Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

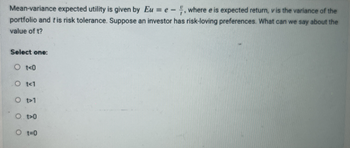

Transcribed Image Text:Mean-variance expected utility is given by Eu = e-, where e is expected return, v is the variance of the

portfolio and tis risk tolerance. Suppose an investor has risk-loving preferences. What can we say about the

value of t?

Select one:

Ot<0

O t<1

O t>1

O. t>0

O t=0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Time series forecasting maybe used to predict future values of a variable by: A. A simple moving average B. A weighted moving average C. Exponential smoothing D. All of the abovearrow_forwardThe variance of expected returns is equal to the square root of the expected returns. a. True b. Falsearrow_forwardAssume a utility function of ? = ?[?] − 1 ?? 2. Which statement(s) is/are correct about investors with this utility function? [I] An investor with a higher degree of risk aversion chooses the optimal portfolio with a higher risk premium [II] An investor with a higher degree of risk aversion chooses the optimal portfolio with lower risk [III] An investor with a higher degree of risk aversion chooses the optimal portfolio with a higher sharpe ratio [IV] The extent to which the investor dislikes risk is captured by ? 2 A. [II] only B. [I], [II] only C. [III] , [IV] only D. [II], [IV] only E. [I], [II], [III] onlyarrow_forward

- Under the stop-loss reinsurance model, suppose the total claim follows exponential distribution with mean 1/λ. For given premium P, (a) Derive the retention level M; (b) Calculate the sum of shared variances Var(X*) + Var.Xarrow_forward1. Determine the expected return and the variance of the portfolio formed by the two assets S₁, S₂ with weights ₁ = 0.6, x2 = 0.4. The assets returns are described by the following scheme: scenario W1 2لا W3 probability 0.1 0.4 0.5 T1 -20% 0% 20% 12 -10% 20% 40%arrow_forwardGiven the following probability distribution, what are the expected return and the standard deviation of returns for Security J? State Pi ri 1 0.5 11% 2 0.3 8% 3 0.2 5% O 9.40%; 2.04% O 8.90%; 2.34% O 7.40%; 2.94% O 8.40%; 2.64% O 7.90%; 1.74%arrow_forward

- There is one period. Assume a representative agent with utility function U(ct) = αc_t − βc^2_tassume the following: α = 100, β = 1, and δ = 0.97. Consumption at t = 0 is C0 = 24. At t = 1 one of two states θ1 and θ2 eventuate with probability π1 = 0.5, and π2 = 0.5,respectively. There are two complex securities s^1 and s^2.s^1 has a payoff of 23 in θ1 and 27 in θ2.s^2 has a payoff of 20 in θ1 and 32 in θ2.What is the stochastic discount factor mt+1? hint: Recall mt+1 =δU′(ct+1)/U′(ct)arrow_forwardSuppose that there are four risky assets whose expected returns E(r) and variance- covariance matrix (S) are shown in the spreadsheet below. We also consider the portfolio weights of two portfolios x and y of risky assets (see Cells B8:E9): 1 8 Portfolio x 9 Portfolio y A FOUR-ASSET PORTFOLIO PROBLEM Variance-covariance, S 20 Portfolio variance, 21 Portfollo standard deviation o 0.10 0.01 0.03 0.05 11 Portfolio x and y statistics: Mean, variance, covariance, correlation 12 Mean, Ejr, 13 Variance, 14 Covariance() 15 Correlation P 16 17 Calculating returns of combinations of Portfolio x and Portfolio y 18 Proportion of x 19 Mean portfolio return, r 0.01 0.30 0.06 -0.04 0.20 0.20 10.50% 0.1216 0.0714 0.4540 ? ? ? 0.3 0.03 0.06 0.40 0.02 0.30 0.10 ? 0.05 0.02 0.50 0.40 0.10 0.10 0.60 Mean, Er Variance, 0.2014 Question il Question ili Mean returns E(r) ? 7% 9% 11% 20% Question i i. Write the Excel formula used to estimate the mean and variance of portfolio y in cells E12 and E13,…arrow_forwardThe lower the standard deviation of returns on a security, the _____ the expected rate of return and the _____ the risk. Multiple Choice lower; lower lower; higher higher; lower higher; higherarrow_forward

- Question 1 Are the following statements true or false? Provide a short justification for your answer. (You are evaluated on your justification.) Remember that a statement is false if any part of the statement is false. A single correct counterexample is sufficient to show that a statement is false. a) assets A, B, C, with expected returns and standard deviations: Suppose you are a mean-variance optimizer. The risk-free rate is 3%. There are three risky E [řa] = 10%, SD [FA] = 5% E [řB] = 15%, SD [řB] = 7% E [řc] = 12%, SD [řc] = 9% You cannot invest in all three risky assets. Instead, you have to choose whether to invest in only assets (A, B), or only assets (A, C). Asset B mean-variance dominates asset C, since it has higher return and lower standard deviation than asset C. Thus, as long as you are risk-averse, you would always prefer the set of assets (A, B) to the set assets (A, C). b) the same market B's. The covariance matrix between A, B, C is: Suppose the CAPM holds. Consider…arrow_forward2. The following table gives information on the return and variance of assets A and B, whose covariance is 0.0003: A B 0} 0,0009 0,0012 E (R₂) 0,05 0,06 a. Does the portfolio (1/3 of A and 2/3 of B) dominate the portfolio (2/3 of A and 1/3 of B)? b. Does the portfolio (1/2, 1/2) belong to the efficient frontier? c. If there were the possibility of lending and borrowing at 2%, would the portfolio (1/2, 1/2) belong to the new efficient frontier?arrow_forwardAccording to modern portfolio theory, pair-wise covariance is more important to total portfolio risk than individual security variance. True or Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education