FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

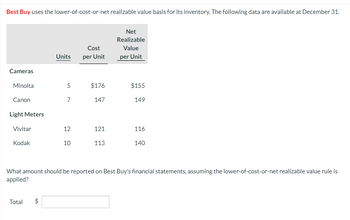

Transcribed Image Text:Best Buy uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31.

Cameras

Minolta

Canon

Light Meters

Vivitar

Kodak

Total

Units

$

5

7

12

10

Cost

per Unit

$176

147

121

113

Net

Realizable

Value

per Unit

$155

149

116

What amount should be reported on Best Buy's financial statements, assuming the lower-of-cost-or-net realizable value rule is

applied?

140

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Best Buy uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Net Realizable Cost Value Units per Unit per Unit Cameras Minolta LO 5 $159 $150 Canon 8 160 163 Light Meters Vivitar 12 135 116 Kodak 10 109 131 What amount should be reported on Best Buy's financial statements, assuming the lower-of-cost-or-net realizable value rule is applied? Total $arrow_forwardThe following is the detail of the purchase and sale of inventory of a product of Simco Co. May 1 Beg. Inventory 60 units @ $220 May 2 Purchase 100 units @ $216 May 14 Purchase 50 units @ $224 May 22 Purchase 60 units @ $234 May 30 Sale 200 units Required: 1. Compute the cost of goods sold and cost of ending inventory for Simco Co. for May under the FIFO, LIFO, and weighted average cost assumptions. 2. Which method results in Simco Co. paying the least tax?arrow_forwardUMET's Stores had the following inventory transactions in 2020: Transaction Units Cost per unit 1/1 Balance 50 $6 2/14 Sale 25 5/23 Purchase 100 8 8/21 Sale 50 11/5 Purchase 25 12 11/18 Sale 95 Required: Compute tge cost of goods sold and the ending inventory using the periodic inventory system for each of the following cost flow assumptions: a. FIFO b. LIFO c. Weighted averagearrow_forward

- The following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forwardSheridan Frame Camera Shop uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Item Units Unit Cost Net Realizable Value Cameras: Minolta 12 $168 $155 Canon 6 154 156 Light meters: Vivitar 12 125 115 Kodak 20 120 135 Determine the amount of the ending inventory by applying the lower-of-cost-or-net realizable value basis. The ending inventory $Enter the ending inventory in dollarsarrow_forwardFine Leather Ltd. had the following inventory at December 31 of the current year. Per Unit Item Quantity Cost Net Realizable Value Leather blazers Model 154 20 $ 100 $ 120 Model 160 15 180 168 Model 165 10 250 260 Handbags Model 11 60 30 32 Model 12 40 45 42 Model 13 25 65 63 Required: 1. Determine the value of ending inventory that should be reported on the statement of financial position by applying the LC&NRV rule to Each item of inventory Each major category of inventory Total inventoryarrow_forward

- Lower-of-cost-or-market inventory Data on the physical inventory of Ashwood Products Company as of December 31 follow: Description InventoryQuantity Market Value per Unit(Net Realizable Value) B12 38 $57 E41 18 180 G19 33 126 L88 18 550 N94 400 7 P24 90 18 R66 8 250 T33 140 20 Z16 15 752 Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Description LastPurchasesInvoiceQuantityPurchased LastPurchasesInvoiceUnit Cost Next-to-the-LastPurchasesInvoiceQuantityPurchased Next-to-the-LastPurchasesInvoiceUnit Cost B12 30 $60 30 $59 E41 35 178 20 180 G19 20 128 25 129 L88 10 563 10 560 N94 500 8 500 7 P24 80 22 50 21 R66 5 248 4 260 T33 100 21 100 19 Z16 10 750 9 745 Required: Determine the inventory at cost and also at the lower of cost or market applied on an item-by-item basis, using the first-in, first-out method. Record the appropriate unit costs on the…arrow_forwardBlossom Camera Shop Inc. uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Units Costper Unit Net Realizable Valueper Unit Cameras Minolta 5 $178 $149 Canon 7 153 161 Light Meters Vivitar 13 136 111 Kodak 10 111 141 What amount should be reported on Blossom Camera Shop’s financial statements, assuming the lower-of-cost-or-net realizable value rule is applied? Total $Enter a dollar amount that should be reported on Unresolved’s financial statementsarrow_forwardYou have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forward

- Best Buy uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Net Realizable Cost Value Units per Unit per Unit Cameras Minolta 5 $165 $156 Canon 7 136 140 Light Meters Vivitar 11 137 103 Kodak 10 120 123 What amount should be reported on Best Buy's financial statements, assuming the lower-of-cost-or-net realizable value rule is applied? Totalarrow_forwardNiles Co. has the following data related to an item of inventory: Inventory, March 1 400 units @ $2.10 Purchase, March 7 1,400 units @ $2.20 Purchase, March 16 280 units @ $2.25 March 31 520 units The value assigned to cost of goods sold if Niles uses FIFO is: A) $3,448. B) $3,392. C) $1,160. D) $1,104. 2. Emley Company has been using the LIFO method of inventory valuation for 10 years since it began operations. Its 2020 ending inventory was $60,000, but it would have been $90,000 if FIFO had been used. Thus, if FIFO had been used, Emley’s income before income taxes would have been: A) $30,000 less in 2020. B) $30,000 greater in 2020. C) $30,000 greater over the 10-year period. 3. Nichols Company had 500 units of “SIO” in its inventory at a cost of $5 each. It purchased, for $2,400, more units of “SIO”. Nichols then sold 600 units at a selling price of $10 each, resulting in a gross profit of $2,100. The cost flow assumption used by Nichols: A) is FIFO. B) is weighted average. C) is…arrow_forwardSkysong Camera Shop Inc. uses the lower-of-cost-or-net realizable value basis for its inventory. The following data are available at December 31. Item Cameras: Minolta Canon Light meters: Vivitar Kodak Units Unit Cost 6 11 13 18 $173 146 The ending inventory $ 136 125 Net Realizable Value $163 170 104 128 What amount should be reported for inventory on Skysong Camera Shop's balance sheet, assuming the lower-of-cost-or-net realizable value rule is applied?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education