FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Materials costs

Conversion costs

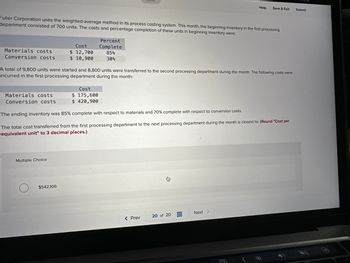

Fuller Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing

department consisted of 700 units. The costs and percentage completion of these units in beginning inventory were:

Materials costs

Conversion costs

Cost

$ 12,700

$ 10,900

Multiple Choice

A total of 9,800 units were started and 8,800 units were transferred to the second processing department during the month. The following costs were

incurred in the first processing department during the month:

$542,106

Percent

Complete

85%

30%

Cost

$ 175,600

$ 420,900

The ending inventory was 85% complete with respect to materials and 70% complete with respect to conversion costs.

The total cost transferred from the first processing department to the next processing department during the month is closest to: (Round "Cost per

equivalent unit" to 3 decimal places.)

Help

< Prev

Save & Exit

20 of 20

Next >

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lights Incorporated calculates cost for an equivalent unit of production using the weighted - average method. Data for July: Work-in-process inventory, July 1 (38,500 units): Direct materials (95% completed) $ 122, 650 Conversion (55% completed) 77, 100 Balance in work in process inventory, July 1 $ 199, 750 Units started during July 92, 500 Units completed and transferred 106, 500 Work - in - process inventory, July 31: Direct materials (95% completed ) 24, 500 Conversion (55% completed) Cost incurred during July: Direct materials $ 182, 500 Conversion costs 290, 500 The cost of goods completed and transferred out under the weighted average method is calculated to be: (Round your intermediate calculations to 2 decimal places and final answer to the nearest whole dollar amount.) Multiple Choice $ 586,860. $96,800. $586, 070. $615,320. $576,165.arrow_forwardWetzel Manufacturing Company has two departments, Assembly and Finishing. The following data for the Assembly Department for June Year 2 is provided: Determination of Equivalent Units Beginning inventory Units started Total Beginning work in process Started during the month Completed during the month Ending work in process Costs added during month Required: a. Prepare a cost of production report for the Assembly Department. Wetzel uses the weighted average method to determine equivalent units. Cost of Production Report Assembly Department Month Ended June 30 Transferred to Finishing Department Ending inventory Total Units Determination of Cost per Unit Cost accumulation: Beginning inventory Materials Labor Overhead Total product costs Divide by equivalent units Cost per equivalent unit Cost Allocation Transferred to Finishing Department Ending work in process inventory Total 500 1,500 1,750 250 Direct Direct % Complete Material Labor Overhead 75% Actual 40% $18, 276 $7,620 $4,564 Total…arrow_forwardThe Fremont Company uses the weighted-average method in its process costing system. The company recorded 37,025 equivalent units for conversion costs for November in a particular department. There were 6,700 units in the ending work-in-process inventory on November 30, 75% complete with respect to conversion costs. The November 1 work-in-process inventory consisted of 8,700 units, 50% complete with respect to conversion costs. A total of 32,000 units were completed and transferred out of the department during the month. The number of units started during November in the department was:arrow_forward

- Inacio Corporation uses the weighted-average method in its process costing system. Data concerning the first processing department for the most recent month are listed below: Beginning work in process inventory: Units in beginning work in process inventory Materials costs Conversion costs Percent complete with respect to materials Percent complete with respect to conversion Units started into production during the month Units transferred to the next department during the month Materials costs added during the month Conversion costs added during the month Ending work in process inventory: Units in ending work in process inventory Percent complete with respect to materials Percent complete with respect to conversion The cost per equivalent unit for materials for the month in the first processing department is closest to: Multiple Choice $16.70 $17.95 800 $ 12,900 $ 5,000 75% 20% 9,500 8,400 $ 172,000 $ 240,200 1,900 90% 30%arrow_forwardThe Lakeside Company uses a weighted-average process costing system. The following data are available: Beginning inventory Units started in production Units finished during the period Units in process at the end of the period (complete as to materials, % complete as to labor and overhead) Cost of materials used Labor and overhead costs Total cost of the 16,400 units finished is: -0- 20,800 16,400 4,400 $39,780 $42,000arrow_forwardLights Incorporated calculates cost for an equivalent unit of production using the welghted-average method. Data for July: Work-in-process inventory, July 1 (36,000 units): Direct materials (100% completed) $ 122,400 Conversion (5e% completed) 76,800 Balance in work in process inventory, July 1 $ 199, 200 Units started during July Units completed and transferred Work-in-process inventory, July 31: 90,000 102,000 Direct materials (180% completed) Conversion (50% completed) Cost incurred during July: 24,000 Direct materials $ 180,000 Conversion costs 288, 000 Cost per equlvalent unit for materials under the welghted-average method is calculated to be: Multiple Choice $3.10. O $3.20. O $2.00. O $240. $3.00.arrow_forward

- Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent month. Required: Using the FIFO method: a. Determine the equivalent units of production for materials and conversion costs. b. Determine the cost per equivalent unit for materials and conversion costs. c. Determine the cost of ending work in process inventory. d. Determine the cost of units transferred out of the department during the month. Work in process, beginning: Units in process Percent complete with respect to materials Percent complete with respect to conversion Costs in the beginning inventory: Materials cost Conversion cost Units started into production during the month Units completed and transferred out Costs added to production during the month: Daosta Inc. uses the FIFO method in its process costing system. The following data concern the operations of the company's first processing department for a recent…arrow_forwardJarvene Corporation uses the FIFO method in its process costing system. The following data are for the most recent month of operations in one of the company's processing departments: Units in beginning inventory Units started into production Units in ending inventory Units transferred to the next department Percentage completion of beginning inventory Percentage completion of ending Inventory 390 4,330 320 4,408 Materials $18.00 The cost of beginning Inventory according to the company's costing system was $7,880 of which $4,807 was for materials and the remainder was for conversion cost. The costs added during the month amounted to $179.771. The costs per equivalent unit for the month were: Conversion $ 23,00 Materials 70% 70% Cost per equivalent unit Required: 1. Compute the total cost per equivalent unit for the month. Conversion 30x 40x 4arrow_forwardAnnin Laboratories uses the weighted-average method to account for its work-in-process inventories. The accounting records show the following information for February: Beginning WIP inventory Direct materials $ 27,553 Conversion costs 8,905 Current period costs Direct materials 166,592 Conversion costs 86,000 Quantity information is obtained from the manufacturing records and includes the following: Beginning inventory 6,000 units (40% complete as to materials, 15% complete as to conversion) Current period units started 45,400 units Ending inventory 25,000 units (75% complete as to materials, 35% complete as to conversion) Compute the cost of goods transferred out and the ending inventory for February using the weighted-average method. Note: Do not round intermediate calculations.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education