Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve this Financial accounting

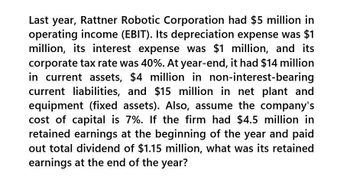

Transcribed Image Text:Last year, Rattner Robotic Corporation had $5 million in

operating income (EBIT). Its depreciation expense was $1

million, its interest expense was $1 million, and its

corporate tax rate was 40%. At year-end, it had $14 million

in current assets, $4 million in non-interest-bearing

current liabilities, and $15 million in net plant and

equipment (fixed assets). Also, assume the company's

cost of capital is 7%. If the firm had $4.5 million in

retained earnings at the beginning of the year and paid

out total dividend of $1.15 million, what was its retained

earnings at the end of the year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 4. Last year Rattner Robotics had $5 million in operating income (EBIT). Its depreciationexpense was $1 million, its interest expense was $1 million, and its corporate tax rate was40%. At year-end, it had $14 million in current assets, $3 million in accounts payable, $1million in accruals, and $15 million in net plant and equipment. Assume that Rattner’s onlynoncash item was depreciation. a. What was the company’s net income?b. What was its net working capital (NWC)?c. Rattner had $12 million in net plant and equipment the prior year. Its net workingcapital has remained constant over time. What is the company’s free cash flow (FCF) forthe year that just ended?d. If the firm had $4.5 million in retained earnings at the beginning of the year and paidout total dividends of $1.2 million, what was its retained earnings at the end of the year?Assume that all dividends declared were actually paid.arrow_forwardPatterson Brothers recently reported an EBITDA of $7.5 million andnet income of $2.1 million. It had $2.0 million of interest expense, and its corporate tax ratewas 30%. What was its charge for depreciation and amortization?arrow_forwardPatterson recently reported EBITA of $14.5 million. It had $2.0 million of interest expense, and its corporate tax rate was 40%. What was its charge for depreciation and amortization?arrow_forward

- Talbot Enterprises recently reported an EBITDA of $8 million and net incomeof $2.4 million. It had $2.0 million of interest expense, and its corporate taxrate was 40%. What was its charge for depreciation and amortization?arrow_forwardDelta Ray Brands Corp. just completed their latest fiscal year. The firm had sales of $16,818,300. Depreciation and amortization was $830,300, interest expense for the year was $872,900, and selling general and administrative expenses totaled $1,404,600 for the year, and cost of goods sold was $10,640,400 for the year. Assuming a federal income tax rate of 34%, what was the Delta Ray Brands net income after-tax? Round to the nearest cent.arrow_forwardNeed help pleasearrow_forward

- Mo’s INC recently reported an EBITDA of $15 million and net income of $5.3 million. It had $3 million of interest expense, and its corporate tax rate was 22%. What was its charge for depreciation and amortization?arrow_forwardLast year, Stewart-Stern Inc. reported $11,250 of sales, $4,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had $2,500 of bonds outstanding that carry a 7.00% interest rate, and its federal-plus-state income tax rate was 25.00%. During last year, the firm had expenditures on fixed assets and net operating working capital that totaled $1,600. These expenditures were necessary for it to sustain operations and generate future sales and cash flows. This year's data are expected to remain unchanged except for one item, depreciation, which is expected to increase by $900. By how much will the depreciation change cause (1) the firm's net income and (2) its free cash flow to change? Note that the company uses the same depreciation for tax and stockholder reporting purposes. Do not round the intermediate calculationsarrow_forwardGive me answer of this questionarrow_forward

- A chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forwardRao Construction recently reported $28.00 million of sales, $12.60 million of operating costs other than depreciation, and $3.00 million of depreciation. It had $8.50 million of bonds outstanding that carry a 7.0% interest rate, and its federal-plus-state income tax rate was 25%. What was Rao's operating income, or EBIT, in millions? a. $15.40 b. $11.81 c. $12.40 d. $8.85 e. $18.40arrow_forwardShrives Publishing recently reported $11,500 of sales, $5,500 of operating costs other than depreciation, and $1,250 of depreciation. The company had $3,500 of bonds that carry a 6.25% interest rate, and its federal-plus-state income tax rate was 25%. During the year, the firm had expenditures on fixed assets and net operating working capital that totaled $1,550. These expenditures were necessary for it to sustain operations and generate future sales and cash flows. What was its free cash flow? a. $4,450.00 b. $2,012.50 c. $3,262.50 d. $4,812.50 e. $6,362.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT