FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

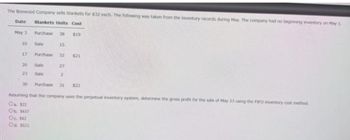

Transcribed Image Text:The Boxwood Company sells blankets for $32 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1.

Date Blankets Units Cost

May 3

Purchase 38 $19

10

Sale

15

17

Purchase

32

$21

23

22

Sale

27

Sale

30

Purchase 31

$22

Assuming that the company uses the perpetual inventory system, determine the gross profit for the sale of May 23 using the FIFO inventory cost method.

Oa. $22

Ob. $437

Oc. 142

Od. $521

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps with 2 images

Knowledge Booster

Similar questions

- Boxwood Company sells blankets for $33 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 03 Purchase 8 $26 10 Sale 17 Purchase 13 $27 20 Sale 23 Sale 30 Purchase 11 $29 Assuming that the company uses the perpetual inventory system, determine the cost of merchandise sold for the sale of May 20 using the LIFO inventory cost method. Oa. $319 Ob. $108 Oc. $54 Od. $78arrow_forwardHelp me please asap...arrow_forwardThe Boxwood Company sells blankets for $37 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 7 $15 10 Sale 3 17 Purchase 12 $18 20 Sale 6 23 Sale 3 30 Purchase 10 $21 Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method. a.$168 b.$102 c.$153 d.$96arrow_forward

- The Boxwood Company sells blankets for $40 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 10 $18 10 Sale 5 17 Purchase 14 $16 20 Sale 6 23 Sale 3 30 Purchase 10 $22 Assuming that the company uses the perpetual inventory system, determine the May 31 inventory balance using the FIFO inventory cost method.arrow_forwardBoxwood Company sells blankets for $35 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date Blankets Units Cost May 3 10 17 20 23 30 Oa. $216 Ob. $42 Purchase Oc. $14 Od. $80 Sale Purchase Sale Sale 9 5 9 6 3 $16 Purchase 9 $24 Determine the cost of goods sold for the sale of May 20 using the LIFO inventory costing method. $14arrow_forwardAaron's chairs is in the process of preparing a production costbudget for August. Actual costs in July for 120 chairs were:Materials cost $4,730Labor cost 2,940Rent 1,500Depreciation 2,500Other fixed costs 3,200Materials and labor are the only variable costs. If productionand sales are budgeted to change to 120 chairs in August,how much is the expected total variable cost on the Augustbudget?arrow_forward

- ompany reported... Salmone Company reported the following purchases and sales for its only product. Salmone uses a perpetual inventory system. Determine the cost assigned to cost of goods sold using LIFO. Activities Date May 1 May 5 Beginning inventory Purchase Units Acquired at Cost 178 units @ $10 = $ 1,780 248 units @ $12 = $ 2,976 May 10 Sales May 15 Purchase 128 units @ $13 = $ 1,664 May 24 Sales Multiple Choice $3,560 $2,740 $2,870 $3,550 $3,680arrow_forwardBoxwood Company sells blankets for $33 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 9 $29 10 Sale 4 17 Purchase 11 31 20 Sale 5 23 Sale 3 30 Purchase 12 32 Assuming that the company uses the perpetual inventory system, determine the cost of merchandise sold for the sale of May 20 using the LIFO inventory cost method. a.$116 b.$384 c.$93 d.$155arrow_forwardBoxwood Company sells blankets for $38 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system. Date May 3 10 17 20 23 30 Blankets Purchase Sale Purchase Sale Sale Purchase Units 8 4 15 5 2 8 Cost $15 $14 $20 Determine the May 31 inventory balance using the LIFO inventory costing method. a. $158 b. $490 c. $460 Od. $332arrow_forward

- Oriole Company uses a periodic inventory system and reports the following for the month of June. Date June 1 12 23 30 Explanation Units Inventory Purchase Purchase Inventory Cost of the ending inventory 130 Cost of goods sold 400 210 212 $ Unit Cost $ $5 6 7 Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round per unit cost to 3 decimal places, e.g. 15.647 and final answers to O decimal places, e.g. 5,125.) Total Cost FIFO $650 2,400 1,470 $ $ LIFO $ $ Average-costarrow_forward19arrow_forwardThe Boxwood Company sells blankets for $36 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1. Date Blankets Units Cost May 3 Purchase 9 $16 10 Sale 4 17 Purchase 12 $18 20 Sale 7 23 Sale 3 30 Purchase 12 $22 Assuming that the company uses the perpetual inventory system, determine the cost of goods sold for the sale of May 20 using the FIFO inventory cost method. a.$116 b.$206 c.$190 d.$122arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education