ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

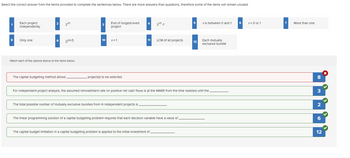

Transcribed Image Text:Select the correct answer from the terms provided to complete the sentences below. There are more answers than questions, therefore some of the items will remain unused.

1

8

Each project

independently

Only one

2

2m

9 2(m-1)

Match each of the options above to the items below.

The capital budgeting method allows

3

10

End of longest-lived

project

x=1

project(s) to be selected.

4

The total possible number of mutually exclusive bundles from m independent projects is

11

2m-1

LCM of all projects

The capital budget limitation in a capital budgeting problem is applied to the initial investment of

The linear programming solution of a capital budgeting problem requires that each decision variable have a value of

5

12

For Independent project analysis, the assumed reinvestment rate on positive net cash flows is at the MARR from the time realized until the

x Is between 0 and 1

Each mutually

exclusive bundle

x = 0 or 1

7

More than one

8

3

2

12

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Capitalized cost: Select one: a. is the future sum needed to provide a perpetual series of cash flows that will support a capital project. b. is a special kind of present worth analysis that chooses between alternatives with different duration c. is the net present value (NPV) of a perpetual series of cash flows d. is a cash flow series that allows the principal to be withdrawn every year and the amortization will always remainarrow_forwardDefine the term Net Present Worth in the present worth analysis?arrow_forwardAssume a pool of 115 people in an insurance pool (a group of people insured through community rating). It is estimated that a small number in the pool will have significant pre- existing conditions as indicated in the table. Based on the age of these 115 people, the insurance company estimates the following distribution of health care claims (which includes necessary profit and administrative costs of the insurance company). Number of Insured Antidipated Heath Costs/Year/Person $1,400 $1,500 $1,600 $1,700 $1,800 $1,900 $2,000 $2,100 $2,200 $2.300 $2,400 $2,500 $2,700 $2,000 $2,900 $3,000 $3,100 $3.200 $3.300 $4,000 57,00 $10,000 Everyone joins the poal ad pays the necessary premum in the first year. The clams experience of the customers is faund to be generaly consstent with expeclations of the insurance company. A) What would be the premium In the third year if there is no inflation, based on the company's oxperience from the past year? B) If those customers who have anticipated…arrow_forward

- Q4. The cash flow details of a public project is as follows = BD 250000 Initial cost /investment Annual benefits/revenues = BD 120000 Worth of annual cost Salvage value Interest rate per year 8% and useful lie 30 Years Use the three project evaluation methods( PW, FW, AW) = BD 12,000 = BD 150000arrow_forwardA city tnat operates automobile parking facilities is evaluating a proposal to erect and operate a structure for parking in its downtown area. Three designs for a facility to be built on available sites have been identified as follows, where all dollar figures are in thousands: Design A Design B Design C Cost of site $240 $180 $200 Cost of building $2,200 $700 $1,400 Annual fee collection $830 $750 $600 Annual maintenance cost $410 $360 $310 Service life 30 years 30 years 30 years At the end of the estimated service life, the selected facility would be torn down and the land would be sold. It is estimated that the proceeds from the resale of the land will be equal to the cost of clearing the site. If the city's interest rate is known to be 10%, which design alternative would be selected on the basis of the benefit-cost criterion?arrow_forwardWhich of the following interpretations would be best for the scenario analysis results shown below? Worst- case PW (18%) -$650,000 IRR 2.10% Most- likely case Best-case $58,000 $2,660,000 33% 14.60% a. Since the most-likely case has a PW <0, the project should be abandoned immediately b. Since the worst-case has a negative present worth, this project must be rejected. c. Since the average of the three cases is a positive present worth, the project is acceptable. d. Because only one of the scenarios shows the project as profitable, the project should be considered very risky, and, if accepted, should be subject to greater scrutiny in its planning and forecasting.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education