Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

1. How much total money would you have spent out of pocket with each plan?

2. With each plan, how much total money would you have to spend before the insurance coverage pays 100% of your medical costs?

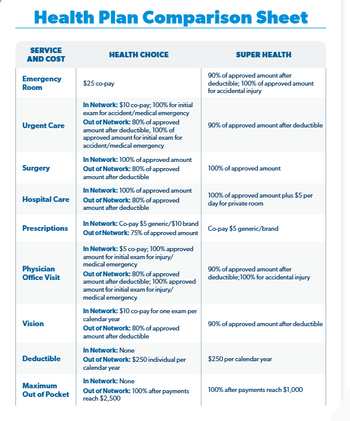

Transcribed Image Text:Health Plan Comparison Sheet

SERVICE

AND COST

Emergency

Room

Urgent Care

Surgery

HEALTH CHOICE

$25 co-pay

In Network: $10 co-pay; 100% for initial

exam for accident/medical emergency

Out of Network: 80% of approved

amount after deductible, 100% of

approved amount for initial exam for

accident/medical emergency

In Network: 100% of approved amount

Out of Network: 80% of approved

amount after deductible

In Network: 100% of approved amount

Hospital Care Out of Network: 80% of approved

Prescriptions

Physician

Office Visit

Vision

Deductible

Maximum

Out of Pocket

amount after deductible

In Network: Co-pay $5 generic/$10 brand

Out of Network: 75% of approved amount

In Network: $5 co-pay; 100% approved

amount for initial exam for injury/

medical emergency

Out of Network: 80% of approved

amount after deductible; 100% approved

amount for initial exam for injury/

medical emergency

In Network: $10 co-pay for one exam per

calendar year

Out of Network: 80% of approved

amount after deductible

In Network: None

Out of Network: $250 individual per

calendar year

In Network: None

Out of Network: 100% after payments

reach $2,500

SUPER HEALTH

90% of approved amount after

deductible; 100% of approved amount

for accidental injury

90% of approved amount after deductible

100% of approved amount

100% of approved amount plus $5 per

day for private room

Co-pay $5 generic/brand

90% of approved amount after

deductible; 100% for accidental injury

90% of approved amount after deductible

$250 per calendar year

100% after payments reach $1,000

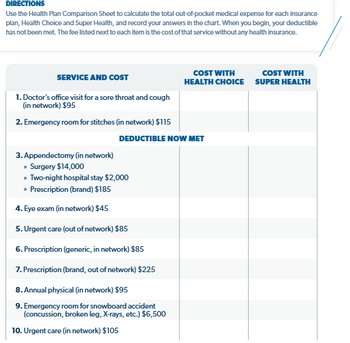

Transcribed Image Text:DIRECTIONS

Use the Health Plan Comparison Sheet to calculate the total out-of-pocket medical expense for each insurance

plan, Health Choice and Super Health, and record your answers in the chart. When you begin, your deductible

has not been met. The fee listed next to each item is the cost of that service without any health insurance.

SERVICE AND COST

COST WITH

HEALTH CHOICE

COST WITH

SUPER HEALTH

1. Doctor's office visit for a sore throat and cough

(in network) $95

2. Emergency room for stitches (in network) $115

DEDUCTIBLE NOW MET

3. Appendectomy (in network)

» Surgery $14,000

» Two-night hospital stay $2,000

» Prescription (brand) $185

4. Eye exam (in network) $45

5. Urgent care (out of network) $85

6. Prescription (generic, in network) $85

7. Prescription (brand, out of network) $225

8. Annual physical (in network) $95

9. Emergency room for snowboard accident

(concussion, broken leg, X-rays, etc.) $6,500

10. Urgent care (in network) $105

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Pls correct solution with steps.arrow_forwardFor life insurance policies, some of the premium pays for the cost of the insurance, and the remainder goes toward the cash value of the policy and earns interest like a savings account. Consider the following insurance company options. Company 1: pays 4.2% compounded monthly on the cash value of their policies Company 2: pays 4.21% compounded semiannually on the cash value of their policies What is the APY offered by each company? (Round your answers to the nearest hundredth.) Company 1 % Company 2 %arrow_forwardAn individual has determined utilizing the annuity method of capital needs analysis that he needs $1,045,656 at the beginning of his retirement to meet his retirement life expectancy goals. If this individual would like to be more conservative in his retirement planning forecast and maintain this capital balance throughout his retirement life expectancy of 32 years, given an expected earnings rate of 6%, and an inflation rate of 3% during the period, how much more would he need to have at the beginning of his retirement?arrow_forward

- 10. Perpetuities Perpetuities are also called annuities with an extended or unlimited life. Based on your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. The present value of a perpetuity is calculated by dividing the amount of the payment by the investor's opportunity interest rate. A perpetuity is a series of regularly timed, equal cash flows that is assumed to continue indefinitely into the future. ☐ A perpetuity continues for a fixed time period. In a perpetuity, returns-in the form of a series of identical cash flows-are earned. Your grandfather wants to establish a scholarship in his father's name at a local university and has stipulated that you will administer it. As you've committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you'll want to set aside the money for the scholarship immediately. At tomorrow's meeting with your grandfather and the bank's…arrow_forwardsolve question carrow_forwardSelect all the statements on perpetuities that are correct. a. The present value of a perpetuity increases if the interest rate increases. b. If I multiply the present value of a perpetuity with the interest rate then I get the value of a single payment of the cashflow stream. c. The present value value of a perpetuity is independent of the interest rate. d. The present value of a perpetuity is infinite as all the payments add up to infinity. e. A perpetuity describes a constant cashflow at the end of each year that continues infinitely long.arrow_forward

- v.1arrow_forwardII. Instead of buying insurance for retirement, you decided to set aside some savings in the bank. You believe that saving money in the bank is safer and more convenient than buying insurance. A)IfyouinvestOMR15,000nowat10%compoundedannually,howmuchwillbeinyouraccount after 20 years? B)IfyouinvestOMR15,000nowat10%compoundedquarterly,howmuchwillbeinyouraccount after 20 years? C)Discussthefactorswhatwillincreasethefuturevalueoftheamount.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education