FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

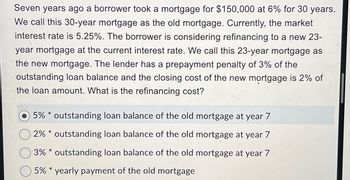

Transcribed Image Text:Seven years ago a borrower took a mortgage for $150,000 at 6% for 30 years.

We call this 30-year mortgage as the old mortgage. Currently, the market

interest rate is 5.25%. The borrower is considering refinancing to a new 23-

year mortgage at the current interest rate. We call this 23-year mortgage as

the new mortgage. The lender has a prepayment penalty of 3% of the

outstanding loan balance and the closing cost of the new mortgage is 2% of

the loan amount. What is the refinancing cost?

*

5% outstanding loan balance of the old mortgage at year 7

2% outstanding loan balance of the old mortgage at year 7

3% outstanding loan balance of the old mortgage at year 7

5% yearly payment of the old mortgage

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A homeowner took out a 25-year fixed-rate mortgage of $205,000. The mortgage was taken out 7 years ago at a rate of 7.05 percent. If the homeowner refinances, the charges will be $3,350. What is the highest interest rate at which it would be beneficial to refinance the mortgage? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. APR %arrow_forwardA mortgage for $200,000 with interest rate of 7.20%, fixed monthly payments, and term of 30 years was originated 10 years ago. If the loan's current balance is refinanced for the rest of the original term of at the rate of 6.30% with monthly payments, what is the implied annual savings rate given that the existing loan has a refinancing fee of 4% of the remaining balance at the time of refinancing and that loan is expected to be outstanding for 9 years? Selected Answer: Below 6% O A. Correct Answer: Е. Between 12% and 14%arrow_forwardIf Bobby takes out a mortgage for 30 years at an interest rate of 4% and his monthly repayments are $835.48, what is the loan principal (that is, the balance of the loan at drawdown)? Give your answer to the nearest ten dollars. Do not include commas or the dollar sign in your answer.arrow_forward

- Ma & Pa General Store is taking out a mortgage for a new building. It is going to be an interest-only, 15-year balloon mortgage for $350,000. The APR is 4.25%. The last payment will be the balloon payment of the full principal. What is their balloon mortgage payment?arrow_forwardA mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment > 2 D TRENE VAR TVUNG S 2006- E - Earrow_forwardThe Mendez family is considering a mortgage loan of $350,000 at an annual interest rate of 6.55%. (a) How much greater is their mortgage payment if the term is 20 years rather than 30 years?(b) How much less is the amount of interest paid over the life of the 20-year loan than over the life of the 30-year loan?arrow_forward

- A homeowner took out a 15-year fixed-rate mortgage of $140,000. The mortgage was taken out 7 years ago at a rate of 7.4 percent. If the homeowner refinances, the charges will be $1,000. What is the highest interest rate at which it would be beneficial to refinance the mortgage? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. APR %arrow_forwardFour years ago, you took out a $375,000, 25-year mortgage with an interest rate of 5% and a 3% prepayment fee applicable for the first five years. If you decide to pay off this mortgage now, what will the balance due be?arrow_forwardDavid obtained a fully amortizing loan 8 years ago for $12,0000 at 8% for 30 years. Mortgage rates have dropped in such a manner so as to provide a loan for 22 years at 6.5%. There is no prepayment penalty on the mortgage balance of the original loan, but 2 points will be charged on the new loan and other closing cost will be $3000. All payments are monthly. How much does David need to borrow if he decides to borrow only outstanding loan balance? Is refinancing a good option if David decides to repay the full amount of loan in 5 more years? How would your answer for part 2a change if David decides to borrow outstanding loan balance and other refinancing costs? Would your answer for part 2b change if David decides to keep the loan for full term of the loan?arrow_forward

- A mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forwardA homeowner took out a 20-year fixed-rate mortgage of $175,000. The mortgage was taken out 6 years ago at a rate of 6.75 percent. If the homeowner refinances, the charges will be $3,050. What is the highest interest rate at which it would be beneficial to refinance the mortgage? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. APR 6.00arrow_forwardMr. Tramp made a mortgage 5 years ago for $85, 000 at 8.25% interest and a 15 year term. Rates have now risen to 10% for an equivalent loan. Mr. Tramps lender is willing to discount the loan by $2, 000 if he will prepay the loan. What rate of return would Mr. Tramp receive by prepaying the loan?(A)7.83% (B) 10.24% (C) 14.32% (D) 9.14%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education