FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

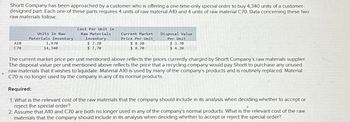

Transcribed Image Text:Shortt Company has been approached by a customer who is offering a one-time-only special order to buy 4,340 units of a customer-

designed part. Each one of these parts requires 4 units of raw material A10 and 4 units of raw material C70. Data concerning these two

raw materials follow:

A10

C70

Units in Raw

Materials Inventory

1,970

14,340

Cost Per Unit in

Raw Materials

Inventory

$7.20

$ 7,70

Current Market

Price Per Unit

$8.20

$ 8.70

Disposal Value

Per Unit

$ 3.70

$ 4.20

The current market price per unit mentioned above reflects the prices currently charged by Shortt Company's raw materials supplier.

The disposal value per unit mentioned above reflects the price that a recycling company would pay Shortt to purchase any unused

raw materials that it wishes to liquidate. Material A10 is used by many of the company's products and is routinely replaced. Material

C70 is no longer used by the company in any of its normal products.

Required:

1. What is the relevant cost of the raw materials that the company should include in its analysis when deciding whether to accept or

reject the special order?

2. Assume that A10 and C70 are both no longer used in any of the company's normal products. What is the relevant cost of the raw

materials that the company should include in its analysis when deciding whether to accept or reject the special order?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Beantown Baseball Company makes baseballs that sell for $13 per two-pack. Current annual production and sales are 576,000 baseballs. Costs for each baseball are as follows: Direct material $2.00 Direct labor $1.25 Variable overhead $0.50 Variable selling expenses $0.25 Total variable cost $4.00 Total fixed overhead $750,000 i. Beantown Baseball Company has received an offer to provide a one-time sale of 12,000 baseballs at $8.80 per two-pack to the Lowell Spinners. This sale would not affect other sales, nor would the cost of those sales change. However, the variable cost of the additional units would increase by $0.20 for shipping, and fixed cost would increase by $3,600. Based solely on financial information, should the company accept this offer? Incremental pre-tax loss $______ The company should Reject the offerarrow_forwardTikTok Electronics manufactures an aluminium fibre tripod model “TRI-X” which sells for$1,600. The production cost computed per unit under traditional costing for each model in2019 was as follows: Traditional Costing TRIXDirect Materials $700Direct Labour ($20/hour) $120Manufacturing overhead ($38 per DLH) $228Total per unit cost $1, 048 In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRIX as it has continuously failed to reach the gross profit target of $600. Before finalizing itsdecision, management asks TikTok Electronics management accountant to prepare an analysis using activity-based costing (ABC). The management accountant accumulates thefollowing information about overhead for the year ended December 31, 2019. Follow the image. Required:1. Calculate the activity rates for each of the overhead items using the four cost drivers. 2. Using the…arrow_forwardStuart Publications established the following standard price and costs for a hardcover picture book that the company produces. Standard price and variable costs Sales price $ 36.10 Materials cost 8.90 Labor cost 4.20 Overhead cost 5.90 Selling, general, and administrative costs 6.30 Planned fixed costs Manufacturing overhead $ 128,000 Selling, general, and administrative 49,000 Stuart planned to make and sell 30,000 copies of the book. Required: a. - d. Prepare the pro forma income statement that would appear in the master budget and also flexible budget income statements, assuming production volumes of 29,000 and 31,000 units. Determine the sales and variable cost volume variances, assuming volume is actually 31,000 units. Indicate whether the variances are favorable (F) or unfavorable (U). (Select "None" if there is no effect (i.e., zero variance).)arrow_forward

