FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

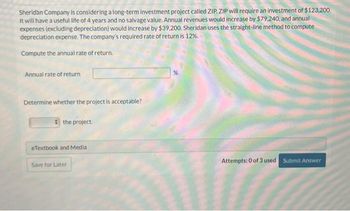

Transcribed Image Text:Sheridan Company is considering a long-term investment project called ZIP. ZIP will require an investment of $123,200.

It will have a useful life of 4 years and no salvage value. Annual revenues would increase by $79.240, and annual

expenses (excluding depreciation) would increase by $39,200. Sheridan uses the straight-line method to compute

depreciation expense. The company's required rate of return is 12%.

Compute the annual rate of return.

Annual rate of return

Determine whether the project is acceptable?

the project.

eTextbook and Media

Save for Later

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tempura, Inc., is considering two projects. Project A requires an investment of $48,000. Estimated annual receipts for 20 years are $19.000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $77,000, has annual receipts for 20 years of $23,000, and has annual costs of $18,000. Assume both projects have a zero salvage value and that MARR is 11.0 %/year. Click here to access the TVM Factor Table Calculator Part a What is the present worth of each project? Project A. $ Project B: $arrow_forwardWendy and Wayne are evaluating a project that requires an initial investment of $792,000 in fixed assets. The project will last for fourteen years, and the assets have no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 143,000 units per year. Price per unit is $43, variable cost per unit is $24, and fixed costs are $800,712 per year. The tax rate is 36 percent, and the required annual return on this project is 12 percent. The projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/- 15 percent. Required: (a)Calculate the best-case NPV. (Do not round your intermediate calculations.) (Click to select) (b)Calculate the worst-case NPV. (Do not round your intermediate calculations.) (Click to select) Warrow_forwardVaughn Company is considering a capital investment of $378,400 in additional productive facilities. The new machinery is expected to have a useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $18,920 and $86,000, respectively. Vaughn has an 7% cost of capital rate, which is the required rate of return on the investment. (a1) Compute the cash payback period. (Round answer to 2 decimal places, e.g. 2.25.) Your answer is correct. Cash payback period (a2) eTextbook and Media (b) Your answer is correct. Annual rate of return Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 2.25%.) eTextbook and Media 4.4 years Net present value $ 10 Attempts: 1 of 5 used % Attempts: 1 of 5 used Using the discounted cash flow technique, compute the net present value. (Round present value factor calculations to 5…arrow_forward

- XYZ Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (Ignore income taxes.): Sales $ 500,000 Less cash variable expenses 200,000 Less cash fixed expenses 150,000 Less depreciation expenses 45,000 Net operating income $ 105,000 The company's required rate of return is 12%. Compute the payback period for this project Enter your answerarrow_forwardConcose Park Department is considering a new capital investment. The cost of the machine is $230,000. The annual cost savings if the new machine is acquired will be $105,000. The machine will have a 5-year life and the terminal disposal value is expected to be $38,000. There are no tax consequences related to this decision. If Concose Park Department has a required rate of return of 16%, which of the following is closest to the present value of the project? A. $131,858 B. $145,662 C. $31,892 D. $113,770arrow_forwardA 3-year project requires the purchase of a machine (fixed asset) for $6,000 in Year 0. In Year 2, the project is expected to have net income of $2,000 and the depreciation rate is 45%. The tax rate is 35%. There is no interest expense. What is the Operating Cash Flow in Year 2? Enter your answer without the dollar sign and round your final answer to the nearest whole number (nearest dollar).arrow_forward

- aarrow_forwardVaughn Company is considering a capital investment of $378,400 in additional productive facilities. The new machinery is expected to have a useful life of 6 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment, annual net income and net annual cash flows are expected to be $18,920 and $86,000, respectively. Vaughn has an 7% cost of capital rate, which is the required rate of return on the investment. (a1) Compute the cash payback period. (Round answer to 2 decimal places, e.g. 2.25.) Your answer is correct. Cash payback period (a2) eTextbook and Media (b) Your answer is correct. Annual rate of return Compute the annual rate of return on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 2.25%.) eTextbook and Media Your answer is correct. 4.4 years Net present value $ 10 % Attempts: 1 of 5 used Using the discounted cash flow technique, compute the net present value. (Round present value factor calculations to…arrow_forwardPina Colada Company is considering a capital investment of $419,870 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is computed by the straight-line method. During the life of the investment, annual net income and cash flows are expected to be $39,000 and $121,000, respectively. Pina Colada has a 12% cost of capital rate, which is the minimum acceptable rate of return on the investment. Click here to view PV tables. (a) Compute the annual rate of return. (Round answer to 1 decimal place, e.g. 15.5.) Annual rate of return. % Compute the cash payback period on the proposed capital expenditure. (Round answer to 2 decimal places, e.g. 15.25.) Cash payback period yearsarrow_forward

- The management of Kunkel Company is considering the purchase of a $29,000 machine that would reduce operating costs by $6,500 per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return is 16%. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the investment in the machine. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount. Use the appropriate table to determine the discount factor(s).) Net present valuearrow_forwardThe lovely company has a new 4-year project that will have annual sales of 9,300 units. The price per unit it $20,80 and the variable cost per unit is $8.55. The project will require fixed assets of $103.000, which will be depreciated on a 3 year MACRS schedule. The annual depreciation percentages are 33.33 percent, 44.45 percent, 14.81 percent, 7.41 percent, respectively. Fixed costs are $43,000 per year and the tax rate is 34 percent. What is the operating cash flow for year 3?arrow_forwardBad Company has a new 4-year project that will have annual sales of 8,400 units. The price per unit is $19.90 and the variable cost per unit is $7.65. The project will require fixed assets of $94,000, which will be depreciated on a 3-year MACRS schedule. The annual depreciation percentages are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. Fixed costs are $34,000 per year and the tax rate is 25 percent. What is the operating cash flow for Year 3? $20,705 $80,655 $57,550 $55,155 $60,744arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education