FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

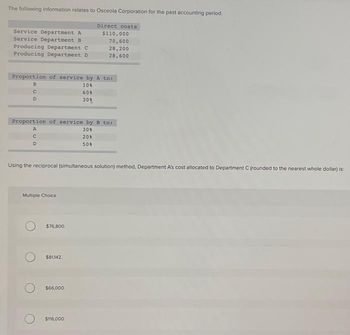

Transcribed Image Text:The following information relates to Osceola Corporation for the past accounting period.

Service Department A

Service Department B

Producing Department C

Producing Department D

Proportion of service by A to:

10%

60%

30%

BUD

C

Proportion of service by B to:

30%

20%

50%

RUD

A

с

Using the reciprocal (simultaneous solution) method, Department A's cost allocated to Department C (rounded to the nearest whole dollar) is:

Multiple Choice

$76,800

Direct costs

$110,000

70,600

28,200

28,600

$81,142.

$66,000.

$116,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 8arrow_forwardContribution margin per constraint Zion Metals Inc. has three grades of metal product, A1, B3, and E6. Financial data for the three grades are as follows: A1 B3 E6 Revenue $ 400,000 $ 578,000 $ 300,000 Variable cost $(250,000) $(380,000) $(270,000) Fixed cost (105,000) (118,800) (20,000) Total cost $(355,000) $(498,800) $(290,000) Operating income $ 45,000 $ 79,200 $ 10,000 Number of units ÷ 15,000 ÷ 16,500 ÷ 5,000 Operating income per unit $ 3.00 $ 4.80 $ 2.00 Zion Metals’ operations require all three grades to be melted in a furnace before being formed. The furnace runs 24 hours a day, 7 days a week, and is a production constraint. The furnace hours required per unit of each product are as follows: A1: 8 hours B3: 10 hours E6: 6 hours The Marketing Department is considering a new marketing and sales campaign. Which product should be emphasized in the marketing and sales…arrow_forwardHaresharrow_forward

- Please do not give solution in image format thankuarrow_forwardanswer with correct optionarrow_forwardTransfer pricingMogi Corp. manufactures one primary product, which is processed through two divisions (P and R). Costs for each division are: P R Variable cost per gallon $3 $15 Fixed cost per gallon* 2 12 * Based on production of 75,000 and 120,000 gallons for P and R respectively. P Division produces 75,000 gallons per month. R Division uses 120,000 gallons per month; of that, 75,000 gallons are purchased internally and 45,000 are purchased externally at $10 per gallon. After processing through R Division, a gallon of final product can be sold for $55.a. What would be P’s transfer price to R Division if the price is set at 180 percent of variable cost? $Answer b. What would be P’s transfer price to R Division if the price is set at 130 percent of full cost? $Answer c. What would be P’s transfer price to R Division if the price is set at market value? $Answer d. What is Mogi Corp.’s operating profit if all 120,000 gallon of final product can be sold for $55 per…arrow_forward

- Transfer pricingMogi Corp. manufactures one primary product, which is processed through two divisions (P and R). Costs for each division are: P R Variable cost per gallon $3 $15 Fixed cost per gallon* 2 12 * Based on production of 25,000 and 40,000 gallons for P and R respectively. P Division produces 25,000 gallons per month. R Division uses 40,000 gallons per month; of that, 25,000 gallons are purchased internally and 15,000 are purchased externally at $10 per gallon. After processing through R Division, a gallon of final product can be sold for $55.a. What would be P’s transfer price to R Division if the price is set at 180 percent of variable cost? Answer: 5.4 b. What would be P’s transfer price to R Division if the price is set at 130 percent of full cost? Answer: 6.5 c. What would be P’s transfer price to R Division if the price is set at market value? Answer: 10 d. What is Mogi Corp.’s operating profit if all 40,000 gallon of final product can be sold for $55…arrow_forwardAllocating Joint Costs Using the Constant Gross Margin Method A company manufactures three products, L-Ten, Triol, and Pioze, from a joint process. Each production run costs $13,000. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Further Processing Eventual Market Product Gallons Cost per Gallon Price per Gallon L-Ten 3,400 $0.50 $2.00 Triol 4,000 1.00 5.00 Pioze 2,600 1.50 6.00 Required: 1. Calculate the total revenue, total costs, and total gross profit the company will earn on the sale of L-Ten, Triol, and Pioze. Total Revenue Total Costs Total Gross Profit 42,400 V 22,600 19,800 V 2. Allocate the joint cost to L-Ten, Triol, and Pioze using the constant gross margin percentage method. Round the gross margin percentage to four decimal places and round all other computations to the nearest dollar. Product L-Ten Joint Cost Allocationarrow_forwardPlease do not give solution in image format thankuarrow_forward

- Problem 11-60 (Algo) Cost Allocation: Step and Reciprocal Methods (LO 11-1) Dunedin Bank has two operating departments (Retail and Commercial) and three service departments: Operations, Information Technology (IT), and Transactions. For the last period, the following costs and service department usage ratios were recorded: Supplying Department Transactions IT Operations Direct cost Using Department Transactions IT Operations Retail Commercial Ө Ө 70% 30% 10% Ө 20% 30% 40% 50% Ө Ө 10% 40% $ 390,000 $ 810,000 $ 1,650,000 $ 3,850,000 $ 2,400,000 Required: a. Allocate the service department costs to the two operating departments using the reciprocal method. From: Costs Operations Allocated to: Transactions Retail Commercial IT $ 810,000 $ 162,000 $ 81,000 $ 243,000 $ 324,000 Operations Transactions Total $ 243,000 $ 324,000arrow_forwardPlease do not give solution in image format thankuarrow_forwardRequirement in 2nd imagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education