FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

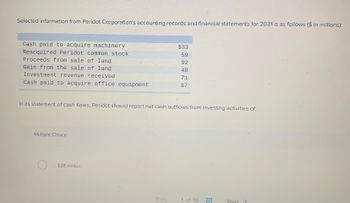

Transcribed Image Text:Selected information from Peridot Corporation's accounting records and financial statements for 2021 is as follows ($ in millions):

Cash paid to acquire machinery

Reacquired Peridot common stock

Proceeds from sale of land.

Gain from the sale of land

Investment revenue received

Cash paid to acquire office equipment

Multiple Choice

In its statement of cash flows, Peridot should report net cash outflows from investing activities of:

$28 million.

$33

59

Prey

92

48

71

87

1 of 10

www.

www.

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a gain of $8,081 is realized in selling (for cash) office equipment having a book value of $62,903, the total amount reported in the cash flows from investing activities section of the statement of cash flows is:arrow_forwardThe income statement and a schedule reconciling cash flows from operating activities to net income are provided below ($ in thousands) for Peach Computers. PEACH COMPUTERSIncome StatementFor the Year Ended December 31, 2021 Sales $ 380.0 Cost of goods sold (190.0 ) Gross margin 190.0 Salaries expense $ 43.0 Insurance expense 20.0 Depreciation expense 9.0 Loss on sale of land 7.0 79.0 Income before tax 111.0 Income tax expense (55.5 ) Net income $ 55.5 Reconciliation of Net IncomeTo Net Cash Flows from Operating Activities Net income $ 55.5 Adjustments for Noncash Effects Depreciation expense 9.0 Loss on sale of land 7.0 Changes in operating assets and liabilities: Decrease in accounts receivable 11.0 Increase in inventory (38.0 ) Decrease in accounts payable (23.0 ) Increase in salaries payable…arrow_forwardssarrow_forward

- Oriole Company provided the following information on selected transactions during 2021: Purchase of land by issuing bonds Proceeds from issuing bonds Purchases of inventory Purchases of treasury stock Loans made to affiliated corporations Dividends paid to preferred stockholders Proceeds from issuing preferred stock Proceeds from sale of equipment $1100000 2960000 3820000 603000 1370000 394000 1690000 293000 The net cash provided (used) by investing activities during 2021 isarrow_forwardStatement of Cash Flows The following is a list of the items for L Company's 2019 statement of cash flows: a. depreciation expense, $4,100 g. proceeds from issuance of note, $6,100 b. proceeds from sale of land, $5,500 h. gain on sale of land, $1,900 c. payment of dividends, $5,000 i. payment for purchase of building, $14,000 d. net income, $8,000 j. increase in accounts receivable, $2,800 e. conversion of bonds to common stock, $7,000 k. ending cash balance, $14,000 f. increase in accounts payable, $3,000 Required: Prepare the statement of cash flows. Use a minus sign to indicate cash outflows, a decrease in cash or cash payments. L COMPANY Statement of Cash Flows For Year Ended December 31, 2019 Operating Activities: $fill in the blank 2 Adjustment for noncash income items: fill in the blank 4 fill in the blank 6 Adjustments for cash flow effectsfrom working capital items: fill in the blank 8…arrow_forwardUsing the information below, complete the operating cash flow section of the Statement of Cash Flows for Peter Ltd using direct method. Your presentation must be consistent with the requirements of AASB107. Ignore tax. Reporting date is 30 June. The balances of selected accounts of Peter Ltd at 30 June 2021 and 30 June 2022 were ($000): 2021 2022 Cash 3850 1200 Inventory 3750 4250 Accounts receivable 2800 3500 Allowance for doubtful debts 320 260 Land 5000 5000 Plant 2750 2800 Accumulated depreciation 490 450 Accounts payable 3200 3500 Rent payable 100 130 Salaries payable 120 190 Share capital 1000 1000 Sales (on credit) 7750 6550 Cost of goods sold 1250 1100 Doubtful debts expense 280 300 Rent expense 540 450 Salaries expense 800 750 Depreciation expense 260 180 Required: Peter Ltd’s operating cash flow section extracted from the Statement of Cash Flows for year ended 30 June 2022 (Direct Method)arrow_forward

- Shepherd Nonprofit had the following information related to its investment balances during the fiscal year ended June 30, 2021. Beginning investments $1,200,000 en Ending investments $1,460,000 Purchases of investments $500,000 Proceeds from sale of investments $220,000 Realized loss on sale of investments $30,000 Report the section(s) in the statement of cash flows (using the indirect method) where investment transactions would appear, including the direction and amount associated with each.arrow_forwardThe following are excerpts from Hamburg Company’s statement of cash flows and other financial records. From Statement of Cash Flows: Cash flows from operating activities $433,104 Cash flows from investing activities -13,381 Cash flows from financing activities -221,035 From other records: Capital expenditure costs 18,547 Cash dividend payments 12,864 Sales revenue 465,762 Total assets 446,698 Compute free cash flow.arrow_forwardShown below are totals of the three sections from the SCF for the Sivad Motel for the year just ended. Analyze this information and prepare a report indicating your opinion regarding its sources and uses of cash and their impact on the future of the company. Your conclusions and recommendations should be supported with proper explanations and assumptions. Statement of Cash Flows Net cash provided by operating activities $10,000 Net cash used by investing activities (15,000) Net cash used by financing activities (5,000) Decrease in cash for the year (10,000) Cash at beginning of year 15,000 Cash at end of…arrow_forward

- Below is the data for Michael Ski Company . Prepare the cash flows from operating activities in the statement of cash flows using the direct method. (Do not prepare a reconciliation schedule.) David Ski Company had the following statements prepared as of December 31, 2020: Michael Ski Company Comparative Balance Sheet As of December 31 2020 2019 Cash 2,500 4,000 Account receivable 103,000 97,000 Short-term investment (Available-for-sale) 96,000 121,000 Inventories 91,000 54,000 Prepaid insurance 4,000 6,000 Ski equipment 89,000 43,000 Accumulated depr.-equipment (23,500) (18,000) Trademarks 79,000 83,000 Total asets 441,000 390,000 Account payable 92,200 75,000 income taxes payable 21,800 15,700 Wages payable 4,000 9,000 Short-term loans payable to bank 23,500 0 Long-term loans payable 75,000 125,000 Common stock, $1 par 100,000 100,000 Additional paid-in capital 20,000 20,000 Retained earnings 104,500 45,300 Total…arrow_forwardFree Cash Flow Kat Co. reports the following financial data for the current year: Cash flow from operating activities Cash flow from investing activities Cash flow from financing activities Cash disbursed for capital expenditures Compute Kat's free cash flow. Free cash flow S 17175 x Check $21,500 (10,555) 4,250 (4,325)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education