- TikTok Electronics manufactures an aluminium fibre tripod model “TRI-X” which sells for $1,600. The production cost computed per unit under traditional costing for each model in 2019 was as follows: Traditional Costing TRIX Direct Materials $700 Direct Labour ($20/hour) $120 Manufacturing overhead ($38 per DLH) $228 Total per unit cost $1, 048 In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI- X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTok Electronics management accountant to prepare ananalysis using activity-based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019. Activity Cost Pools Cost Drivers…arrow_forwardCapitol, Incorporated, has received a special order for 2,080 units of its product at a special price of $158. The product normally sells for $208 and has the following manufacturing costs: Cost per Unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit cost $ 58 38 28 48 $ 172 Assume that Capitol has sufficient capacity to fill the order without harming normal production and sales. Required: a. If Capitol accepts the order, what effect will the order have on the company's short-term profit? b. What minimum unit price should Capitol charge to achieve a $48,000 incremental profit? c. Now, assume Capitol is currently operating at full capacity and cannot fill the order without harming normal production and sales. If Capitol accepts the order, what effect will the order have on the company's short-term profit? Complete this question by entering your answers in the tabs below. Required A Required B Required C If Capitol accepts the order,…arrow_forwardMooran Corporation has been asked by a customer to fill a special order for 9,000 units of product AB40 for $20.50 a unit. While the product would be modified slightly for the special order, product AB's normal unit product cost is $14.40: Direct materials $ 3.10 Direct labor 1.50 Variable manufacturing overhead 6.40 Fixed manufacturing overhead 3.40 Unit product cost $ 14.40 Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product AB45 that would increase the variable costs by $5.00 per unit and that would require an investment of $36,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Shadee Corporation expects to sell 640 sun shades in May and 360 in June. Each shade sells for $161. Shadee's beginning and ending finished goods inventories for May are 60 and 40 shades, respectively. Ending finished goods inventory for June will be 65 shades. Each shade requires a total of $55.00 in direct materials that includes 4 adjustable poles that cost $10.00 each. Shadee expects to I have 120 in direct materials inventory on May 1, 100 poles in inventory on May 31, and 110 poles in inventory on June 30. Required: Prepare Shadee's May and June purchases budget for the adjustable poles. Budgeted Cost of Poles Purchased May Junearrow_forwardPlease answer full question .arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

- harshalarrow_forwardEdge Manufacturing produces two types of entry doors: Deluxe andStandard. The assignment basis for support costs has been directlabor dollars. For 2009, Edge Manufacturing compiled the followingdata for the two products:Deluxe StandardSales units $50,000 $400,000Sales price per unit $650.00 $475.00Direct material and labor costs perunit$180.00 $130.00Manufacturing support costs per unit $ 80.00 $120.00Last year, Edge Manufacturing purchased an expensive roboticssystem to allow for more decorative door products in the deluxeproduct line. The CFO suggested that an ABC analysis could bevaluable to help evaluate a product mix and promotion strategy for thenext sales campaign.She obtained the following ABC information for 20X5:Activity Cost Driver Cost Total Deluxe StandardSetups # of setups $ 500,000 500 400 100Machinerelated# of machinehours$44,000,000 600,000 300,000 300,000Packing # of shipments $ 5,000,000 250,000 50,000 200,000N.B.: # = numberRequired:a. Using the activity-based…arrow_forwardTikTok Electronics manufactures an aluminium fibre tripod model “TRI-X” which sells for$1,600. The production cost computed per unit under traditional costing for each model in2019 was as follows:Traditional Costing TRIXDirect Materials $700Direct Labour ($20/hour) $120Manufacturing overhead ($38 per DLH) $228Total per unit cost $1, 048In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, thegross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRIX as it has continuously failed to reach the gross profit target of $600. Before finalizing itsdecision, management asks TikTok Electronics management accountant to prepare an 3analysis using activity-based costing (ABC). The management accountant accumulates thefollowing information about overhead for the year ended December 31, 2019.Activity CostPoolsCost Drivers EstimatedOverheadExpected Use ofCost DriversPurchasing Number oforders$1,200,000 40,000Machine setups Number…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education