Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

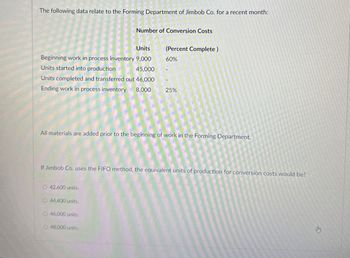

Transcribed Image Text:The following data relate to the Forming Department of Jimbob Co. for a recent month:

Number of Conversion Costs

Units

(Percent Complete)

Beginning work in process inventory 9,000

60%

Units started into production

45,000

Units completed and transferred out 46,000

Ending work in process inventory 8,000

25%

All materials are added prior to the beginning of work in the Forming Department.

If Jimbob Co. uses the FIFO method, the equivalent units of production for conversion costs would be?

O 42,600 units.

O 44,400 units.

46,000 units.

O 48,000 units,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ardt-Barger has a beginning work in process inventory of 5.500 units and transferred in 25,000 units before ending the month with 3.000 u flits that were 100% complete with regard to materials and 80% complete with regard to conversion costs. The cost per unit of material is $5.45, and the cost per unit for conversion is $6.20 per unit, Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardHeap Company manufactures a product that passes through two processes: Fabrication and Assembly. The following information was obtained for the Fabrication Department for September: a. All materials are added at the beginning of the process. b. Beginning work in process had 80,000 units, 30 percent complete with respect to conversion costs. c. Ending work in process had 17,000 units, 25 percent complete with respect to conversion costs. d. Started in process, 95,000 units. Required: 1. Prepare a physical flow schedule. 2. Compute equivalent units using the weighted average method. 3. Compute equivalent units using the FIFO method.arrow_forwardThe Converting Department of Tender Soft Tissue Company uses the weighted average method and had 1,900 units in work in process that were 60% complete at the beginning of the period. During the period, 15,800 units were completed and transferred to the Packing Department. There were 1,200 units in process that were 30% complete at the end of the period. a. Determine the number of whole units to be accounted for and to be assigned costs for the period. b. Determine the number of equivalent units of production for the period. Assume that direct materials are placed in process during production.arrow_forward

- K-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: The cost of beginning work in process was direct materials, 40,000; conversion costs, 30,000. Required: 1. Determine the cost of ending work in process and the cost of goods transferred out. 2. Prepare a physical flow schedule.arrow_forwardCost per equivalent unit The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of 9,000 of direct materials. A. Determine the number of units transferred to the next department. B. Determine the costs per equivalent unit of direct materials and conversion. C. Determine the cost of units started and completed in November.arrow_forwardNarwhal Swimwear has a beginning work in process inventory of 13,500 units and transferred in 130,000 units before ending the month with 14,000 units that were 100% complete with regard to materials and 30% complete with regard to conversion costs. The cost per unit of material is $5.80 and the cost per unit for conversion is $8.20 per unit. Using the weighted-average method, what is the amount of material and conversion costs assigned to the department for the month?arrow_forward

- During March, the following costs were charged to the manufacturing department: $22,500 for materials; $45,625 for labor; and $50,000 for manufacturing overhead. The records show that 40,000 units were completed and transferred, while 10,000 remained in ending inventory. There were 45,000 equivalent units of material and 42,500 units of conversion costs. Using the weighted-average method, prepare the companys process cost summary for the month.arrow_forwardChavez Concrete Inc. has two production departments. Blending had 1,000 units in process at the beginning of the period, two-fifths complete. During the period 7,800 units were received from Mixing, 8,200 units were transferred to the finished goods storeroom, and 600 units were in process at the end of the period, 1/3 complete. The cost of the beginning work in process was: The costs during the month were: 1. Using the data in E5-15, prepare a cost of production summary for the month ended January 31, 2016. 2. Prepare a journal entry to transfer the cost of the completed units from Blending to the finished goods storeroom.arrow_forwardThe costs per equivalent unit of direct materials and conversion in the Rolling Department of Kraus Steel Company are 750 and 120, respectively. The equivalent units to be assigned costs are as follows: The beginning work in process inventory on October 1 had a cost of 163,800. Determine the cost of completed and transferred-out production, the ending work in process inventory, and the total costs assigned by the Rolling Department.arrow_forward

- During December, Krause Chemical Company had the following selected data concerning the manufacture of Xyzine, an industrial cleaner: All materials are added at the beginning of processing in this department, and conversion costs are added uniformly during the process. The beginning work in process inventory had 120 of raw materials and 180 of conversion costs incurred. Materials added during December were 540, and conversion costs of 1,484 were incurred. Krause uses the first-in, first-out (FIFO) process cost method. The equivalent units of production used to compute conversion costs for December were: a. 110 units. b. 104 units. c. 100 units. d. 92 units.arrow_forwardThe Rolling Department of Kraus Steel Company had 200 tons in beginning work in process inventory (60% complete) on October 1. During October, 3,900 tons were completed. The ending work in process inventory on October 31 was 300 tons (25% complete). What are the total equivalent units for conversion costs?arrow_forwardProteger Company manufactures insect repellant lotion. The Mixing Department, the first process department, mixes the chemicals required for the repellant. The following data are for the current year: Direct materials are added at the beginning of the process. Ending inventory is 95 percent complete with respect to direct labor and overhead. The cost of goods transferred out for the year is: a. 4,471,200 b. 3,571,200 c. 3,780,000 d. 3,024,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning