FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

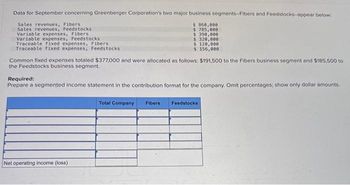

Transcribed Image Text:Data for September concerning Greenberger Corporation's two major business segments-Fibers and Feedstocks-appear below.

Sales revenues, Fibers

Sales revenues, Feedstocks

Variable expenses, Fibers

Variable expenses, Feedstocks

Traceable fixed expenses, Fibers

Traceable fixed expenses, Feedstocks

Common fixed expenses totaled $377,000 and were allocated as follows: $191,500 to the Fibers business segment and $185,500 to

the Feedstocks business segment.

$ 860,000

$ 785,000

$ 390,000

$ 320,000

$ 120,000

$ 156,000

Required:

Prepare a segmented income statement in the contribution format for the company. Omit percentages; show only dollar amounts.

Net operating income (loss)

Total Company Fibers

Feedstocks

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data for January for Bondi Corporation and its two major business segments, North and South, appear below. Sales revenues, North Variable expenses, North Traceable fixed expenses, North Sales revenues, South Variable expenses, South Traceable fixed expenses, South $ 620,000 $ 359,700 $ 74,100 $ 478,400 $ 273,000 $ 61,900 In addition, common fixed expenses totaled $167,800 and were allocated as follows: $87,100 to the North business segment and $80,700 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the segment margin of the North business segment is:arrow_forward= Profit Center Responsibility Reporting Championship Sports Inc. operates two divisions-the Winter Sports Division and the Summer Sports Division. The following income and expense accounts were provided from the trial balance as of December 31, 20Y9, the end of the fiscal year, after all including those for inventories, were recorded and posted: Sales-Winter Sports Division Sales-Summer Sports Division Cost of Goods Sold-Winter Sports Division Cost of Goods Sold-Summer Sports Division Sales Expense-Winter Sports Division Sales Expense-Summer Sports Division Administrative Expense-Winter Sports Division Administrative Expense-Summer Sports Division Advertising Expense Transportation Expense Accounts Receivable Collection Expense Warehouse Expense Sales $29,925,000 33,060,000 17,955,000 19,095,000 5,130,000 4,560,000 Cost of goods sold Gross profit Divisional selling and administrative expenses: 2,992,500 2,935,500 1,091,000 Divisional selling expenses Divisional administrative expenses…arrow_forwardUsing the data below for the Ace Guitar Company: A Region B Region Sales $521,500 $968,500 Cost of goods sold 198,200 368,000 Selling expenses 125,200 232,400 Service department expenses Purchasing $250,300 Payroll accounting 166,900 Allocate service department expenses proportional to the sales of each region. Determine the divisional income from operations for the A and B regions. For interim calculations, round percentages to one decimal place. A Region $ B Region $arrow_forward

- Windmill Corp. has three manufacturing divisions, each of which has been Determined to be reportable segment. Common costs are appropriately allocated on the basis of each division’s sales in relation to Windmill’s aggregate sales. In the current year, Division 1 had sales of P6,000,000, which was 20%of Windmill’s total sales, and had traceable cost of P3,800,00. Windmill incurred operating cost of P1,000,000 that were not directly traceable to any of the divisions. In addition, Windmill incurred interest expense of P600,000. In reporting segment information, what amount should be shown as operating profit of Division 1 for the current year?arrow_forwardFinancial information for BDS Enterprises for the year-ended December 31, 20xx, was gathered from an accounting intern, who has asked for your guidance on how to prepare an income statement format that will be distributed to management. Subtotals and totals are included in the information, but you will need to calculate the values. Pretax income? Gross profit? Allocated costs (uncontrollable) $2,035 Labor expense 41,580 Sales 188,000 Research and development (uncontrollable) 310 Depreciation expense17,000 Net income/(loss) ? Cost of goods sold 118,440 Selling expense 1,240 Total expenses ? Marketing costs (uncontrollable) 800 Administrative expense 690 Income tax expense (21% of pretax income) ? Other expenses 310arrow_forwardi am confused for this question please provide correct answerarrow_forward

- Severo S.A. of Sao Paulo, Brazil, is organized into two divisions. The company's contribution format segmented income statement (in terms of the Brazilian currency, the real, R) for last month is given below: Sales Variable expenses Contribution margin Traceable fixed expenses: Advertising Selling and administrative Depreciation Total traceable fixed expenses Divisional segment margin Common fixed expenses Operating income Sales Traceable fixed expenses: Total Company R 3,675,000 1,745,500 1,929,500 Traceable fixed expenses: R Advertising Selling and administrative Depreciation Variable expenses as a percentage of sales Total traceable fixed expenses 634,000 449,000 233,000 1,316,000 Common fixed expenses: Top management can't understand why the Leather Division has such a low segment margin when its sales are only 25% less than sales in the Cloth Division. As one step in isolating the problem, management has directed that the Leather Division be further segmented into product lines.…arrow_forwardSpiess Corporation has two major business segments--Apparel and Accessories. Data concerning those segments for December appear below: Sales revenues, Apparel Variable expenses, Apparel Traceable fixed expenses, Apparel Sales revenues, Accessories Variable expenses, Accessories Traceable fixed expenses, Accessories $ 699,000 $ 367,000 $ 179,000 $ 795,000 $ 483,000 $145,000 the Accessories business segment. Common fixed expenses totaled $231,000 and were allocated as follows: $89,000 to the Apparel business segment and $142,000 to Required: Prepare a segmented income statement in the contribution format for the company. Net operating income (loss) S Total Company Apparel Accessories 0 0 0 0 $ 0 0arrow_forwardWhite has a reportable segment if the segment's revenue will total to what amount? The following information pertains to the White Company and its divisions for the year ended December 31, 2014: Sales to unaffiliated customers P10,000,000 Inter-segment sales of products similar to those sold to unaffiliated customers 2,000,000 White Company and all of its divisions are engaged solely in manufɛcturing operations. Your answerarrow_forward

- Data for January for Blondi Corporation and its two major business segments, North and South, appear below Sales revenues, North Variable expenses, North Traceable fixed expenses, North Sales revenues, South Variable expenses, South Traceable fixed expenses, South In addition, common fixed expenses totaled $179.000 and were allocated as follows: $93,000 to the North business segment and $86.000 to the South business segment. A properly constructed segmented income statement in a contribution format would show that the net operating income of the company as a whole is: Multiple Choice $7,000) $172,000 $351,000 $496,000 $660,000 $ 383,000 $ 79,000 s 510,000 $ 291,000 $ 66,000arrow_forwardA condensed income statement for the Electronics Division of Gihbli Industries Inc. for the year ended December 31 is as follows: Sales $2,340,000 Cost of goods sold 1,788,000 Gross profit $ 552,000 Operating expenses 318,000 Income from operations $ 234,000 Invested assets $1,800,000 Assume that the Electronics Division received no cost allocations from service departments. The president of Gihbli Industries Inc. has indicated that the division’s return on a $1,800,000 investment must be increased to at least 15% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of $360,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would be less than the amount of depreciation expense on the old equipment by $64,800. This decrease in expense would be included as part of the cost of goods sold. Sales would remain…arrow_forwardAJ Manufacturing Company incurred $50,500 of fixed product cost and $40.400 of variable product cost during its first year of operation. Also during its first year, AJ incurred $16,150 of fixed and $13,100 of variable selling and administrative costs. The company sold all of the units it produced for $162,000. Required a. Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). b. Prepare an income statement using the contribution margin approach. Complete this question by entering your answers in the tabs below. Required A Required B Prepare an income statement using the format required by generally accepted accounting Principles (GAAP). AJ MANUFACTURING COMPANY Income Statement Required B > Mc Graw Hillarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education