrow_forwardThe Boxwood Company sells blankets for $60 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase $20 10 Sale 3 17 Purchase 10 $24 20 Sale 6 23 Sale 3 30 Purchase 10 $30 Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the LIFO inventory cost method. Oa. $364 Оb. s372 Oc. $320 Od. $324arrow_forward

- Weatarrow_forwardThe Boxwood Company sells blankets for $36 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 10 $19 10 Sale 4 17 Purchase 15 $18 20 Sale 4 23 Sale 2 30 Purchase 12 $21 Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the FIFO inventory cost method. Oa. $522 Ob. $486 Oc. $567 Od. $513arrow_forwardSheffield Corp. accumulates the following cost and net realizable value data at December 31. Inventory Categories Cost Data Net Realizable Value $12,200 $13,230 Cameras Camcorders DVDs 8,750 11,300 9,450 The lower-of-cost-or-net realizable value $ 9,800 Compute the lower-of-cost-or-net realizable value for company's inventory.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education