FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

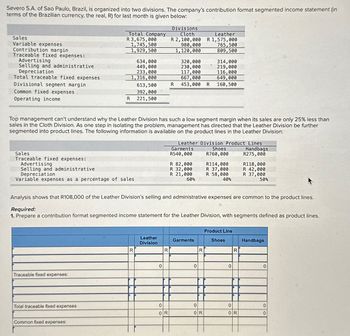

Transcribed Image Text:Severo S.A. of Sao Paulo, Brazil, is organized into two divisions. The company's contribution format segmented income statement (in

terms of the Brazilian currency, the real, R) for last month is given below:

Sales

Variable expenses

Contribution margin

Traceable fixed expenses:

Advertising

Selling and administrative

Depreciation

Total traceable fixed expenses

Divisional segment margin

Common fixed expenses

Operating income

Sales

Traceable fixed expenses:

Total Company

R 3,675,000

1,745,500

1,929,500

Traceable fixed expenses:

R

Advertising

Selling and administrative

Depreciation

Variable expenses as a percentage of sales

Total traceable fixed expenses

634,000

449,000

233,000

1,316,000

Common fixed expenses:

Top management can't understand why the Leather Division has such a low segment margin when its sales are only 25% less than

sales in the Cloth Division. As one step in isolating the problem, management has directed that the Leather Division be further

segmented into product lines. The following information is available on the product lines in the Leather Division:

613,500

392,000

221,500

R

Leather

Division

0

Divisions

Cloth

Leather

R 2,100,000 R 1,575,000

980,000

1,120,000

R

320,000

230,000

117,000

667,000

R 453,000 R

0

OR

Analysis shows that R108,000 of the Leather Division's selling and administrative expenses are common to the product lines.

Required:

1. Prepare a contribution format segmented income statement for the Leather Division, with segments defined as product lines.

Garments

R540,000

Leather Division Product Lines

Handbags

R275,000

R 82,000

R 32,000

R 21,000

60%

Garments

765,500

809,500

0

314,000

219,000

116,000

649,000

160,500

R

0

OR

Shoes

R760,000

R114,000

R 37,000

R 58,000

40%

Product Line

Shoes

0

R

R118,000

R 42,000

R 37,000

50%

0

OR

Handbags

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Benson Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Segment Sales Cost of goods sold Sales commissions BENSON COMPANY Income Statements for Year 2 Contribution margin General fixed operating expenses (allocation of president's salary) Advertising expense (specific to individual divisions) Net income (loss). Complete this question by entering your answers in the tabs below. Required A Required B A $ 169,000 (130,000) (21,000) 18,000 (43,000) (5,000) $ (30,000) B $ 238,000 (81,000) (23,000) 134,000 (37,000) (14,000) $ 83,000 с $ 247,000 (83,000) (31,000) 133,000 (26,000) 0 Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. $ 107,000arrow_forward= Profit Center Responsibility Reporting Championship Sports Inc. operates two divisions-the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all including those for inventories, were recorded and posted: Sales-Winter Sports Division Sales-Summer Sports Division Cost of Goods Sold-Winter Sports Division Cost of Goods Sold-Summer Sports Division Sales Expense-Winter Sports Division Sales Expense-Summer Sports Division Administrative Expense-Winter Sports Division Administrative Expense-Summer Sports Division Advertising Expense Transportation Expense Accounts Receivable Collection Expense Warehouse Expense Sales $29,925,000 33,060,000 17,955,000 19,095,000 5,130,000 4,560,000 Cost of goods sold Gross profit Divisional selling and administrative expenses: 2,992,500 2,935,500 1,091,000 Divisional selling expenses Divisional administrative expenses…arrow_forwardBuckley Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. BUCKLEY COMPANY Income Statements for Year 2 Segment A B C Sales $ 330,000 $ 480,000 $ 500,000 Cost of goods sold (242,000 ) (184,000 ) (190,000 ) Sales commissions (30,000 ) (44,000 ) (44,000 ) Contribution margin 58,000 252,000 266,000 General fixed operating expenses (allocation of president’s salary) (92,000 ) (92,000 ) (92,000 ) Advertising expense (specific to individual divisions) (6,000 ) (20,000 ) 0 Net income (loss) $ (40,000 ) $ 140,000 $ 174,000 Required Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Options for required A table are: Advertising…arrow_forward

- Sagararrow_forwardFrinner Company has two divisions, A and B, that reported the following results for October: Sales Variable expenses as a percentage of sales .... Segment margin .......... C. d. Division A £90,000 £31,000. £62,000. £93,000. £52,000 70% £2,000 Division B £150,000 If common fixed expenses were £31,000, total fixed expenses must have been a. b. 60% £23,000arrow_forward9arrow_forward

- Toxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income. Total Company $ 885,000 572,300 312,700 276,000 $36,700 Commercial Residential $ 295,000 $ 590,000 418,900 153,400 141,600 171, 100 122,000 $ 19,600 154,000 $ 17,100 In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $73,500 of common fixed expenses that would continue to be incurred even if the Commercial or Residential…arrow_forwardStryker corp. Has two major business segments- east and west. In April, the east business segment had sales revenue of 500,000, variable expenses of 280,000 and traceable fixed expenses of 80,000. During the same month, the west business segment had sales revenues of 970,000, variable expenses of 514,000 and traceable fixed expenses of 184,000. The common fixed expenses total 280,000 and were allocated as follows: 112,000 to the east business segment and 168,000 to the west business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the east business segment is: 108,000 28,000 140,000 280,000arrow_forwardsssaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education