FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

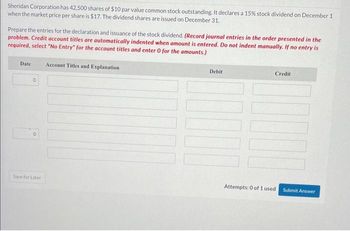

Transcribed Image Text:Sheridan Corporation has 42,500 shares of $10 par value common stock outstanding. It declares a 15% stock dividend on December 1

when the market price per share is $17. The dividend shares are issued on December 31.

Prepare the entries for the declaration and issuance of the stock dividend. (Record journal entries in the order presented in the

problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is

required, select "No Entry" for the account titles and enter 0 for the amounts.)

Date

O

O

Save for Later

Account Titles and Explanation

Debit

Credit

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Pharoah Corporation has outstanding 420,000 shares of $10 par value common stock. The corporation declares a 5% stock dividend when the fair value of the stock is $70 per share. Prepare the journal entries for Pharoah Corporation for both the date of declaration and the date of distribution. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Declaration Date Distribution Date 77°F A d0) O pe here to searcharrow_forwardPlease help mearrow_forwardFlint Corporation issued 1,900 shares of stock. Prepare the entry for the issuance under the following assumptions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) (b) (c) (d) (e) No. Account Titles and Explanation (a) (b) The stock had a par value of $5.25 per share and was issued for a total of $46,500. The stock had a stated value of $5.25 per share and was issued for a total of $46,500. The stock had no par or stated value and was issued for a total of $46,500. The stock had a par value of $5.25 per share and was issued to attorneys for services during incorporation valued at $46,500. The stock had a par value of $5.25 per share and was issued for land worth $46,500. (c) (d) (e) J Debit Creditarrow_forward

- On June 1, Sage Hill Inc. issues 2,500 shares of no-par common stock at a cash price of $7 per share. Prepare a tabular summary to record the issuance of the shares. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) June 1 Assets Cash Liabilities Paid-in-Capital Common Stock Revenue Stockholders' Equity Expense Retained Earnings Dividendarrow_forwardFlint Corporation issued 1,900 shares of stock. Prepare the entry for the issuance under the following assumptions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) The stock had a par value of $5.25 per share and was issued for a total of $46,500. (b) The stock had a stated value of $5.25 per share and was issued for a total of $46,500. (c) The stock had no par or stated value and was issued for a total of $46,500. A (d) The stock had a par value of $5.25 per share and was issued to attorneys for services during incorporation valued at $46,500. (e) The stock had a par value of $5.25 per share and was issued for land worth $46.500.arrow_forwardOn June 1, Bramble Inc. issues 3,600 shares of no-par common stock at a cash price of $9 per share. Journalize the issuance of the shares assuming the stock has a stated value of $2 per share. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation June 1 Debit Creditarrow_forward

- Helparrow_forwardDelta Corporation issued 10,000 shares of no-par common stock for $1 per share on July 13. Record the stock issuance. (Check your spelling carefully and do not abbreviate. Be sure to include the type of stock in the account names where applicable. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Jul. 13arrow_forwardSheridan Company issued 1,150 shares of stock.Prepare the entry for the issuance under the following independent assumptions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) The stock had a par value of $5 per share and was issued for a total of $49,450. (b) The stock had a stated value of $5 per share and was issued for a total of $49,450. (c) The stock had no par or stated value and was issued for a total of $49,450. (d) The stock had a par value of $5 per share and was issued to attorneys for services provided during incorporation valued at $49,450. (e) The stock had a par value of $5 per share and was issued for land worth $49,450. No. Account Titles and Explanation Debit Credit (a) Enter an account title Enter a debit amount Enter a credit amount Enter an account title Enter a…arrow_forward

- Bonita Inc. has outstanding 10,400 shares of $10 par value common stock. On July 1, 2020, Bonitareacquired 107 shares at $87 per share. On September 1, Bonita reissued 61 shares at $94 per share. On November 1, Bonita reissued 46 shares at $84 per share.Prepare Bonita’s journal entries to record these transactions using the cost method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardVaughn Corporation has outstanding 323,000 shares of $10 par value common stock. The corporation declares a 100% stock dividend when the fair value of the stock is $71 per share.Prepare the journal entries for both the date of declaration and the date of distribution. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardFlint Corporation purchased 2,500 shares of its $10 par value common stock for $167,500 on August 1. It will hold these shares in the treasury until resold. On December 1, the corporation sold 1,500 shares of treasury stock for cash at $75 per share. Journalize the treasury stock transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation eTextbook and Media Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education