FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

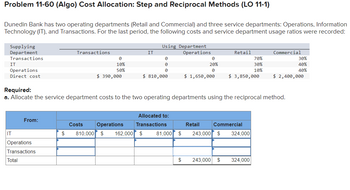

Transcribed Image Text:Problem 11-60 (Algo) Cost Allocation: Step and Reciprocal Methods (LO 11-1)

Dunedin Bank has two operating departments (Retail and Commercial) and three service departments: Operations, Information

Technology (IT), and Transactions. For the last period, the following costs and service department usage ratios were recorded:

Supplying

Department

Transactions

IT

Operations

Direct cost

Using Department

Transactions

IT

Operations

Retail

Commercial

Ө

Ө

70%

30%

10%

Ө

20%

30%

40%

50%

Ө

Ө

10%

40%

$ 390,000

$ 810,000

$ 1,650,000

$ 3,850,000

$ 2,400,000

Required:

a. Allocate the service department costs to the two operating departments using the reciprocal method.

From:

Costs

Operations

Allocated to:

Transactions

Retail

Commercial

IT

$

810,000 $ 162,000 $ 81,000 $

243,000 $ 324,000

Operations

Transactions

Total

$

243,000 $ 324,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Do not give image formatarrow_forwardsarrow_forwardProblem 6-21 (Algo) Segment Reporting and Decision Making [LO6-4] Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales. Variable expenses Contribution margin Fixed expenses Net operating income $ 800,000 300,000 500,000 460,000 $ 40,000 Management wants to improve profits and gathered the following data: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $208,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $172,000 and $88,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $125,000 and $275,000, respectively, in the Northern territory…arrow_forward

- Exercise 14-25 (Algo) Compute RI and ROI (LO 14-2, 3) The Campus Division of All-States Bank has assets of $2,000 million. During the past year, the division had profits of $235 million. All-States Bank has a cost of capital of 6 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Campus Division. (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) b. Compute the divisional RI for the Campus Division. (Enter your answer in dollars, not in millions.)arrow_forwardAnswer No. 4, 5, and 6. Please Provide a Complete Solution. Thank Youarrow_forwardUse the following information to answer questions 2 through 6: M2). The following information is available. A company has two service departments (S1 and 52) and two manufacturing divisions (M1 and Percent Allocable to $2 20% Costs Incurred Department $1 $200,000 500,000 d. 62.5% $2 50% 2. Using the direct method, what proportion of S1's costs will be allocated to M2! a 20% b. 37.5% C. $295,400 d. $302,500 3. Using the direct method, how much of the service department costs will be allocated to M1? a. $195,250 b. $205,750 c. $308,750 d. $326,450 4. Using the step method, how much of the service department costs will be allocated to M1? a. $243,000 b. $265.700 a. S1-$290,000+ 0.5 × $2 b. S1-$290,000+ 0.2 × S2 c. S1-$290,000+ 0.3 × $2 715473_1&course_id=_31557 M1 M2 expressed? Using the reciprocal method, how should the total service department costs of S1 be E d. S1 - $500,000+ 0.5 × $2 Matching.docx 6. Using the reciprocal method, how much of the service department costs will be…arrow_forward

- Required information [The following information applies to the questions displayed below.] The following information is departmental cost allocation with two service departments and two production departments. Department Service 1 (S1) Service 2 (S2) Production 1 (P1) Production 2 (P2) Cost $ 47,000 37,000 270,000 320,000 Percentage Service Provided to S1 0% 20 S2 P1 20% 40% 20 0 P2 40% 60 What is the amount of service department cost allocated to P1 and P2 using the direct method if the cost in P1 is changed from $270,000 to $290,000?arrow_forwardProblem 11-60 (Algo) Cost Allocation: Step and Reciprocal Methods (LO 11-1) Dunedin Bank has two operating departments (Retail and Commercial) and three service departments: Operations, Information Technology (IT), and Transactions. For the last period, the following costs and service department usage ratios were recorded: Supplying Department Transactions IT Operations Direct cost IT From: Operations Transactions Transactions Total 8 18% 70% $ 310,000 IT Costs Operations S 250,000 $ 750,000 670,000 x 1,510,000 x Using Department Operations 8 8 8 $ $ 730,000 Required: a. Allocate the service department costs to the two operating departments using the reciprocal method. x Answer is complete but not entirely correct. Allocated to: Transactions 250,000 XS 2,233,333 x $ 8 30% 8 $ 1,570,000 $ 3,770,000 Retail 0X X $ Retail OX 0x 0 Commercial S 70% 30% 18% 833,333 X 0x 0 x 833,333 Commercial 30% 38% 28 $ 2,320,000arrow_forwardHomeLife Life Insurance Company has two service departments (actuarial and premium rating) and two production departments (advertising and sales). The distribution of each service department's efforts (in percentages) to the other departments is shown in the following table: To From Actuarial Premium Rating Advertising Sales Actuarial - 70% 15% 15% Premium 20% 20 60 The direct operating costs of the departments (including both variable and fixed costs) are: Actuarial $81,000 Premium rating 16, 000 Advertising 61, 000 Sales 41, 000 Required: 1. Determine the total costs of the advertising and sales departments after using the direct method of allocation. 2. Determine the total costs of the advertising and sales departments after using the step method of allocation. 3. Determine the total costs of the advertising and sales departments after using the reciprocal method of allocation.arrow_forward

- HomeLife Life Insurance Company has two service departments (actuarial and premium rating) and two production departments (advertising and sales). The distribution of each service department’s efforts (in percentages) to the other departments is shown in the following table: To From Actuarial Premium Rating Advertising Sales Actuarial — 80% 10 % 10 % Premium 20% — 20 60 The direct operating costs of the departments (including both variable and fixed costs) are: Actuarial $ 80,000 Premium rating 15,000 Advertising 60,000 Sales 40,000 Required: 1. Determine the total costs of the advertising and sales departments after using the direct method or allocation. 2. Determine the total costs of the advertising and sales departments after using the step method of allocation. 3. Determine the total costs of the advertising and sales departments after using the reciprocal method of allocation. What is the…arrow_forward22. Question Content Area Support Department Allocations The centralized computer technology department of Hardy Company has expenses of $28,000. The department has provided a total of 2,000 hours of service for the period. The Retail Division has used 1,620 hours of computer technology service during the period, and the Commercial Division has used 380 hours of computer technology service. How much should each division be allocated for computer technology department services? Do not round interim calculations. Retail Division $ Commercial Division $arrow_forwardHomeLife Life Insurance Company has two service departments (actuarial and premium rating) and two production departments (advertising and sales). The distribution of each service department’s efforts (in percentages) to the other departments is shown in the following table: To From Actuarial Premium Rating Advertising Sales Actuarial — 75 % 10 % 15 % Premium 20 % — 20 60 The direct operating costs of the departments (including both variable and fixed costs) are: Actuarial $ 88,000 Premium rating 23,000 Advertising 68,000 Sales 48,000 Required: 1. Determine the total costs of the advertising and sales departments after using the direct method or allocation. 2. Determine the total costs of the advertising and sales departments after using the step method of allocation. 3. Determine the total costs of the advertising and sales departments after using the reciprocal method of allocation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education