FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer questions 4-5

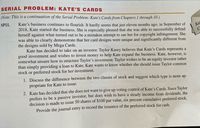

Transcribed Image Text:**Serial Problem: Kate’s Cards**

*Note: This is a continuation of the Serial Problem: Kate's Cards from Chapters 1 through 10.*

**SP11.**

Kate’s business continues to flourish. It hardly seems that just eleven months ago, in September of 2018, Kate started the business. She is especially pleased that she was able to successfully defend herself against what turned out to be a mistaken attempt to sue her for copyright infringement. She was able to clearly demonstrate that her card designs were unique and significantly different from the designs sold by Mega Cards.

Kate has decided to take on an investor. Taylor Kasey believes that Kate’s Cards represents a good investment and wishes to invest money to help Kate expand the business. Kate, however, is somewhat unsure how to structure Taylor’s investment. Taylor wishes to be an equity investor rather than simply providing a loan to Kate. Kate wants to know whether she should issue Taylor common stock or preferred stock for her investment.

1. **Discuss the difference between the two classes of stock and suggest which type is more appropriate for Kate to issue.**

2. Kate has decided that she does not want to give up voting control of Kate’s Cards. Since Taylor prefers to be a passive investor, but does wish to have a steady income from dividends, the decision is made to issue 50 shares of $100 par value, six percent cumulative preferred stock.

Provide the journal entry to record the issuance of the preferred stock for cash.

Transcribed Image Text:### Stockholders' Equity

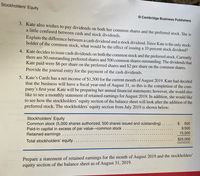

#### 3. Dividends on Common and Preferred Stock

Kate is interested in paying dividends on her common and preferred stocks but is confused between cash and stock dividends. It is important to explain the differences:

- **Cash Dividend**: A distribution of a portion of the company's earnings to shareholders in cash.

- **Stock Dividend**: A dividend payment made in the form of additional shares rather than a cash payout.

Since Kate is the sole stockholder of the common stock, she wonders about the effect of a 10% stock dividend.

#### 4. Issuing Cash Dividends

Kate decides to distribute cash dividends on both types of stock. She has 50 preferred shares and 500 common shares outstanding. The dividends are:

- $6 per share on preferred stock

- $2 per share on common stock

A journal entry for the cash dividends needs to be prepared.

#### 5. Net Income and Retained Earnings

Kate’s Cards reports a net income of $1,500 for August 2019. Kate plans for the fiscal year-end on August 31, marking the close of the business's first operational year.

- Kate will prepare annual financial statements and a monthly retained earnings statement for August 2019.

- She also wants to see the impact on stockholders’ equity after including the preferred stock.

### Stockholders' Equity Section (July 2019)

| Description | Amount |

|------------------------------------------------|---------|

| Common stock (5,000 shares authorized, 500 shares issued and outstanding) | $500 |

| Paid-in capital in excess of par value—common stock | $9,500 |

| Retained earnings | $15,000 |

| **Total stockholders’ equity** | **$25,000** |

Kate is tasked to prepare a statement of retained earnings for August 2019 and update the stockholders' equity section as of August 31, 2019.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Should $1,300 dividends be subtracted in the statement of

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Should $1,300 dividends be subtracted in the statement of

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you please solve questions 5-15 of the problem above. Thank you.arrow_forwardComment on the trends you see in attached numbers. 5 to 6 sentences Thanksarrow_forwardQuestion 3 Listen What are the values of r and r² for the below table of data? Hint: Make sure your diagnostics are turned on. Enter the data into L1 and L2. Click STAT, CALC, and choose option 8: Lin Reg(a+bx). A r = -0.862 r2=0.743 B r=0.673 2=0.820 X y 5 C r=0.743 r2=-0.862 8 22 23.9 14 9 14 17 20 5.2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education