FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Show the

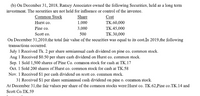

Transcribed Image Text:(b) On December 31, 2018, Ramey Associates owned the following Securities, held as a long term

investment. The securities are not held for influence or control of the investee.

Common Stock

Share

Cost

Hurst co.

1.000

TK.60,000

Pine co.

3,000

TK.45,000

Scott co.

500

TК. 30,000

On December 31,2010,the total fair value of the securities was equal to its cost.In 2019,the following

transactions occurred.

July 1 Received Tk. 2 per share semiannual cash dividend on pine co. common stock.

Aug 1 Received $0.50 per share cash dividend on Hurst co. common stock.

Sep. 1 Sold 1,500 shares of Pine Co. common stock for cash at TK.17

Oct. 1 Sold 200 shares of Hurst co. common stock for cash at TK.58

Nov. 1 Received $1 per cash dividend on scott co. common stock.

31 Received $1 per share semiannual cash dividend on pine o. common stock.

At December 31,the fair values per share of the common stocks were:Hurst co. TK.62,Pine co.TK.14 and

Scott Co.TK.59

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oriole, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company 960 shares @ $ 14 each $ 13,440 Rogers Company 880 shares @ $ 20 each 17,600 Chance Company 520 shares @ $ 10 each 5,200 Equity investments @ cost 36,240 Fair value adjustment ( 7,300 ) Equity investments @ fair value $ 28,940 During 2020, the following transactions took place. 1. On March 1, Rogers Company paid a $ 2 per share dividend. 2. On April 30, Oriole, Inc. sold 320 shares of Chance Company for $ 11 per share. 3. On May 15, Oriole, Inc. purchased 100 more shares of Evers Company stock at $ 17 per share. 4. At December 31, 2020, the stocks had the following price per share values: Evers $ 18, Rogers $ 19, and Chance $ 9. During 2021, the following transactions took place. 5. On February 1, Oriole, Inc. sold the remaining Chance shares for $ 9 per share. 6. On March 1, Rogers Company paid a $ 2…arrow_forwardThe following information is provided for Apolis Inc. Total common stockholders' equity on Dec. 31, 2020 $302,000 Total common stockholders' equity on Dec. 31, 2019 $288,000 Sales, 2020 $165,000 Total assets $605,000 Common shares outstanding, 2020 Dividends declared and paid, 2020 Market price per share, Dec. 31, 2020 If the payout ratio is .20, what is the return on equity? Select one: O O O a. 0.10 b. 0.09 c. 0.08 d. 0.07 « Previous 50,000 $6,000 $21 Save Answersarrow_forwardThe equity section of a company for the last 2 years shows the following: - Share capital 885 M Euros in 2020 (777 M euros in 2019) - Share premium 3,555 M euros in 2020 (2,941 M euros in 2019) - Retained earnings 6,241 M euros in 2020 (5,293 M euros is 2019) - Treasury shares 82 M euros in 2020 (50 M euros in 2019) Assuming the par value of the company shares is 2 euros. Which of the following statement is correct regarding 2020? do calculation please The company has issued 54 million new shares The company has issued 108 million new shares The company has issued 722 million new shares The company has issued 361 million new sharesarrow_forward

- Texas, Inc. has net income for 2019 of $555,000. At January 1, 2019, the company had outstanding 54,000 shares of $75 par value common stock and 10,000 shares of 6%, $150 par value cumulative preferred stock. On September 1, 2019, an additional 18,000 shares of common stock were issued. What is the earnings per share for 2019 (to the nearest cent)? Select one: O O O A. $6.47 B. $9.26 C. $7.75 D. $6.66arrow_forwardBelow is a company’s stock quote on March 1, 2021: Name Close Net Chg Div P/E DSD 20.25 -.15 1.05 16 What is the company’s earnings per share (EPS)?arrow_forwardSubject:arrow_forward

- Prepare a retained earnings statement for the year ended December 31, 2021 in proper format: Ladila corporation has retained earnings of P725,825 at January 1, 2021. Net income during the year was P1,800,900, and cash dividends declared and paid during 2021 totaled P98,000.arrow_forwardThe summarized balance sheet of WIPRO Itd forthe year ended 31/03/2020 and 31/03/2021 are given below. Prepare funds flow statement. Liabilities Equity share capital General Reserve Pro fit&loss a/c Sundry Creditor Provision for Tax 2020 5,00,000 2,00,000 40,000 1,58,000 45,000 2021 Assets 2020 2021 Land & Building 6,00,000 2,20,000 1,32,000 1,72,000 30,000 1,80,000 Plant and Machinery 2,10,000 80,000 2,00,000 1,70,000 1,03,000 9,43,000 3,00,000 2,76,000 95,000 1,90,000 1,95,000 98,000 11,54,000 Other fixed Assets Stock Debtors Cash at bank Total 9,43,000 The following adjustment the company faces during the year. 11,54,000 Total Dividend Rs. 30,000 was paid during the year. An old machinery costing 1,20.000 was sold for 1,00,000 and the depreciation Rs 50,000.arrow_forwardAdditional information: 1. The market price of Pina’s common stock was $7.00, $7.50, and $8.50 for 2020, 2021, and 2022, respectively. 2. You must compute dividends paid. All dividends were paid in cash. Compute the following ratios for 2021 and 2022. 2022 2021 Profit margin enter percentages % enter percentages % (Round answers to 1 decimal place, e.g. 1.5%.) Gross profit rate enter percentages % enter percentages % (Round answers to 1 decimal place, e.g. 1.5%.) Asset turnover enter asset turnover in times times enter asset turnover in times times (Round answers to 2 decimal places, e.g. 1.83.) Earnings per share $enter earnings per share in dollars $enter earnings per share in dollars (Round answers to 2 decimal places, e.g. 1.83.) Price-earnings ratio enter price-earnings ratio in times times enter price-earnings ratio in times times (Round answers to 1 decimal place,…arrow_forward

- Notes relating to the above Statements (pictures): i. The market value of the shares of the business at the end of the reporting period was £3.00 for 2019 and £2.00 for 2020. ii. All sales and purchases are made on credit. iii. At 1 April 2018, the trade receivables stood at £250 million and the trade payables at £210 million. iv. A dividend of £40 million had been paid to the shareholders in respect of each of the years. v. The business employed 14,000 staff at 31 March 2019 and 18,628 at 31 March 2020. vi. The business expanded its capacity during 2020 by setting up a new warehouse and distribution centre. vii. At 1 April 2018, the total of equity stood at £450 million and the total of equity and non-current liabilities stood at £650 million. Required Using the information from the given financial statements, statement of financial position (balance sheets) and income statement (profit & loss accounts) in page 3, calculate and interpret the following ratios for XYZ Plc for the…arrow_forwardThe balance in retained earnings at December 31, 2019 was $1,440,000 and at December 31, 2020 was $1,164,000. Net income for 2020 was $1,000,000. A stock dividend was declared and distributed which increased common stock $500,000 and paid-in capital $220,000. A cash dividend was declared and paid. The stock dividend should be reported on the statement of cash flows (indirect method) as an outflow from financing activities of $500,000. а. b. an outflow from financing activities of $720,000. an outflow from investing activities of $720,000. d. Stock dividends are not shown on a statement of cash flows. С.arrow_forwardCan someone please help with the ones in RED with working ?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education