Important: EXCEL Spreadsheet Must be Used for this Problem.

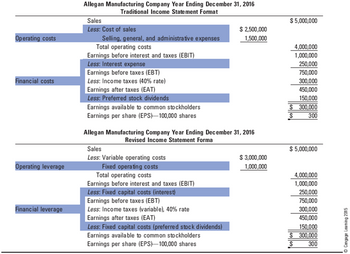

Per your request, Table 14-1 is included as an attachment.

The Hurricane Lamp Company forecasts that next year’s sales will be $6 million. Fixed operating costs are estimated to be $800,000, and the variable cost ratio (that is, variable costs as a fraction of sales) is estimated to be 0.75. The firm has a $600,000 loan at 10 percent interest. It has 20,000 shares of $3

a)

Answer: EPS (Sales = $6 million) = $5.40

b) Calculate Hurricane Lamp’s degree of operating leverage (DOL) at a sales level of $6 million using the following:

- The definitional formula (Equation 14.1)

- The simpler, computational formula (Equation 14.2)

- What is the economic interpretation of this value?

Answer: DCL = 2.778

c) Calculate Hurricane Lamp’s degree of financial leverage (DFL) at the EBIT level corresponding to sales of $6 million using the following:

- The definitional formula (Equation 14.3)

- The simpler computational formula (Equation 14.4)

- What is the economic interpretation of this value?

d) Calculate Hurricane Lamp’s degree of combined leverage (DCL) using the following:

- The definitional formula (Equation 14.5)

- The simpler computational formula (Equation 14.7)

- The degree of operating and financial leverage calculated in Parts b and c

What is the economic interpretation of this value?

Table 14 -1 is attached. Thank you.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 7 images

Please answer section d) only

Please answer section d) only

- Ans.arrow_forwardThe Mitchem marble Company has a target current ratio of 2.2 but has experienced some difficulties financing its expanding sales in the past few months. At present, the firm has a current ratio of 2.7 and current assets of $2.38 million. If Mitchem expands its receivable and inventories using its short-term line of credit, how much additional short-term funding can it borrow before its current ratio standard is reached?arrow_forwardThe following table presents sales forecasts for Golden Gelt Giftware. The unit price is $40. The unit cost of the giftware is $25. Year 1 2 3 4 Thereafter Unit Sales 22,000 30,000 14,000 5,000 8 It is expected that net working capital will amount to 20% of sales in the following year. For example, the store will need an initial (Year 0) Investment in working capital of 0.20 x 22,000 × $40 = $176,000. Plant and equipment necessary to establish the giftware business will require an additional Investment of $200,000. This Investment will be depreciated straight-line over 3 years. The firm's tax rate is 30%. The discount rate is 20%. a. What is the net present value of the project? Note: Do not round Intermediate calculations. Round your answer to the nearest whole dollar amount. b. By how much does NPV Increase if the firm takes Immediate 100% bonus depreciation? a. Net present value b. Increase in NPVarrow_forward

- Your storage firm has been offered $96,900 in one year to store some goods for one year. Assume your costs are $95,200, payable immediately, and the cost of capital is 8.1%. Should you take the contract? The NPV will be $ Should you take the contract? The contract (Round to the nearest cent.) be taken (Select from the drop-down menu.)arrow_forwardWhen calculating Return on Investment (ROI) we take the benefit/cost x 100. Or as we reviewed in class: ROI= (average annual profit/total investment) x 100. So, if I invest in Fall protection for my company at a cost of $10,000, and for the purposes of calculation, you determine if it saves that company 10% of it's fall- related WC claims annually, the annual benefit would be around $3,000 annually, what would you project your ROI to be? (one best answer) 30% 10% $3,000 I don't need to calculate the ROI, because it is required by law.arrow_forwardPlease answer fast I give you upvotearrow_forward

- The Mitchem Marble company has a target current ratio of 2.2 but has experienced some difficulties financing its expanding sales in the past few months. At present the firm has a current ratio of 2.9 and current assests of $2.62 million. If Mitchem expands its receivables and inventories using its short-term line of credit, how much additional short-term funding can it borrow before its current ratio standard is reached? The additional amount of receivables and inventories (short term debt) is how many million? (rounded to two decimal places)arrow_forwardUse an excel spreedsheet to answer this question: The National Potato Cooperative purchased a deskinning machine last year for $150,000. Revenue for the first year was $ 50,000. Over the total estimated life of 8 years, use a spreadsheet to estimate the remaining equivalent annual revenues (years 2 through 8) to ensure breakeven by recovering the investment and a return of 10% per year. Costs are expected to be constant at $42,000 per year and a salvage value of $10,000 is anticipated.arrow_forwardYour storage firm has been offered $100,000 in one year to store some goods for one year. Assume your costs are $95.700, payable immediately, and the cost of capital is 8.5%. Should you take the contract? The NPV will be $ (Round to the nearest cent.)arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education