FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

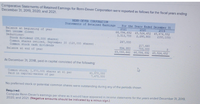

Transcribed Image Text:Comparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending

December 31, 2019, 2020, and 2021.

RENN-DEVER CORPORATION

Statenents of Retained Earnings

For the Years Ended Decenber 31

2020

66,894,692 45,524, 452 $5,674, 552

2,290, 900

2021

2019

Balance at beginning of year

Net incone (loss)

Deductions:

Stock dividend (35,000 shares)

Common shares retired, September 30 (120, 000 shares).

Common stock cash dividends

Balance at end of year

3,313, 700

(150, 100)

247,000

217,660

703, 000

66,894, 692 45, 524, 452

894,950

$9,066, 442

At December 31, 2018, paid-in capital consisted of the following:

Common stock, 1,870,000 shares at 61 par

Paid in capital-exces of par

61,870,000

7,470, 000

No preferred stock or potential common shares were outstanding during any of the periods shown.

Required:

Compute Renn-Dever's earnings per share as it would have appeared in income statements for the years ended December 31, 2019,

2020, and 2021. (Negative amounts should be indicated by a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2021. At January 1, 2021, the corporation had outstanding 107 million common shares, $1 par per share. Retained Earnings ($ in millions) 109 Beginning balance Retirement of 7 million common shares for $38 million 2 Declaration and payment of a $0.35 per 98 Net income for the year Share cash dividend 35 Declaration and distribution of a ______6% stock dividend 25_________________________________________…arrow_forwardYou are auditing the financial statements of Brin Inc. for the year 2020. The details of the unadjusted balances of its Accumulated Profit account are as follows: ACCUMULATED PROFIT Particulars Debit Credit Balance 500,000 540,000 740,000 670,000 690,000 660,000 580,000 150,000 730,000 640,000 Date Beginning Balance Gain on sale of treasury shares Net income for the year Payment of dividends declared in 2018 Paid in capital in excess of par Loss on sale of treasury shares Net loss for the year Net income for the year Payment of dividends declared in 2019 01.01.2018 08.31.2018 40,000 200,000 12.31.2018 02.28.2019 70,000 05.31.2019 20,000 07.31.2019 12.31.2019 12.31.2020 30,000 80,000 12.31.2020 90,000 Your examination disclosed the following: a. Omissions at the end of each year of the following: 2017 4,000 2018 2019 7,000 2020 Merchandise Inventory, end Accrued Expense 3,000 5,000 b. The cost of major repairs on the company's equipment on January 1, 2018 in the amount of P150,000 was…arrow_forwardFor this question, please refer to the Fact Pattern below (Same fact pattern as previous question). Given the set of transactions above, what was Adjusted EBITDA in 2021? O $1,107.2 O $1,082.2. O $1,068.2 $1,092.2 Activities during the year: Capital expenditures Cost of Goods Sold (excluding D&A) Dividend Payout Ratio (dividends/ net income to common shareholders) Income Tax Net Interest Expense Net Revenues Non-controlling Interest Expense (After-Tax) Litigation Expense Other Operating Expenses (excluding D&A) Purchases of intangible assets Preferred dividends Research And Development (excluding D&A) Proceeds from sale of land with book value of $15 Selling, General, & Administrative (excluding D&A) Write-down of PP&E 2021 580.0 3,256.0 40% 35% 45.6 5,800.0 25.0 97.0 16.5 45.0 5.0 56.3 20.0 1,488.0 7.0arrow_forward

- Every entry should have narration pleasearrow_forwardComparative Earnings per Share Lucas Company reports net income of $2,580 for the year ended December 31, 2019, its first year of operations. On January 4, 2019, Lucas issued 9,000 shares of common stock. On August 2, 2019, it issued an additional 4,200 shares of stock, resulting in 13,200 shares outstanding at year-end. During 2020, Lucas earned net income of $17,840. It issued 2,000 additional shares of stock on March 3, 2020, and declared and issued a 2-for-1 stock split on November 3, 2020, resulting in 30,400 shares outstanding at year-end. During 2021, Lucas earned net income of $29,184. The only common stock transaction during 2021 was a 20% stock dividend issued on July 2, 2021. If required, round your final answers to two decimal places. Required: 1. Compute the basic earnings per share that would be disclosed in the 2019 annual report. $ per share 2. Compute the 2019 and 2020 comparative basic earnings per share that would be disclosed in the 2020 annual report. 2020: $ per…arrow_forwardBelow is a company’s stock quote on March 1, 2021: Name Close Net Chg Div P/E DSD 20.25 -.15 1.05 16 What is the company’s earnings per share (EPS)?arrow_forward

- View Policies Current Attempt in Progress The following information was extracted from the accounts of Sandhill Co. at December 31, 2020: CR(DR). Total reported income since incorporation $4810000 Total cash dividends paid (2480000) Unrealized holding loss on available-for-sale securities (368000) Total stock dividends distributed (604000) Prior period adjustment, recorded January 1, 2020 226000 What should be the balance of retained earnings at December 31, 2020? O $1876000. O $ 1584000. O $ 1952000. O $ 3042800. Save for Later Attempts: 0 of 1 used Submit Answarrow_forwardAddition to Retained EarningsYour corporation reported net income of $930 for 2020 and the Board of Directors decided to declare dividends of $200. What is the 2020 corporation's addition to retained earnings? Please show your formula and calculations in the space provided.arrow_forwardEvaluate the company's perfomance and position using financial ratio analysisarrow_forward

- Calculation of EPS and retained earnings Everdeen Mining, Inc., ended 2019 with net profits before taxes of $447,000. The company is subject to a 21% tax rate and must pay $64,100 in preferred stock dividends before distributing any earnings on the 168,000 shares of common stock currently outstanding. a. Calculate Everdeen's 2019 earnings per share (EPS). b. If the firm paid common stock dividends of $0.76 per share, how many dollars would go to retained earnings? a. The firm's EPS is $ (Round to the nearest cent.) Carrow_forwardPlease do not give image formatarrow_forwardThe summarized balance sheets of Cullumber Company and Vaughn Company as of December 31, 2021 are as follows: Cullumber CompanyBalance SheetDecember 31, 2021 Assets $2440000 Liabilities $310000 Capital stock 1220000 Retained earnings 910000 Total equities $2440000 Vaughn CompanyBalance SheetDecember 31, 2021 Assets $1840000 Liabilities $420000 Capital stock 1170000 Retained earnings 250000 Total equities $1840000 If Cullumber Company acquired a 30% interest in Vaughn Company on December 31, 2021 for $450000 and during 2022 Vaughn Company had net income of $151000 and paid a cash dividend of $61000, applying the equity method would give a debit balance in the Equity Investments (Vaughn) account at the end of 2022 of $431700. $495300. $477000. $450000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education