FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

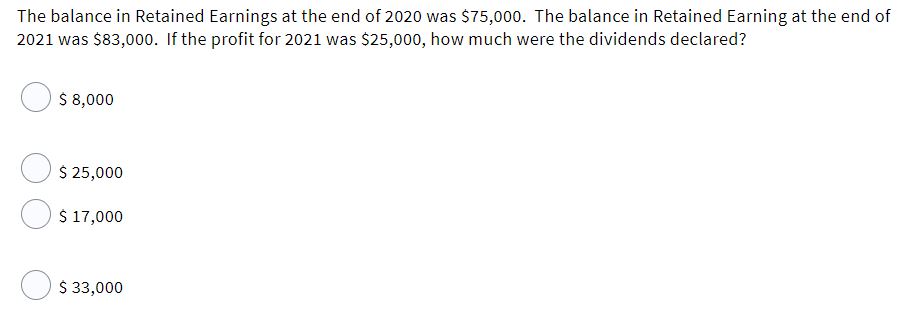

Transcribed Image Text:The balance in Retained Earnings at the end of 2020 was $75,000. The balance in Retained Earning at the end of

2021 was $83,000. If the profit for 2021 was $25,00o, how much were the dividends declared?

$ 8,000

$ 25,000

$ 17,000

O $ 33,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Sales are $2.45 million in 2020, $2.55 million in 2021, and $2.35 million in 2022.What is the percentage change from 2020 to 2021? What is the percentage change from 2021 to 2022? Be sure to indicate whether the percentage change is an increase or a decrease. (Round your answers to 1 decimal place.)arrow_forwardThe 2023 annual report for Pronghorn Industries Inc. contained the following information: Dec. 31, 2022 Dec. 31, 2023 Total assets 561,000 605,000Total liabilities 65,400 88,900Net revenue 410,000 530,000Net income 54,000 32,000 Calculate the rate of return on assets using profit margin for 2023arrow_forwardA company has the following items for the fiscal year 2020: Revenue =10 million EBIT = 5 million Net income = 2 million Total Equity = 20 million Total Assets = 40 million Calculate the company’s ROA and ROEarrow_forward

- If Ivanhoe Company had net income of $627,000 in 2021 which reflected a 20% increase in net income over 2020, what was its 2020 net income? (Round answer to O decimal places, e.g. 5,250.) Net income in 2020 $arrow_forwardA firm $925, 000 of retained earnings in 2021 and $1, 05, 000 in 2022. The firm generated net income after tax of $215, 000. How much did they pay in dividends in 2021? A. 180, 000 B. 162, 500 C. 173,000 D. 152, 000arrow_forwardAbbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 13% in 2022 and all assets and liabilities increase correspondingly. Income Statement Sales Costs, including interest Net income $ 6,800 4,900 $ 1,900 2021 Balance Sheet, Year-End 2020 Net assets $ 5,916 $ 5,500 Total $ 5,916 $ 5,500 Debt Equity Total 2021 $ 2,516 3,400 $ 5,916 2020 $ 2,433 3,067 $ 5,500 a. If the payout ratio is set at 60% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? b. If the payout ratio is set at 60% and the firm maintains a fixed debt ratio but issues no equity, what is the maximum possible growth rate for Archimedes? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. a. Maximum possible growth rate b. Maximum possible growth rate % %arrow_forward

- The retained earnings of Volga plc at 1 March 2020 were £450,550. The retained earnings at 28 Febuary 2021 were £875,000. The pofit for the year is £581,450. What was the total dividend paid by Volga plc during the year?arrow_forwardFor XYZ Corporation, the book value per share at the end of 2021 Is 31.46, ROI is .1, and earnings per share for 2022 (at the end of the year) are 4.57. What is the value of residual earnings per share for 2022? O2.38 1.42 O 3.57 O 1.13arrow_forwardThe 2019 financial statements for Growth Industries are presented below. INCOME STATEMENT, 2019 Sales $ 270,000 Costs 185,000 EBIT $ 85,000 Interest expense 17,000 Taxable income $ 68,000 Taxes (at 21%) 14,280 Net income $ 53,720 Dividends $ 21,488 Addition to retained earnings $ 32,232 BALANCE SHEET, YEAR-END, 2019 Assets Liabilities Current assets Current liabilities Cash $ 3,000 Accounts payable $ 10,000 Accounts receivable 8,000 Total current liabilities $ 10,000 Inventories 29,000 Long-term debt 170,000 Total current assets $ 40,000 Stockholders’ equity Net plant and equipment 210,000 Common stock plus additional paid-in capital 15,000 Retained earnings 55,000 Total assets $ 250,000 Total liabilities plus stockholders' equity $ 250,000 Sales and…arrow_forward

- What is Naboo Manufacturing's 2019 Current Ratio?arrow_forwardAbbreviated financial statements for Archimedes Levers are shown in the table below. Assume sales and expenses increase by 14% in 2022 and all assets and liabilities increase correspondingly. Income Statement Sales Costs, including interest Net income Net assets Total $ 4,800 3,900 $ 900 Balance Sheet, Year-End 2021 2020 $ 3,936 $3,500 $ 3,936 $3,500 Debt Equity Total 2021 $ 1,536 2,400 $ 3,936 2020 $1,433 2,067 $3,500 a. If the payout ratio is set at 50% and no external debt or equity is to be issued, what is the maximum possible growth rate for Archimedes? b. If the payout ratio is set at 50% and the firm aintains a fixed debt ratio but issues no equity, what is the maximum possible growth rate for Archimedes? Note: For all requirements, do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.arrow_forwardSuppose in its 2027 annual report that McDonald's Corporation reports beginning total assets of $20.80 billion, ending total assets of $19.20 billion, net sales of $21.80 billion, and net income of $4.10 billion. (a) Compute McDonald's return on assets. (Round return on assets to one decimal place, e.g. 5.1%.) McDonald's return on assets % (b) Compute McDonald's asset turnover. (Round asset turnover to 2 decimal places, e.g. 5.12.) McDonald's asset turnover timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education